What if an insurance provider could predict customer needs before they even arise, slashing through bureaucratic delays with a single tap, and transform the way clients experience insurance services? In a world where efficiency and personalization are paramount, DXC Technology is stepping up with a

I'm thrilled to sit down with Simon Glairy, a leading authority in the insurance and Insurtech space, whose expertise in risk management and AI-driven risk assessment has helped shape the industry's technological frontier. With a deep understanding of how artificial intelligence is revolutionizing

Setting the Stage for Insurance AI Transformation In an era where data drives decision-making, the insurance industry stands at a critical juncture, grappling with the staggering statistic that up to 80% of AI projects fail due to poor data quality, highlighting a pervasive challenge. How can

What if securing coverage for the most intricate business risks was as simple as a few clicks? In an industry often bogged down by complexity, Bold Penguin has made a striking move by acquiring SquareRisk, a specialized marketplace for specialty and excess & surplus (E&S) insurance. This deal,

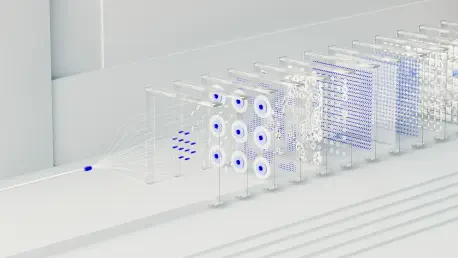

Setting the Stage for Transformation in Insurance Underwriting The commercial insurance sector is undergoing a seismic shift as technology redefines traditional processes, with underwriting at the epicenter of this change. Imagine a landscape where underwriters, once bogged down by manual data

Setting the Stage: The Digital Imperative in Insurance Broking The insurance broking industry is grappling with a seismic shift as digital transformation becomes a non-negotiable factor for competitiveness. Small and mid-sized brokers, in particular, face a daunting challenge: how to keep pace with