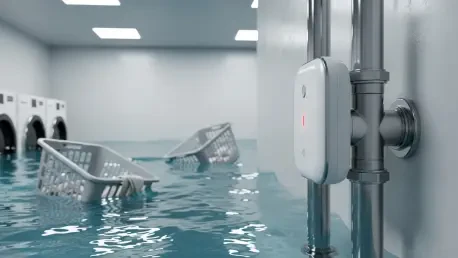

A multi-thousand-dollar smart water valve, designed with sophisticated sensors and cloud connectivity to prevent catastrophic floods, can be rendered completely useless by something as mundane as a changed Wi-Fi password or a power cord accidentally unplugged from the wall. This simple reality creates a dangerous and costly paradox for homeowners and the insurance industry. While carriers increasingly reward policyholders for installing these advanced mitigation devices, a lack of continuous oversight means that a significant portion of this technology fails to provide any protection at all, fostering a false sense of security that leaves properties critically vulnerable to the very disasters they were meant to prevent.

The Promise of Protection vs The Peril of an Unplugged Cord

The central appeal of a smart water shutoff valve lies in its proactive capability. Unlike traditional leak detectors that merely sound an alarm, these devices are engineered to automatically stop the flow of water at its source, mitigating what could otherwise become tens of thousands of dollars in damage. This promise of immediate intervention forms the bedrock of their value proposition. However, this advanced protection is entirely dependent on a fragile ecosystem of power and connectivity. The technology’s greatest strength—its ability to communicate and act remotely—is simultaneously its most common point of failure, a vulnerability often overlooked until it is far too late.

The Smart Home Gold Rush Why Insurers Are All In

Driven by the escalating costs of water damage claims, the insurance industry has championed the adoption of smart shutoff technology with substantial financial incentives. Carriers nationwide offer valuable premium credits to policyholders who install approved devices, creating a powerful motivation for homeowners to invest in this form of protection. This strategy is built on a clear and compelling logic: by preventing large-scale water losses, insurers can significantly reduce their claim payouts, making the premium discounts a sound financial investment.

From an underwriter’s perspective, the arrangement appears to be a definitive win-win. Policyholders benefit from lower insurance costs and the peace of mind that comes with having a digital safeguard against plumbing failures. In parallel, carriers believe they are effectively shrinking their exposure to one of the most frequent and costly types of residential property claims. This widespread adoption initiative has positioned smart shutoffs as a cornerstone of modern risk mitigation programs, fundamentally altering how insurers calculate risk for tech-enabled homes.

The Disconnect A Failure Rate Hiding in Plain Sight

Beneath this optimistic surface, however, a critical disconnect persists. Monitoring data reveals a startling truth: at any given time, an estimated 30% to 50% of smart shutoff devices for which insurers are providing credits are offline and non-functional. The culprits behind these failures are rarely dramatic. More often, they are the mundane realities of modern home life, such as a router being replaced, a network password being updated, or a device being improperly configured during its initial setup. The result is an illusion of protection where homes appear shielded on paper, but the underlying risk remains entirely unmitigated.

Real-world incidents starkly illustrate the consequences of this gap between installation and operation. In one case in Texas, a correctly installed valve failed because its subterranean access box, where the device was housed, flooded with mud after a heavy rain, severing its connection. In another instance in New York, a preventable disaster occurred when an installer’s mistake—leaving a bypass loop open—allowed water to continue flowing freely during a leak, completely negating the smart valve’s attempt to shut off the main line. These events are not isolated anomalies but symptoms of a widespread issue where the final, crucial step of ongoing verification is missing.

Calculating the Cost The Financial Fallout of False Security

This widespread dysfunction carries severe financial repercussions. Insurers extend millions in premium credits based on the assumption of active protection, creating a significant misalignment between premiums and actual risk. For example, analysis of one carrier’s portfolio revealed it had extended over $11 million in credits for devices that, due to being offline, were only protecting an estimated $5.7 million in genuine exposure. This gap represents an “invisible exposure” that is not captured in standard reporting, leading to flawed portfolio management and fundamentally mispriced policies.

The root of this problem lies in the insurance industry’s standard verification process. Typically, carriers confirm a device’s installation at a single point in time, often by simply reviewing a photo and a paid invoice. This method fails to account for the dynamic nature of connected technology. Without a consolidated, verifiable, and ongoing source of data to confirm that these devices remain active, insurers operate with a significant blind spot. This lack of accurate data can distort the long-term perception of the technology’s effectiveness, potentially leading carriers to wrongly conclude the devices are less effective than they truly are and undermining confidence in mitigation programs altogether.

Closing the Gap From Passive Hope to Active Verification

The most effective solution to this challenge is a strategic shift from passive hope to active, third-party monitoring. By implementing continuous, hardware-agnostic validation tools, carriers can confirm on an ongoing basis whether credited devices are online and functional. This verification process serves as a definitive “source of truth,” ensuring that premium credits are accurately aligned with genuine risk reduction. Active monitoring transforms incentive programs from a speculative investment into a measurable and reliable strategy for reducing claims costs.

Ultimately, realizing the full potential of smart mitigation technology required a cooperative, ecosystem-wide approach. This involved shared responsibility among several key players. Manufacturers began designing more resilient devices with proactive user notifications for connectivity issues. Homeowners were educated on the importance of periodic system checks, while insurers took a more active role in teaching agents and policyholders about simple verification steps. Tying it all together, independent monitoring services provided a unified platform for carriers, offering a cost-effective method to confirm mitigation performance and report on connectivity across vast portfolios. This collective commitment ensured that the promise of smart shutoffs became a reliable reality.