In the ever-evolving landscape of the insurance industry, a troubling trend has emerged that threatens the integrity of benefits plans across Canada, with fraudulent claims orchestrated by individual plan members, service providers, or sophisticated organized crime networks becoming a pervasive challenge. This issue drains resources and undermines trust, prompting insurers to act decisively. Recent data from a comprehensive healthcare survey indicates that a significant percentage of plan sponsors have noticed a marked uptick in suspicious activities, with many experts suggesting that the true scale of the problem may still be underreported. This growing concern has spurred insurers to adopt cutting-edge technologies and collaborative strategies to detect and prevent fraud, while also balancing the need to protect legitimate stakeholders. As the battle against deceptive practices intensifies, the industry is at a critical juncture, seeking innovative solutions to safeguard the system without compromising access to essential care.

Emerging Strategies to Detect Fraud

Harnessing Technology for Enhanced Detection

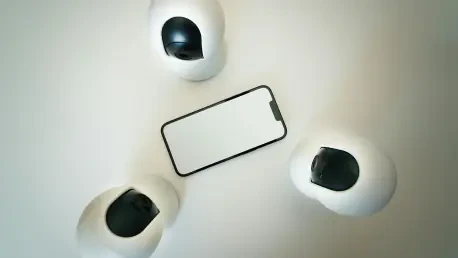

The fight against benefits fraud has taken a significant leap forward with the integration of advanced technology into claims monitoring processes. Insurers are increasingly turning to artificial intelligence (AI) and machine learning algorithms to analyze vast datasets, identifying unusual patterns that may indicate fraudulent behavior. These tools can pinpoint anomalies at a granular level, such as specific providers or geographic areas with unusually high claim rates. By automating the detection of irregularities, insurers can allocate resources more efficiently, focusing human expertise on high-risk cases. This technological shift not only improves the speed of identifying potential fraud but also enhances accuracy, reducing the likelihood of false positives that could unfairly impact honest providers or claimants. The adoption of such systems represents a proactive stance, ensuring that suspicious activities are flagged before they escalate into larger financial losses for benefits plans.

Strengthening Industry Collaboration

Beyond technology, collaboration across the insurance sector has emerged as a cornerstone in combating fraudulent claims. Through initiatives led by industry associations, companies are sharing critical data to build a more comprehensive picture of fraud trends. This cooperative approach allows for the identification of repeat offenders and organized schemes that might otherwise go unnoticed within a single insurer’s dataset. By pooling resources and insights, the industry can develop more robust defenses against deceptive practices. Additionally, partnerships with external experts, such as private investigators, bolster these efforts by providing on-the-ground verification of suspicious claims. This collective vigilance sends a clear message to potential fraudsters that the industry is united in its resolve to protect benefits plans, while also fostering a culture of transparency with plan sponsors who rely on insurers to safeguard their programs.

Balancing Enforcement with Fairness

Educating Providers to Prevent Unintentional Errors

A critical aspect of addressing benefits fraud lies in supporting healthcare providers who may inadvertently engage in questionable practices due to a lack of understanding of industry standards. Many providers operate in complex regulatory environments, where the line between acceptable and inappropriate billing can be unclear. Industry leaders have emphasized the importance of education, offering webinars and resources to clarify guidelines and best practices. By equipping providers with the knowledge to navigate claims processes correctly, insurers aim to reduce unintentional errors that could be mistaken for fraud. This preventive approach not only protects providers from severe repercussions but also preserves the integrity of benefits plans by minimizing discrepancies. Educational outreach reflects a commitment to fairness, ensuring that anti-fraud measures do not disproportionately harm those who act in good faith while still addressing deliberate misconduct.

Rehabilitative Approaches Over Punitive Measures

While enforcement remains essential for tackling intentional fraud, there is a growing recognition that punitive actions, such as delisting providers from claims processing, can have far-reaching consequences for communities. Such measures, often described as drastic, may deprive patients of access to vital care, particularly in underserved areas. As an alternative, some industry voices advocate for rehabilitative strategies, such as fines or mandatory training programs, to address cases of unintentional misconduct. These solutions offer providers a pathway to rectify mistakes and return to good standing without facing irreparable damage to their livelihoods. Striking a balance between accountability and compassion is key to ensuring that anti-fraud initiatives do not inadvertently penalize honest practitioners or harm public access to health services. This nuanced perspective highlights the need for tailored responses that consider the broader impact of enforcement actions.

Forging a Path Forward

Reflecting on Collaborative Successes

Looking back, the concerted efforts of insurers to combat benefits fraud through technology and collaboration proved to be a turning point in the industry. The deployment of AI-driven tools transformed the detection landscape, enabling companies to identify deceptive patterns with unprecedented precision. Meanwhile, data-sharing initiatives fostered a united front, amplifying the impact of individual efforts to curb fraudulent activities. These combined strategies not only reduced financial losses but also reinforced trust among stakeholders who depended on the integrity of benefits plans. The commitment to transparency, through public identification of bad actors and enhanced communication with plan sponsors, further deterred potential fraudsters, creating a more secure environment for legitimate claims.

Building Sustainable Solutions

Moving ahead, the focus should shift toward refining these approaches to ensure long-term sustainability. Insurers must continue investing in technological advancements while expanding educational programs to prevent errors at the source. Policymakers and industry leaders could explore frameworks that integrate rehabilitative options into anti-fraud policies, minimizing unintended consequences for providers and communities. Encouraging ongoing dialogue between insurers, providers, and associations will be crucial in adapting to evolving fraud tactics. By prioritizing innovation alongside fairness, the industry can build a resilient system that protects benefits plans without sacrificing access to care, setting a precedent for balanced and effective fraud prevention.