In a rapidly evolving insurance landscape where digital innovation is becoming the cornerstone of competitive advantage, a significant development has emerged that underscores the industry's shift toward specialized, technology-driven solutions. Brown & Brown (Europe), a leading insurance brokerage

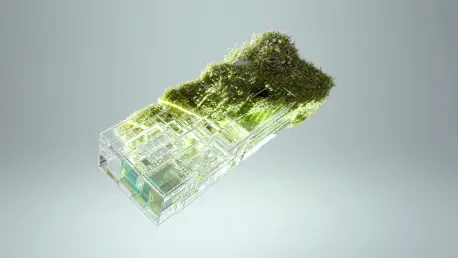

As climate change intensifies, bringing more frequent and severe natural disasters like wildfires, hailstorms, and flooding, the insurance industry faces an unprecedented challenge in managing escalating risks, while the increasing cost of these events, often reaching billions of dollars in losses,

In today’s fast-paced insurance world, inefficiencies can cost agencies and carriers more than just time—they can erode trust and hinder growth. Picture an independent agent juggling multiple carrier portals, manually entering data late into the night, while a client waits for a critical quote.

Imagine a world where devastating hurricanes, raging wildfires, and unprecedented earthquakes are no longer rare anomalies but frequent threats that challenge the very foundation of risk management. This stark reality is driving the insurance industry to rethink its strategies, particularly in the

Setting the Stage for Innovation in Insurance In the fast-evolving landscape of commercial insurance, the integration of artificial intelligence (AI) is no longer a futuristic vision but a tangible reality reshaping market dynamics. Imagine a scenario where underwriters can assess property risks

Setting the Stage: A Booming Property Insurance Landscape In the bustling heart of Worcester, UK, a regional powerhouse is reshaping the contours of the property insurance sector with remarkable determination. Hazelton Mountford, an independent chartered insurance broker, has embarked on a