Setting the Stage for Transformation in Insurance Underwriting

The commercial insurance sector is undergoing a seismic shift as technology redefines traditional processes, with underwriting at the epicenter of this change. Imagine a landscape where underwriters, once bogged down by manual data analysis, can now make precise risk decisions in real time, thanks to cutting-edge tools. This is the reality being crafted by the strategic partnership between Sapiens International Corporation, a leader in SaaS-based insurance software solutions, and Linqura, a pioneer in sales and underwriting intelligence. This market analysis delves into how their collaboration is poised to revolutionize underwriting efficiency, exploring current trends, data-driven insights, and projections for the commercial insurance industry. The importance of this partnership lies in its potential to address longstanding inefficiencies, offering a glimpse into a future where technology and human expertise converge to drive profitability.

Deep Dive into Market Trends and Technological Integration

Harnessing AI for Precision Underwriting

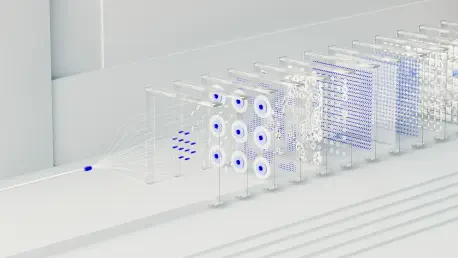

The integration of artificial intelligence into insurance underwriting marks a pivotal trend in the market, and the Sapiens-Linqura collaboration exemplifies this shift. By embedding Linqura’s agentic AI platform into Sapiens’ PolicyPro for P&C policy administration system, underwriters gain access to an Underwriting Advisor tool that delivers real-time insights. This technology analyzes hundreds of data points on U.S. businesses, covering risks, exposures, and potential loss triggers, enabling faster and more accurate decision-making. The market impact is significant, as insurers adopting such tools can reduce processing times and enhance risk selection, positioning themselves ahead of competitors still reliant on outdated methods.

Data-Driven Coverage Customization

Another key trend shaping the industry is the move toward hyper-personalized coverage recommendations, facilitated by expansive data resources. Linqura’s system leverages a classification of over 1,100 NAICS codes to provide tailored policy suggestions, ensuring coverage aligns with specific business risks. This precision contrasts sharply with traditional approaches that often applied broad assumptions, leading to coverage gaps or overpricing. As insurers increasingly adopt these data-driven solutions, the market is likely to see improved customer satisfaction and pricing confidence, fostering growth in niche segments where specialized risk assessment is critical.

Addressing Regional and Sectoral Variations

The commercial insurance market is not monolithic; it varies widely across regions and industries, presenting unique challenges that technology must address. The Sapiens-Linqura partnership stands out for its ability to adapt AI-driven analytics to these disparities, offering insights into localized risk profiles and sector-specific needs. For instance, risks in coastal regions prone to natural disasters differ vastly from those in urban manufacturing hubs, and tailored solutions are essential. This adaptability signals a broader market trend toward flexible, technology-enabled platforms that can cater to diverse portfolios, ensuring insurers remain competitive in an increasingly fragmented landscape.

Projections for the Future of Commercial Underwriting

Scaling Technology Adoption Across the Industry

Looking ahead, the market is expected to witness a rapid uptake of AI and machine learning in underwriting, with partnerships like Sapiens and Linqura setting the benchmark. Projections suggest that by 2027, a significant portion of commercial insurers will integrate similar intelligent systems to streamline operations. This shift is driven by the need to handle complex accounts efficiently, allowing underwriters to focus on high-value tasks rather than repetitive data analysis. The scalability of such platforms will likely encourage smaller insurers to adopt these technologies, leveling the playing field and intensifying market competition.

Navigating Regulatory and Ethical Challenges

As technology reshapes underwriting, regulatory frameworks around data privacy and AI ethics are anticipated to evolve, impacting market dynamics. Insurers will need to balance innovation with compliance, ensuring that data usage aligns with emerging standards. The Sapiens-Linqura collaboration offers a potential model for navigating these challenges, as it emphasizes transparency in AI-driven recommendations. Market analysts predict that insurers who proactively address these concerns will build greater trust with clients, gaining a competitive edge in a landscape increasingly focused on ethical technology deployment.

Driving Profitability Through Specialization

A critical projection for the market centers on profitability, as technology enables underwriters to become instant specialists across diverse accounts. By leveraging tools that provide deep insights into specific business risks, insurers can unlock growth in underrepresented sectors, enhancing revenue streams. The partnership between Sapiens and Linqura highlights this potential, demonstrating how integrated platforms can refine risk selection and pricing accuracy. Over the next few years, this trend is expected to redefine market standards, with insurers prioritizing specialization as a key driver of financial success.

Reflecting on Insights and Strategic Pathways Forward

Looking back, this market analysis reveals how the collaboration between Sapiens and Linqura has transformed the commercial insurance underwriting landscape by integrating advanced AI and data analytics into policy administration systems. Their partnership addresses inefficiencies, empowers underwriters with precision tools, and adapts to diverse market needs, setting a new industry benchmark. For insurers, the strategic implication is clear: adopting scalable, technology-driven platforms is essential to remain competitive. The path forward involves investing in training to ensure seamless integration of these tools, while also focusing on ethical data practices to build client trust. Additionally, exploring similar partnerships offers a way to stay ahead of market trends, ensuring sustained growth in a digital-first era.