The journey of launching a new insurance program has historically been fractured by a critical disconnect between its initial design and its ultimate placement with a carrier, a gap that frequently results in costly delays and frustrating setbacks. This fragmented process often creates significant friction, hindering innovation and slowing speed-to-market. The purpose of this article is to explore an integrated solution designed to bridge this divide, answering key questions about the challenges of program placement and the benefits of a unified, end-to-end approach.

Readers can expect to gain a clear understanding of the inefficiencies plaguing the traditional program lifecycle and how a cohesive strategy can streamline the path from concept to launch. By examining the mechanics of this new model, from its core philosophy to its specific services, this article will illuminate a more efficient and effective path forward for MGAs, MGUs, and their carrier partners.

Key Questions or Key Topics Section

What Is the Primary Challenge in Insurance Program Placement

The insurance industry has long contended with a fundamental operational challenge rooted in the separation of program design and carrier placement. In the traditional model, one firm might architect the underwriting guidelines, product features, and actuarial projections, only to hand the finished package over to a different entity for carrier negotiations. This handoff is where the process often breaks down, creating a significant point of failure.

This disconnect means that essential context, strategic reasoning, and nuanced details are frequently lost in translation. Consequently, a program that looks perfect on paper may not align with a carrier’s risk appetite or operational capabilities. This misalignment often leads to significant carrier pushback, forcing expensive and time-consuming redesigns, which in turn delays market entry and can erode investor confidence before the program even begins.

How Does an Integrated Model Provide a Solution

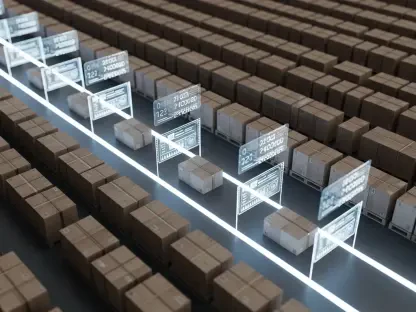

An integrated model directly confronts the inefficiencies of the traditional approach by unifying the design and placement phases under a single, continuous process. Instead of a problematic handoff, the same team of experts who architect the program also manages its placement with a carrier. This continuity ensures that the strategic vision remains intact from the initial blueprint all the way to a binding agreement.

This “Blueprint to Binding” methodology allows potential carrier concerns to be anticipated and addressed during the design phase, not after the fact. By embedding carrier-centric thinking from the very beginning, the program is built to be not only innovative but also imminently placeable. This proactive alignment drastically reduces the likelihood of late-stage rejections and redesigns, creating a smoother, more predictable path to market.

What Services Are Included in This End to End Approach

A truly comprehensive, end-to-end approach moves beyond theoretical design and offers tangible support throughout the placement lifecycle. The services offered through this model leverage deep expertise across the MGA, MGU, and carrier landscapes to provide multifaceted assistance. This begins with carrier-trusted advocacy and introductions, using established relationships to open the right doors for design clients.

Moreover, the service includes strategically pairing MGAs and MGUs with the most suitable carriers based on risk appetite, capacity, and long-term goals. Once a potential partner is identified, the model provides expert contract negotiation support to ensure favorable and sustainable terms. Finally, to guarantee a successful start, hands-on facilitation is provided through the crucial first 90 days after launch, solidifying the new partnership.

Why Is This Model Gaining Traction Now

The growing market demand for streamlined and efficient partnerships is a key driver behind the adoption of this integrated model. In a competitive landscape, accelerating time-to-market while simultaneously mitigating execution risk is a top priority. Stakeholders are increasingly seeking partners who can deliver a comprehensive solution rather than piecing together services from multiple vendors.

This trend is also fueled by a desire to set a “gold standard” for carrier submissions. When a carrier receives a proposal developed through this integrated process, it is not just a concept; it is a fully vetted, market-ready program. The information is presented in a format that anticipates and answers the carrier’s questions, facilitating a fast-tracked decision. To further this goal, some firms now offer diagnostic tools, such as a complimentary Program Readiness Assessment, to give clients an actionable scorecard of their program’s viability before ever engaging with a carrier.

Summary or Recap

The shift toward an integrated model for insurance program development and placement represents a significant evolution in the industry. By consolidating the entire lifecycle under one roof, this approach directly addresses the long-standing inefficiencies caused by a fragmented process. The core benefit of this “Blueprint to Binding” capability is the elimination of the problematic handoff between designers and placement specialists.

This unified strategy ensures that programs are built with carrier acceptance in mind from day one, which drastically reduces the risk of costly redesigns and launch delays. As a result, MGAs and MGUs can approach carriers with greater confidence, armed with a proposal that is not only well-designed but also strategically aligned with market needs and carrier appetites, ultimately accelerating their path to profitability.

Conclusion or Final Thoughts

The development of a unified system for program design and placement marked a crucial advancement for the insurance sector. This evolution was not merely an incremental improvement but a fundamental rethinking of a process that had long been a source of friction and inefficiency. By bridging the gap that had separated creation from execution, the industry took a definitive step toward fostering greater innovation and agility. This cohesive approach provided a clear, effective solution to challenges that had previously slowed progress and eroded confidence.