In an era where data overwhelms traditional systems, the insurance industry faces a staggering challenge: processing claims and managing policies with speed and precision while meeting rising customer expectations. With billions of data points generated annually from policies, claims, and customer interactions, manual processes often falter, leading to delays and inefficiencies. Artificial intelligence (AI) emerges as a transformative force, promising to reshape this landscape by automating workflows, enhancing decision-making, and personalizing customer experiences. This review dives into the capabilities of AI in insurance, exploring its core features, real-world impact, and the potential it holds for modernizing an age-old sector.

Core Features and Performance of AI in Insurance

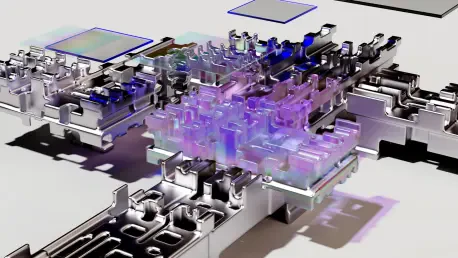

Workflow Automation and Process Optimization

AI-driven automation stands as a cornerstone of innovation in insurance, targeting repetitive tasks that once consumed significant time and resources. Platforms developed by startups integrate seamlessly with legacy systems, handling processes like underwriting and claims processing with remarkable efficiency. These tools rely on machine learning algorithms to minimize human intervention, slashing processing times while maintaining high accuracy levels.

Beyond speed, the measurable benefits include cost reduction and error mitigation. Insurers adopting such technology report shorter turnaround times for routine operations, allowing staff to focus on complex, value-added tasks. This shift not only boosts operational efficiency but also enhances scalability as data volumes continue to grow.

The adaptability of these systems further amplifies their value. Unlike rigid software of the past, modern AI platforms evolve with changing regulations and business needs, ensuring long-term relevance. This flexibility positions automation as a critical tool for insurers aiming to stay competitive in a fast-paced market.

Advanced Data Analytics for Policy Insights

Another powerful facet of AI lies in its ability to analyze vast datasets and deliver actionable insights for policy management and risk assessment. Sophisticated algorithms sift through historical data, identifying patterns that inform coverage gaps and pricing strategies. This capability enables insurers to tailor offerings to individual customer needs, a significant departure from one-size-fits-all policies.

Performance metrics for these tools often highlight improved sales outcomes and customer retention rates. By equipping agents with detailed insights, AI enhances their ability to recommend relevant products, fostering trust and loyalty among policyholders. Such personalization marks a pivotal shift toward customer-centric models in the industry.

Moreover, the predictive nature of these analytics tools helps insurers anticipate risks before they materialize. From assessing environmental hazards to evaluating client behavior, AI provides a proactive edge in policy design. This forward-thinking approach underscores the technology’s role in driving strategic decision-making.

Computer Vision in Claims Management

AI’s application of computer vision transforms claims handling, particularly in scenarios involving catastrophic events like natural disasters or major accidents. This technology guides policyholders through damage documentation, often using mobile apps to capture photos for analysis. The result is a streamlined process that reduces the need for on-site inspections.

Cycle times for claims processing see dramatic improvements with this innovation. Desk reviews, powered by image recognition algorithms, assess damage with precision, cutting down delays and operational costs for insurers. Policyholders benefit from faster resolutions, enhancing overall satisfaction during stressful times.

The scalability of computer vision tools also proves invaluable during large-scale events. When hundreds or thousands of claims arise simultaneously, AI ensures consistent and rapid evaluations without compromising quality. This resilience cements computer vision as an indispensable asset in modern claims management.

Recent Innovations and Collaborative Trends

The insurance sector witnesses a surge in AI adoption through initiatives like the FIRE Accelerator program, a collaborative effort involving industry leaders and community organizations. This program nurtures startups focused on practical AI solutions, with the current cohort including companies like Solvrays, InsureScope, and Obai. Their tools address distinct challenges, from workflow automation to policy analysis and claims processing.

A notable trend is the shift toward digitization and customer-centric solutions. Insurers increasingly prioritize technologies that strengthen relationships among customers, agents, and carriers, reflecting a broader push for seamless experiences. Collaboration between startups and established firms accelerates this progress, blending innovative ideas with industry expertise.

Additionally, the focus on talent management and operational efficiency signals a holistic approach to modernization. Programs like FIRE Accelerator provide capital, mentorship, and networking opportunities, ensuring that emerging technologies gain traction swiftly. This collaborative model sets a precedent for how innovation can thrive in a traditionally cautious industry.

Real-World Impact and Specific Use Cases

AI’s practical applications shine in the property and casualty (P&C) insurance space, where inefficiencies often hinder service delivery. Solvrays, for instance, offers an AI workflow platform that integrates automation into existing systems, reducing manual effort for insurers without disrupting core operations. This solution proves particularly effective in high-volume environments.

InsureScope tackles a different pain point by providing AI-driven policy analysis for insurance professionals. Its tool compares competing policies, identifies coverage gaps, and enhances sales strategies, empowering agents to deliver tailored advice. The impact on customer trust and sales performance has been significant in early deployments.

Obai, meanwhile, focuses on catastrophic auto claims with a claimant-first workflow powered by computer vision. By guiding policyholders through photo capture and supporting desk reviews, it minimizes cycle times and reinspections. Such targeted solutions highlight AI’s versatility in addressing niche challenges while improving outcomes for all stakeholders.

Challenges in AI Integration

Despite its promise, AI adoption in insurance faces notable hurdles, starting with technical compatibility. Many insurers rely on outdated systems that struggle to integrate with cutting-edge tools, creating bottlenecks in implementation. Developing scalable solutions that bridge this gap remains a pressing concern.

Regulatory challenges also loom large, particularly around data privacy and compliance. Handling sensitive customer information demands strict adherence to evolving laws, which can slow deployment of AI technologies. Building trust through transparent practices is essential to navigate this complex landscape.

Market resistance adds another layer of difficulty, as some industry players hesitate to abandon familiar processes. Overcoming this inertia requires robust education and demonstration of AI’s tangible benefits. Partnerships and pilot programs often serve as effective means to ease this transition, fostering gradual acceptance.

Looking Ahead: The Future of AI in Insurance

The trajectory of AI in insurance points toward groundbreaking advancements, particularly in predictive analytics and personalized offerings. Future tools may anticipate customer needs with unprecedented accuracy, crafting policies that adapt in real time to changing circumstances. This potential could redefine how risk is managed and priced.

Seamless customer experiences also stand on the horizon, driven by AI’s ability to integrate across touchpoints. From chatbots handling inquiries to automated claims resolutions, the technology promises a frictionless journey for policyholders. Such developments could elevate customer satisfaction to new heights.

Long-term, the societal and economic impacts of widespread AI adoption appear profound. By reducing costs and improving efficiency, insurers might pass savings to consumers, democratizing access to comprehensive coverage. Collaborative initiatives like FIRE Accelerator will likely play a pivotal role in shaping this transformative future.

Final Thoughts

Reflecting on this exploration, AI proves to be a game-changer for the insurance industry, delivering efficiency and innovation across critical functions. Its ability to automate workflows, analyze data, and streamline claims management demonstrates tangible benefits for insurers and customers alike. The real-world success of startups under programs like FIRE Accelerator underscores the technology’s immediate impact.

Moving forward, the industry must prioritize solutions to integration challenges, focusing on scalable systems and regulatory compliance. Investing in partnerships between startups and established firms can bridge gaps in adoption, ensuring AI’s benefits reach a wider audience. Additionally, continuous education on AI’s value will help dismantle resistance to change.

As a next step, stakeholders should explore pilot projects to test emerging AI tools in controlled environments, gathering data on performance and user feedback. Committing to transparent practices around data usage will also build trust, paving the way for broader implementation. With these efforts, AI’s potential to revolutionize insurance can be fully realized in the years ahead.