The stark reality that nearly nine out of ten new insurance producers exit the industry within five years points directly to a persistent, foundational challenge—the struggle to maintain a consistent flow of new business opportunities. The launch of dedicated AI-powered prospecting tools represents a significant advancement in the insurance sector. This review will explore the evolution of this technology, its key features, performance metrics, and the impact it has had on lead generation applications. The purpose of this review is to provide a thorough understanding of the technology, its current capabilities, and its potential future development.

The Evolution of Lead Generation in Insurance

For decades, the insurance industry has been defined by traditional outreach methods that often yield diminishing returns. The core issue, frequently described as the “dry funnel” problem, arises when agents exhaust their personal networks and referrals, leaving them with no clear path to new clients. This systemic challenge is a significant contributor to the high attrition rates among new professionals.

In this context, solutions like InsuranceReach, which has emerged from its parent platform WealthReach, represent a pivotal shift. By leveraging AI and intent data, the technology is designed to directly address the limitations of cold calling and network-based selling. Its relevance lies in its ability to modernize a historically conservative industry, offering a data-driven alternative that promises a more sustainable and efficient approach to building a client base.

Core Technology and Key Capabilities of InsuranceReach

Intent Data and Prospect Identification

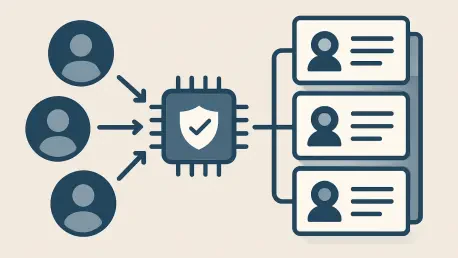

A primary feature of this technology is its capacity to transform anonymous digital footprints into actionable intelligence. The system works by identifying a significant percentage of previously unknown visitors to an agent’s website, enriching their profiles with professional details and behavioral insights. This process effectively de-anonymizes web traffic, providing agents with a clear view of who is exploring their services.

Furthermore, the platform’s intelligence extends beyond an agent’s own digital properties. It tracks the off-site online research activities of potential clients, monitoring their engagement with content related to specific insurance products. This dual approach of on-site and off-site tracking creates a comprehensive picture of a prospect’s journey, signaling an active interest and turning passive browsing into a clear indication of purchasing intent.

AI-Driven Scoring and Prioritization

The crucial component that translates raw data into a strategic advantage is the platform’s AI-driven lead scoring. The system analyzes a multitude of intent signals—from website visits to content consumption across the web—and measures them against an agent’s ideal customer profile. This sophisticated matching process allows the AI to calculate a priority score for each identified prospect.

This prioritization engine is instrumental in optimizing an agent’s workflow. Instead of pursuing a broad and often unresponsive list of contacts, sales teams can concentrate their efforts on a curated list of the most promising opportunities. This focused approach not only increases the likelihood of successful engagement but also ensures that valuable time and resources are allocated where they will have the greatest impact.

Automated and Personalized Outreach

Once a high-intent prospect is identified and scored, the technology’s AI-powered engagement engine initiates contact. The system is designed to generate highly personalized, multi-channel outreach campaigns that span both email and LinkedIn. This is not a simple mail-merge function; the AI crafts messaging relevant to the prospect’s observed interests, such as policy reviews or specific coverage evaluations.

This automated yet tailored approach serves to warm up the initial contact, establishing relevance and credibility before an agent even makes a direct call. By delivering the right message at the right time, this function significantly improves response rates compared to generic, high-volume cold outreach tactics. It effectively bridges the gap between identifying a lead and starting a meaningful conversation.

Emerging Trends and Industry Shifts

The adoption of AI-powered prospecting tools aligns with a broader industry-wide shift away from volume-based, low-success tactics toward more precise, data-driven engagement strategies. Agents and marketing organizations are increasingly recognizing that success is not measured by the number of calls made but by the quality of the connections established. This technology directly facilitates that transition by equipping professionals with the intelligence to engage prospects at the moment they are most receptive.

Moreover, this technology is part of an emerging trend that leverages AI to solve legacy operational challenges like high agent attrition. By providing a consistent and reliable flow of quality leads, such platforms can alleviate one of the primary pressures facing new producers. This ensures they can focus on building relationships and closing sales rather than constantly struggling to find their next opportunity, potentially stabilizing careers and reducing industry turnover.

Transforming the Insurance Sales Funnel

The real-world applications of this technology are already demonstrating its potential to reshape the insurance sales funnel for a wide range of users, including life and property & casualty (P&C) agents, producers, and marketing organizations. For individual agents, it provides a powerful tool to expand their reach far beyond the traditional confines of personal networks and client referrals.

A notable use case is the empowerment of agents to connect directly with in-market prospects who have no prior connection to them. This capability fundamentally changes the dynamic of prospecting, moving it from an outbound, interruptive model to an inbound, responsive one. By identifying individuals actively seeking protection, the technology enables agents to enter conversations where their expertise is immediately relevant and welcomed, dramatically shortening the sales cycle.

Potential Hurdles and Implementation Challenges

Despite its promise, the technology faces several potential hurdles. Technical challenges include ensuring the constant accuracy and timeliness of the intent data, as outdated or incorrect information could lead to misguided outreach efforts. The system’s effectiveness is contingent on the quality of its data streams and the sophistication of its analytical models, which require continuous refinement.

On the market side, agent adoption presents a significant obstacle. Many established professionals are accustomed to traditional methods and may be hesitant to integrate a new, complex technology into their workflow. Overcoming this inertia will require comprehensive and effective training to demonstrate the platform’s value and ensure users can maximize its return on investment. Additionally, evolving data privacy regulations may pose considerations that could affect its widespread implementation and data collection practices.

The Future of AI in Insurance Prospecting

Looking ahead, the trajectory of this technology points toward deeper integration and greater sophistication. Future developments will likely include more seamless connections with major CRM platforms, allowing for a fully unified view of the customer journey from initial intent signal to policy issuance. This would eliminate data silos and create a more efficient, end-to-end sales process.

In the long term, the technology is poised to incorporate more advanced predictive analytics, potentially forecasting future insurance needs based on a wider array of life-event and behavioral data. This evolution could fundamentally reshape the role of the insurance professional, shifting their focus from prospecting to advising. As a result, success metrics may evolve from activity-based KPIs to outcomes centered on client acquisition and retention efficiency.

Conclusion and Overall Assessment

This review identifies AI-powered prospecting technology as a transformative force in the insurance industry. Its ability to identify, score, and engage in-market prospects with a high degree of personalization addresses the critical “dry funnel” issue that has long plagued the sector. By providing a steady stream of warm, qualified leads, it offers a direct solution to the inefficiencies of traditional outreach.

Ultimately, this technology stands as a game-changer for insurance lead generation. While implementation hurdles like agent adoption and data accuracy remain, its core value proposition is compelling. Its continued evolution promises to further enhance efficiency, reduce failure rates, and redefine the metrics of success for insurance professionals, making it a pivotal development for the industry.