The Widening Chasm: A New Generation of Farmers Meets an Old World of Insurance A dangerous disconnect is growing in America’s heartland, a gap not of soil or crop yield, but of risk and understanding. As a new, tech-savvy generation of farmers takes the helm, they are inheriting more than just

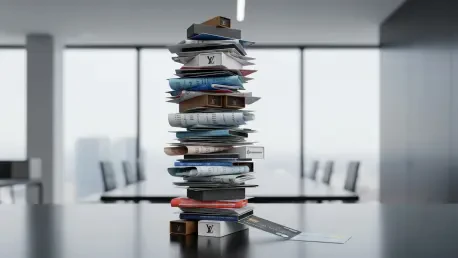

The intricate and often tedious process of crafting commercial insurance proposals has long been a significant operational bottleneck for brokers, consuming valuable hours that could otherwise be dedicated to client engagement and strategic growth. In a landmark move poised to reshape this

For countless pharmacists diligently serving their communities, the annual renewal of their professional liability insurance feels like a routine measure of security, a shield against the unforeseen risks of their practice. This sense of protection, however, is often a dangerous illusion. While

The glittering world of reality television often presents a carefully curated vision of success and opulence, but for The Real Housewives of Potomac stars Wendy and Eddie Osefo, that image is now at the center of a serious legal battle. The couple is currently facing felony fraud charges amid

Countless homeowners with unique property features or complex histories often find themselves navigating a frustrating insurance landscape, where standard policies are unattainable and specialist options are opaque and difficult to access. This significant gap in the market has long left a segment

The United Kingdom's financial sector has been given a much-anticipated roadmap for navigating the complex and often contentious territory of non-financial misconduct, with regulators releasing a definitive framework to establish clearer behavioral standards. For years, financial services firms