The insurance industry has witnessed a transformative shift with the partnership between Simply Business, LLC, and London Underwriters. This alliance brings together Simply Business’s top-rated carriers and London Underwriters’ innovative single sign-on portal, LU One, providing insurance agents with an unprecedented advantage in the marketplace. The collaboration aims to significantly streamline the process of securing insurance for small business clients, ranging from home-based businesses to contractors. This is achieved through a fully digital experience that offers agents the ability to provide customized, high-quality coverage for various insurance needs, including general liability and inland marine insurance.

Enhancing Efficiency and Access

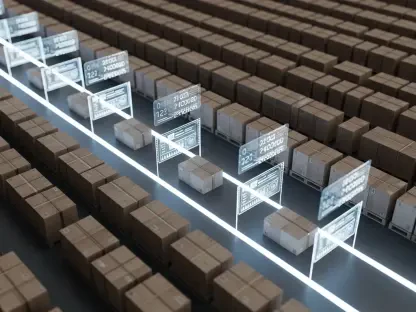

The integration of Simply Business’s panel of top-rated carriers with London Underwriters’ LU One portal represents a pivotal development in the insurance sector. By offering a single sign-on experience, agents gain access to a more efficient workflow, reducing the time and effort required to secure insurance quotes. With just one online application, agents can generate multiple quotes for their clients, facilitating swifter decision-making and policy binding. Additionally, the centralized dashboard simplifies policy management by providing a comprehensive overview of client policies, thus enhancing the agent’s capability to manage and adjust policies as needed.

This partnership is not only about efficiency but also about expanding access to varied insurance solutions. The broad spectrum of coverage types, including general liability, professional liability, property coverage, and inland marine insurance, ensures that agents can meet the diverse needs of their small business clients. This means that whether the clients are online retailers or contractors, agents have the tools to provide tailored solutions that offer optimal protection at competitive prices. The ability to instantly bind coverage means agents can deliver immediate value, making the insurance process as seamless as possible for the client.

Benefits of a Digital Experience

The digital integration provided by Simply Business and London Underwriters transforms how insurance agents operate in today’s market. A significant benefit of this partnership lies in the fully digital experience, which improves both the speed and quality of service provided to clients. Agents can swiftly navigate through the digital interface to find the best coverage options available, ensuring their clients receive the highest level of protection. This digital-first approach aligns with the modern expectations of clients who demand rapid and efficient services.

Moreover, the ability to handle multiple clients simultaneously without compromising service quality is a key advantage of a digital platform. Agents can easily track policy statuses, manage renewals, and adjust coverage options through an intuitive dashboard. This not only boosts the agent’s productivity but also enhances overall client satisfaction by ensuring their insurance needs are consistently met with minimal hassle. The emphasis on customization and efficiency means clients receive insurance solutions that are specifically tailored to their unique risk profiles and operational requirements.

A New Era in Insurance Procurement

The insurance industry has undergone a significant transformation with the partnership between Simply Business, LLC, and London Underwriters. This alliance merges Simply Business’s leading carriers with London Underwriters’ cutting-edge single sign-on portal, LU One, giving insurance agents a substantial edge in the market. The collaboration is designed to greatly streamline the process of securing insurance for small business clients, from home-based enterprises to contractors. By utilizing a fully digital platform, it allows agents to offer customized, high-quality coverage for diverse insurance needs such as general liability and inland marine insurance. This collaboration ultimately aims to simplify and enhance the user experience for insurance agents and their clients, ensuring quicker and more efficient service delivery. Through this partnership, the process of obtaining insurance becomes more accessible and tailored, addressing the specific needs of small businesses with greater accuracy and speed.