In a striking development that has captured the attention of both regulators and homeowners across the nation, the state of Illinois has initiated legal action against State Farm, the largest property and auto insurance provider in the state, based in Bloomington. This lawsuit, filed in late 2024,

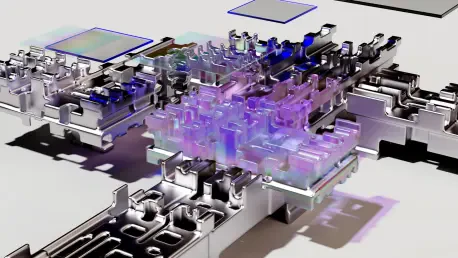

In an era where data overwhelms traditional systems, the insurance industry faces a staggering challenge: processing claims and managing policies with speed and precision while meeting rising customer expectations. With billions of data points generated annually from policies, claims, and customer

Setting the Stage for a Transformed Insurance Landscape In the ever-evolving UK insurance market, a striking trend has emerged: customer switching rates have plummeted to historic lows, with only 33% of motor and 36% of home insurance policyholders changing providers in the first half of this year,

Setting the Stage for Insurance Industry Consolidation The insurance sector is undergoing a seismic shift, with blockbuster mergers and acquisitions (M&A) reshaping the competitive landscape in 2025. High-profile deals, such as Aviva’s £3.7 billion acquisition of Direct Line Group in the UK, Arthur

Setting the Stage: A Snapshot of Insurance Market Dynamics In an era where global uncertainties and economic fluctuations challenge the insurance industry, Zurich Insurance Group has delivered a remarkable performance in Q3 2025, showcasing resilience with an 8% increase in gross written premiums

In a striking turn of events that has captured the attention of industry watchers, Kemper, a well-established insurance group, has reported a significant financial setback for the third quarter of this year, revealing a net loss of $21.0 million, or $(0.34) per share. This marks a dramatic shift