Imagine a world where a simple smartphone scan could save homeowners thousands of dollars by catching hidden risks in their property before disaster strikes. This isn’t a distant dream but a reality unfolding through an innovative partnership between a leading US-based insurance provider and an AI-driven home risk assessment platform. By blending cutting-edge technology with the needs of everyday homeowners, this collaboration is reshaping how home inspections are conducted. It’s not just about identifying problems; it’s about empowering policyholders to take control, prevent costly damages, and protect their most valuable asset. The implications are profound, promising a shift from reactive fixes to proactive care in an industry often bogged down by outdated methods.

Revolutionizing the Inspection Process with AI

Empowering Homeowners Through Smartphone Technology

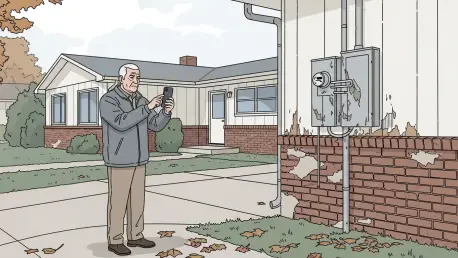

The traditional home inspection process has long been a tedious affair, often involving external assessments that miss critical internal issues. Now, a groundbreaking mobile-guided tool is changing the game. Selected policyholders, especially those facing renewal inspections, can use their smartphones to conduct detailed photo surveys of their homes. This AI-powered platform analyzes images against hundreds of potential failure points, spotting risks like corrosion, outdated wiring, or plumbing weaknesses. Homeowners receive personalized reports with actionable repair suggestions, while urgent issues are flagged for further professional evaluation. This approach not only simplifies the process but also puts power directly into the hands of property owners, allowing them to address hazards before they spiral into expensive claims. The convenience of a self-service option marks a significant departure from waiting on scheduled inspections, offering immediacy and clarity.

A Deeper Look at Risk Detection Capabilities

Beyond ease of use, the real strength of this AI tool lies in its precision. Trained on vast datasets that incorporate construction and insurance expertise, the platform identifies subtle yet dangerous problems often overlooked by conventional methods. For instance, it can detect that nearly a third of homes harbor active plumbing hazards likely to cause issues within a few years—often due to small, fixable components like aging supply lines. Electrical malfunctions, which contribute to thousands of residential fires each year, are also flagged with alarming accuracy. By focusing on internal risks, which account for a majority of non-catastrophic insurance claims, this technology targets the root causes of damage. Water leaks alone, unrelated to weather, frequently cost over $15,000 per incident, while fire losses can average more than $88,000. Such detailed analysis ensures that homeowners aren’t just reacting to disasters but preventing them, fundamentally altering the relationship between policyholders and risk management.

Driving Industry Trends Through Proactive Solutions

Prioritizing Prevention Over Reaction

The broader trend this partnership reflects is a decisive move toward prevention in the insurance sector. Historically, claims have been handled after the fact, with homeowners bearing the emotional and financial toll of recovery. In contrast, this AI-driven initiative emphasizes catching fixable issues early, particularly those related to water damage—a leading cause of claims. By offering in-depth reviews at no additional cost, the program educates property owners about their home’s vulnerabilities and provides clear next steps for mitigation. Leadership from both sides of the partnership has highlighted the importance of this shift. Modern inspection options not only protect homes but also spare families the burden of rebuilding after a preventable loss. This proactive stance isn’t just a technological upgrade; it’s a cultural change, redefining how insurers and homeowners collaborate to safeguard properties across every state where these policies are offered.

Scaling Innovation for Broader Impact

Moreover, the scalability of this initiative sets it apart as a model for the future. Rolled out gradually to existing policyholders during renewal periods, the program ensures a smooth transition while maximizing its reach. This methodical implementation demonstrates a commitment to balancing efficiency with thoroughness, avoiding the pitfalls of rushed tech adoption. By integrating underwriting expertise with advanced AI capabilities, the collaboration creates a seamless system that enhances customer experience through self-service and detailed risk analysis. The focus on digital innovation aligns with industry-wide movements toward technology-driven solutions, prioritizing empowerment over dependency. As this offering expands, it could redefine standards for risk assessment, encouraging other providers to adopt similar tools. Looking back, this partnership proved to be a pivotal moment, showing how strategic alliances between insurers and tech innovators tackled long-standing challenges with ingenuity and precision.

Charting the Path Forward

Reflecting on this collaboration, it became evident that blending AI with insurance expertise marked a turning point in home protection. The journey highlighted how internal hazards, once invisible until catastrophe struck, were brought to light through accessible technology. Moving forward, the next steps involved expanding access to even more homeowners, refining the platform’s algorithms for greater accuracy, and inspiring industry peers to embrace preventative tools. This wasn’t merely about reducing claims; it was about fostering a mindset of vigilance and care. As the initiative gained traction, it laid the groundwork for a future where technology and human insight worked hand in hand to protect investments and peace of mind. The challenge now rests on building upon this foundation, ensuring that every policyholder could benefit from such forward-thinking solutions without barriers.