Countless homeowners with unique property features or complex histories often find themselves navigating a frustrating insurance landscape, where standard policies are unattainable and specialist options are opaque and difficult to access. This significant gap in the market has long left a segment

The United Kingdom's financial sector has been given a much-anticipated roadmap for navigating the complex and often contentious territory of non-financial misconduct, with regulators releasing a definitive framework to establish clearer behavioral standards. For years, financial services firms

As winter casts its long shadow, the most significant financial risk for many households might not be from storm-damaged roofs but from the silent thawing of hundreds of dollars worth of festive food in a powerless freezer. This specific, seasonal threat highlights a growing trend in the insurance

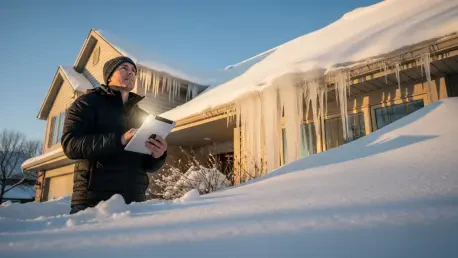

Retirees across the nation are discovering that the reassurance of a homeowners insurance policy provides little comfort when the system designed to help them is critically backlogged, a situation that has become particularly acute this winter. What was once a straightforward process of filing a

In the often-impersonal world of insurance, where call centers and automated systems have become the norm, the true value of a local, community-focused agency is more pronounced than ever. For the residents and business owners of El Monte, California, navigating the complexities of protecting their

After years of enduring some of the nation's most volatile and expensive property insurance premiums, Florida homeowners are on the verge of experiencing significant financial relief. A major market turnaround, spurred by comprehensive legislative action and a period of more predictable storm