The insurance industry has long been constrained by a persistent operational bottleneck that has stifled growth and consumed countless hours of manual labor, specifically the tedious and error-prone process of generating quotes for potential clients. SUPERAGENT AI, Inc. has officially announced a technological breakthrough with the introduction of the world’s first “Quoting AI Agent,” a system poised to fundamentally reshape this critical workflow. This innovation directly confronts the long-standing challenge where producers must manually collect client information, navigate a labyrinth of disparate carrier portals, and repeatedly re-enter the same data to produce viable insurance options. For decades, this inefficiency has acted as a ceiling on agency productivity and scalability, forcing even the most ambitious firms to temper their growth expectations. The new technology promises to shatter this limitation by automating the entire quoting journey, delivering accurate, bindable quotes almost instantaneously and freeing human agents to focus on client relationships and strategic growth initiatives rather than administrative drudgery.

A Paradigm Shift in Insurance Operations

Eliminating the Quoting Bottleneck

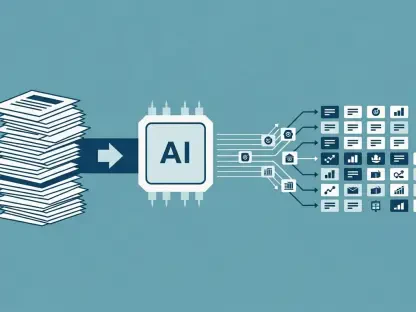

The newly unveiled Quoting AI Agent is engineered to function as an autonomous entity, systematically dismantling the manual steps that have historically defined the quoting process. Its operational protocol begins with intelligent, conversational interaction with prospects to meticulously gather all necessary risk data, eliminating the back-and-forth communication that often causes delays. Once this information is secured, the AI leverages it to pre-fill applications with a high degree of accuracy, effectively sidestepping the redundant and time-consuming task of manual data entry. The system’s core strength lies in its ability to simultaneously interface with a multitude of complex carrier rating systems. It navigates these diverse portals, which often have unique interfaces and data requirements, to optimize rates and identify the most suitable coverage options for the client’s specific needs. This parallel processing capability culminates in the delivery of precise, bindable quotes within seconds, a stark contrast to the hours or even days this process previously required from human producers, fundamentally altering the speed and efficiency of client acquisition.

This automation represents a significant leap forward, not just in speed, but in operational capacity for insurance agencies. By offloading the most labor-intensive aspect of the sales process to an AI, agencies can dramatically increase their volume of prospective clients without a corresponding increase in headcount or administrative overhead. Producers, who once spent the majority of their time on data entry and portal navigation, are now liberated to engage in higher-value activities such as building stronger client relationships, providing expert consultation, and closing complex deals. This shift transforms the role of the insurance professional from a data clerk to a true risk advisor. Moreover, the consistency and accuracy of the AI-driven process minimize the risk of human error, leading to more reliable quotes and a reduction in errors and omissions (E&O) exposure. The technology effectively removes the cap on an agency’s growth potential, allowing for scalable expansion driven by efficiency rather than sheer manpower, heralding a new era of productivity for the entire industry.

The Ecosystem of Intelligent Automation

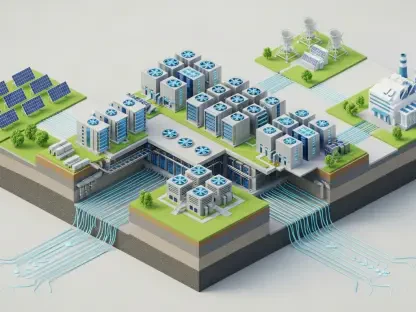

The Quoting AI Agent does not operate in a vacuum; it is a critical and integrated component of a larger, cohesive ecosystem of AI-driven tools designed to automate the entire insurance sales and service lifecycle. This launch is positioned as the linchpin that connects the company’s existing suite of specialized AI agents, which includes dedicated systems for proactive Outbound sales campaigns, responsive Inbound inquiry management, strategic customer Retention efforts, and comprehensive employee Training modules. By introducing an autonomous quoting capability, the company effectively closes the loop, creating a seamless, end-to-end workflow managed by intelligent automation. For example, an Outbound AI can initiate contact with a lead, an Inbound AI can handle the initial questions, and now the Quoting AI can take the gathered information to generate immediate, competitive quotes. This holistic integration ensures that every stage of the customer journey is optimized for speed, efficiency, and a consistent client experience, moving agencies away from fragmented, piecemeal solutions toward a unified operational platform.

The system’s intelligence extends beyond the initial generation of a quote, seamlessly transitioning into the crucial follow-up and engagement phase of the sales cycle. Once a quote is generated and delivered, the platform can be configured to automatically initiate contact with the customer through their preferred communication channel, whether that be a personalized voice call, a timely SMS message, or a detailed email. This automated outreach ensures that no lead is left unattended and that the momentum of the initial engagement is maintained without requiring manual intervention from a producer. This capability is deeply integrated with the other AI agents, allowing for a context-aware follow-up that can answer questions, provide additional information, and guide the prospect toward binding the policy. This comprehensive approach, from initial contact to quote delivery and follow-up, creates a powerful, self-sustaining sales engine that operates around the clock, amplifying an agency’s ability to convert leads into long-term clients while maintaining a high standard of customer service.

The Path to Full Autonomy

The Final Piece of The Puzzle

Company leadership has emphasized that the release of the Quoting AI Agent is more than just an product launch; it represents the final foundational piece required to achieve their ultimate vision: “The Fully Autonomous Insurance AI Agent.” This ambitious goal involves creating a single, independent digital entity capable of managing the entire sales process from start to finish without any need for human intervention. The new quoting technology was the most complex and critical element missing from this equation. By successfully automating the intricate process of data gathering, multi-carrier rating, and quote generation, the path is now clear to merge this capability with the company’s established conversational AI agents. The resulting synthesis will create an AI that can not only communicate intelligently with prospects but also perform the complex analytical and administrative tasks required to secure a bindable policy, effectively creating a digital producer that can operate with complete independence. This marks a pivotal moment in the evolution of insurance technology.

The plan to bring this fully autonomous agent to market is already in motion, with a target set for the first quarter of this year to complete the functional merger of the quoting and conversational AI systems. This integration will produce a singular AI persona capable of handling every step of the client acquisition journey, from identifying and engaging a prospect to understanding their needs, gathering their risk information, shopping the market for the best coverage, presenting a bindable quote, and facilitating the final purchase. The implications of such a technology are profound, suggesting a future where insurance agencies can deploy digital workforces to handle routine sales and service tasks, allowing human agents to focus exclusively on strategic oversight, complex risk management, and fostering high-level client partnerships. This vision moves beyond simple automation of individual tasks to the creation of a truly autonomous agent that can think, act, and sell independently, potentially redefining the structure and operation of the insurance industry itself.

Industry Anticipation and Access

In response to the significant industry interest surrounding this technological advancement, the official global launch of the Quoting AI Agent is scheduled for February 11. Recognizing the potential for high demand from agencies eager to gain a competitive edge, the company has taken proactive steps to manage the rollout. An Early Access Waitlist has been opened, allowing forward-thinking agencies to secure their place in line to adopt the technology. This strategy not only helps manage the initial wave of implementations but also builds a community of early adopters who can provide valuable feedback and showcase the system’s real-world impact. This period of managed access is crucial for ensuring a smooth and successful deployment on a wider scale, allowing the company to fine-tune its support and onboarding processes in preparation for the full market release. The anticipation is palpable, as many in the industry view this as a transformative tool that could redefine competitive dynamics.

To further fuel this anticipation and provide tangible proof of the system’s capabilities, the company is now actively scheduling live demonstrations for interested agencies. These one-on-one sessions are designed to offer a firsthand look at the Quoting AI Agent in action, allowing agency principals and producers to witness its speed, accuracy, and autonomy. This transparent approach is intended to demystify the technology and directly address any skepticism by showcasing its ability to navigate complex quoting scenarios in real-time. By providing this direct, interactive experience, the company aims to move the conversation beyond theoretical benefits to a clear demonstration of practical value. This pre-launch engagement strategy is designed to educate the market, validate the technology’s performance, and build a strong foundation of trust with future clients, ensuring that by the time of the official launch, the industry is not just aware of the innovation but is fully convinced of its transformative potential for their operations.

A New Chapter in Insurtech

The introduction of an autonomous quoting agent marked a definitive turning point for the insurance sector. It signaled a fundamental transition away from legacy systems and manual processes that had long hindered the industry’s potential for innovation and efficiency. The technology effectively dismantled the most significant operational bottleneck, proving that complex, multi-step workflows could be successfully managed by an intelligent, independent system. This development moved the concept of AI in insurance from a peripheral tool for simple tasks to a core component of the business model, capable of handling one of its most critical functions. The successful automation of quoting served as a powerful proof-of-concept for the broader vision of a fully autonomous digital workforce, setting a new benchmark for what was considered possible within the realm of insurance technology and catalyzing a wave of strategic re-evaluation across agencies of all sizes.