Triggered by two recent and seemingly isolated events—a coroner's ruling on a fatal bee sting in the United Kingdom and a large-scale marine sting evacuation in Australia—investors are now grappling with the reality that small-scale environmental incidents can produce significant and far-reaching

A growing number of American drivers are facing a difficult financial calculus following a collision, where the cost of filing an insurance claim, with its high deductible and potential for future rate hikes, often outweighs the benefit of the repair coverage they pay for every month. This

The relentless pursuit of higher yields has pushed many insurers to entrust their investment portfolios to specialist asset management firms, a move designed to leverage market expertise and unlock greater returns. This strategic delegation, however, masks a significant and often underestimated

The glittering world of reality television often presents a carefully curated vision of success and opulence, but for The Real Housewives of Potomac stars Wendy and Eddie Osefo, that image is now at the center of a serious legal battle. The couple is currently facing felony fraud charges amid

In a significant legal blow to public figures Wendy and Eddie Osefo, a Maryland court has mandated the surrender of nearly a decade's worth of financial records to state prosecutors, escalating the stakes in their high-profile insurance fraud case. The ruling represents a critical victory for the

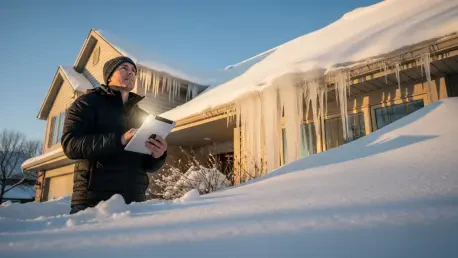

Retirees across the nation are discovering that the reassurance of a homeowners insurance policy provides little comfort when the system designed to help them is critically backlogged, a situation that has become particularly acute this winter. What was once a straightforward process of filing a