The sheer magnitude of modern mass tort litigation has reached a point where a single unresolved claim can spiral into a multi-billion dollar liability that threatens the core survival of even the most established global corporations. In response to this volatile environment, Lee Equity Partners

The sheer scale of the gathering at the InterContinental London this March signals a definitive departure from the speculative era of insurance technology toward a period of high-stakes industrial execution. With more than 6,500 delegates and 400 senior speakers descending upon the capital for

The familiar rhythm of rainfall across the British Isles underwent a sinister transformation during the final week of January as a meteorologically standard storm shattered the country's defensive assumptions. Storm Chandra did not arrive with the record-breaking wind speeds or the unprecedented

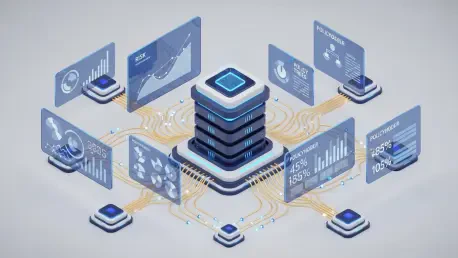

The modern insurance landscape has reached a critical juncture where simply purchasing the latest software no longer guarantees a competitive advantage for carriers. In this era of rapid digitization, the true value of innovation is found within the depth of the partnership behind the technology

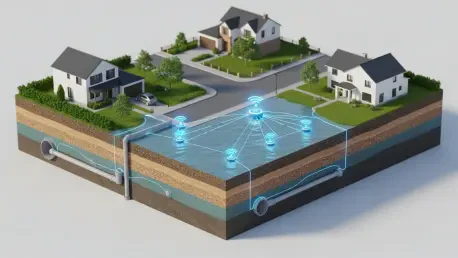

The UK home insurance market is currently at a critical crossroads, having grappled with structural losses for over half a decade due to aging housing stock and rising repair costs. In this conversation, Simon Glairy, a distinguished expert in insurtech and risk assessment, explains how the

The property and casualty insurance market has historically operated as a trillion-dollar industry that paradoxically relies on fragmented, manual systems to manage its most critical profit-and-loss functions. This structural inefficiency often forces product managers to navigate a maze of

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61