In a decisive maneuver that reshapes its strategic footprint within the financial services industry, Assured Guaranty Ltd. (AGL) has officially entered the annuity reinsurance market by acquiring Warwick Re Limited, a Bermuda-based life and annuity reinsurer. This significant diversification was

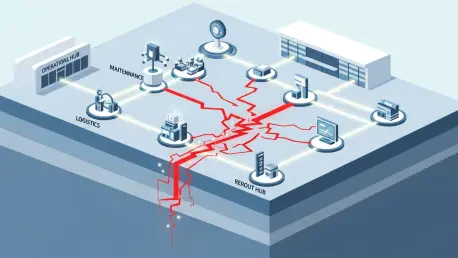

The widespread adoption of generative artificial intelligence has unlocked unprecedented efficiencies for businesses, but it has simultaneously introduced a complex new frontier of risk that is causing cyber insurance underwriters to dramatically intensify their scrutiny. Companies seeking coverage

Despite a year marked by several widely publicized and tragic aviation incidents that captured global attention, the underlying data reveals a surprising narrative of stability within the airline industry's safety record for 2025. The overall frequency of airline insurance claims held steady,

A High-Stakes Battle for Dominance in Specialty Insurance The global insurance market is witnessing a high-stakes standoff as the Swiss behemoth Zurich Insurance Group pursues a takeover of the London-based specialty carrier Beazley. At the heart of the matter is Zurich’s recently rejected $10.3

A New Era of Boardroom Liability: Navigating a Perilous Landscape The landscape of risk for corporate leaders is in a state of unprecedented flux, where traditional threats are converging with emerging technological and societal pressures to create a more unpredictable and perilous future. While

The intricate tapestry of regulations governing the United Kingdom's insurance sector has long been a source of robust consumer protection and considerable operational friction for the firms navigating it. In a landmark move, the Financial Conduct Authority (FCA) has introduced Policy Statement