Japan’s general insurance sector has faced significant challenges and dynamic shifts over recent years. With a deep recession impacting growth in 2023, the industry’s pathway to recovery offers critical insights into prevailing economic conditions, market trends, and evolving consumer demands. As projected by GlobalData, a leading data and analytics company, the sector presents a complex yet cautiously optimistic future.

Economic Context and Industry Performance

2023 Recession and Market Contraction

The recession of 2023 placed a heavy burden on Japan’s general insurance market. The downturn saw a contraction in economic activity, leading to a reduction in gross written premiums (GWP) and forcing the industry to navigate a challenging landscape. This period highlighted the vulnerabilities within the market, particularly in terms of consumer spending and insurance policy uptake. Despite these setbacks, the overall resilience of the industry suggests potential for recovery. The macroeconomic factors that influenced the downturn are essential to assess as they provide a baseline for projecting future growth and stability within the sector.

Assessing the economic downturn of 2023, it becomes evident that consumer spending shrank significantly due to reduced disposable incomes and a cautious approach to financial commitments. Insurance policies, often considered non-essential during economic hardship, saw a decline in uptake, further compounding the industry’s struggles. However, it’s important to remember that economic cycles are typical in any market, and the insurance sector’s resilience lies in its ability to rebound from such phases. As companies and individuals alike navigate the challenging economic landscape, the insurance market plays a crucial role in providing financial security, underlining its indispensable nature.

Growth Projections: A Path to Recovery

Looking forward, the sector is set to rebound with gross written premiums (GWP) projected to grow from JPY11.7 trillion ($81.1 billion) in 2024 to JPY12.7 trillion ($93.9 billion) by 2028. This expected growth marks a compound annual growth rate (CAGR) of 2.2%. Several factors underpin this anticipated recovery, including increased demand for policies covering natural catastrophic (Nat-cat) events and workers’ compensation. These projections are crucial for stakeholders within the industry, as they highlight the potential for strategic adjustments and targeted investments to capture emerging opportunities and address ongoing challenges.

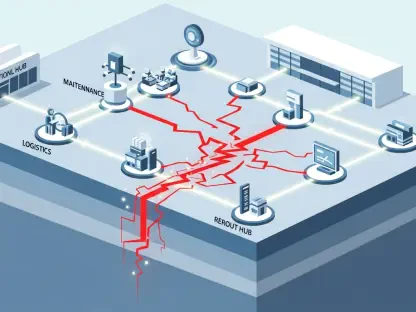

The anticipated recovery reflects a broader economic rebound that stabilizes consumer confidence and, consequently, insurance policy uptake. As enterprises regain stability and individuals seek to safeguard their assets against unforeseen events, the demand for comprehensive insurance policies is poised to rise. Furthermore, the increasing frequency and severity of natural catastrophic events have made it imperative for individuals and businesses to invest in robust insurance coverage. These policies serve as a financial lifeline during disasters, ensuring that losses are mitigated and recovery can commence swiftly. This growing awareness and consequent demand will drive the projected growth in the general insurance sector over the next few years.

Sector-Specific Insights

Motor Insurance: Balancing Act

Motor insurance remains the most significant segment in Japan’s general insurance market, representing 47.5% of GWP in 2024. The sector experienced a downturn in 2023 due to a decline in traffic accidents, which correspondingly reduced GWP for motor insurance. This scenario underscores the direct correlation between economic activities and insurance claims. However, moving forward, the frequen