In the heart of the nation's capital, a silent crisis unfolds on the streets every day, where crash victims face not only physical and emotional trauma but also financial devastation due to outdated auto insurance laws. Despite years of advocacy and mounting evidence of the need for change, the

Setting the Stage for Transformation in Insurance In an era where insurance claims processing often frustrates clients with delays and lack of transparency, a staggering statistic emerges: nearly 30% of claims take over a month to resolve, significantly impacting customer trust and operational

As we dive into the evolving world of insurance technology, I’m thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, with deep expertise in risk management and AI-driven risk assessment. Today, we’re exploring a groundbreaking development in claims management

In a distressing incident that has captured widespread attention, Faith, a New York woman known on social media platforms, found herself grappling with the aftermath of a severe collision involving her Toyota Corolla and a semi-truck. The accident left her vehicle with extensive damage, including a

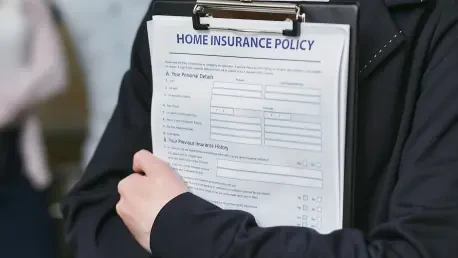

In a striking development that has captured the attention of both regulators and homeowners across the nation, the state of Illinois has initiated legal action against State Farm, the largest property and auto insurance provider in the state, based in Bloomington. This lawsuit, filed in late 2024,

Imagine a scenario where a major corporation relies on an advanced artificial intelligence system to streamline its hiring process, only to face a costly lawsuit due to unintended bias in the algorithm that discriminates against certain candidates. The company turns to its commercial insurance