A recent Michigan Court of Appeals ruling has fundamentally altered the landscape for resolving aged insurance claims, establishing that the authority to decide whether a claim is too old to proceed belongs to an arbitrator, not a judge. In a decision that reversed a lower court's judgment in a

The transition to electric mobility involves more than just swapping a gas tank for a battery; it requires a fundamental rethinking of the entire vehicle ownership experience, including the often-overlooked yet critical aspect of insurance. Electric two-wheeler manufacturer Ather Energy is directly

In a significant legal blow to public figures Wendy and Eddie Osefo, a Maryland court has mandated the surrender of nearly a decade's worth of financial records to state prosecutors, escalating the stakes in their high-profile insurance fraud case. The ruling represents a critical victory for the

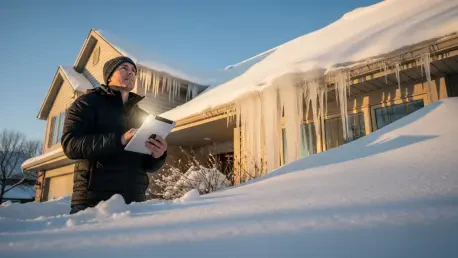

Retirees across the nation are discovering that the reassurance of a homeowners insurance policy provides little comfort when the system designed to help them is critically backlogged, a situation that has become particularly acute this winter. What was once a straightforward process of filing a

After years of enduring some of the nation's most volatile and expensive property insurance premiums, Florida homeowners are on the verge of experiencing significant financial relief. A major market turnaround, spurred by comprehensive legislative action and a period of more predictable storm

In the fast-paced world of technology services, SHIFT Inc. has carved out a distinct and aggressive path to growth, building its investment narrative on a foundation of disciplined Mergers & Acquisitions (M&A) and strategic internal restructuring. The company's core strategy centers on compounding