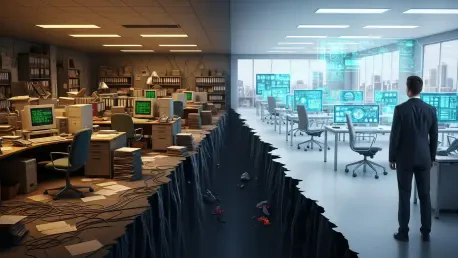

A recent industry poll reveals a startling reality within the managing general agent sector: exactly half of all MGAs are only just beginning their digital transformation journey, struggling with outdated technology stacks while their competitors accelerate into the future. This significant divide highlights a critical inflection point for the industry. While some are embracing modern, API-first strategies to unlock unprecedented agility and innovation, a large contingent remains mired in legacy systems. This technological inertia is not merely a matter of inconvenience; it actively perpetuates operational inefficiencies that have long been accepted as the cost of doing business. The findings from the poll, conducted during a Managing General Agents’ Association (MGAA) Market Briefing, paint a clear picture of a market bifurcating into the digitally enabled and the digitally delayed, raising urgent questions about long-term viability and competitive relevance for those who hesitate to modernize.

The Deepening Digital Divide

A closer look at the data reveals the true extent of the separation within the MGA landscape. The poll indicated that while 40% of respondents are just getting started on their modernization path and another 10% are actively exploring solutions, a concerning 10% have not even placed digital transformation on their strategic roadmap. This stands in stark contrast to the 40% who are making tangible progress, with 20% already in the process of implementing changes and another 20% now fully API-enabled. This is not a gentle curve of adoption but a sharp split between proactive innovators and reactive followers. The implications are profound, suggesting that a significant portion of the market is at risk of being outmaneuvered. For these MGAs, the challenge is no longer about whether to adopt new technology, but how quickly they can close a rapidly widening gap before their digitally native counterparts capture an insurmountable market share, redefine partner expectations, and set a new industry standard for operational excellence.

The consequence of this technological lag is the perpetuation of persistent operational challenges that stifle growth and erode profitability. Inefficient and slow partner onboarding processes, for example, have become so common that they are often seen as an unavoidable industry norm. Similarly, fragmented data, siloed across disparate and non-communicative systems, prevents a holistic view of the business, hindering underwriting accuracy and strategic decision-making. Furthermore, the reliance on outdated infrastructure makes product development and updates incredibly expensive and time-consuming, often taking many months to bring a new offering to market. These pain points are not just minor frustrations; they represent fundamental barriers to agility and innovation. In an increasingly dynamic insurance marketplace, the inability to move quickly, integrate seamlessly, and leverage data effectively constitutes a severe competitive disadvantage that can no longer be ignored or accepted as “business as usual.”

Pivoting to an API-First Future

The foundational solution to these deep-seated problems lies in embracing an API-first infrastructure. Application Programming Interfaces (APIs) serve as the transformative connective tissue that enables seamless, real-time digital communication between different systems and platforms. Much as they have revolutionized industries like finance and travel, APIs are now poised to redefine the insurance ecosystem. For MGAs, this means moving away from monolithic, closed-off legacy systems toward a flexible, interconnected architecture. An API-driven approach allows carriers, brokers, and MGAs to connect and exchange data effortlessly, eliminating the manual processes and data re-entry that create bottlenecks. This shift is not merely an IT upgrade; it represents a fundamental change in business strategy, positioning technology as the core enabler of operational agility, product innovation, and stronger, more efficient partnerships across the entire insurance value chain.

Adopting an API-driven platform unlocks a host of tangible competitive advantages that directly address the industry’s most pressing challenges. One of the most significant benefits is a dramatic acceleration in speed-to-market. Instead of spending months on development, MGAs can launch new and updated products in a matter of weeks, allowing them to respond swiftly to emerging market demands and opportunities. This agility extends to partner integrations, which can be completed more rapidly, expanding distribution networks and revenue streams. An API-first model also empowers MGAs to create new digital distribution channels, reaching customers through modern, user-friendly interfaces. Internally, it fosters more effective collaboration, as teams are equipped with integrated tools and real-time data access. Ultimately, this technological pivot empowers MGAs to break free from the constraints of legacy systems and assume their intended role as key innovators and market makers in the insurance industry.

Forging a Path Forward

The decision to adopt a modern, API-first infrastructure marked a definitive turning point for leading managing general agents. Those who embraced this technological evolution successfully dismantled long-standing operational barriers and fundamentally reshaped their competitive position in the market. By moving beyond the accepted norms of slow onboarding and fragmented data, they established a new benchmark for efficiency and partner collaboration. The ability to rapidly develop and deploy innovative insurance products allowed them to not only meet but anticipate the evolving demands of their customers and partners. This strategic investment in digital transformation was not just about upgrading systems; it was about building a foundation for sustained growth and resilience. The MGAs who made this pivot were the ones who ultimately secured their role as indispensable leaders, driving the future of the insurance industry through agility and innovation.