The insurance industry stands at a critical crossroads, where the immense pressure to innovate and meet modern customer expectations is often counterbalanced by the paralyzing fear of undertaking massive, high-risk core system replacement projects. For many established carriers, legacy technology

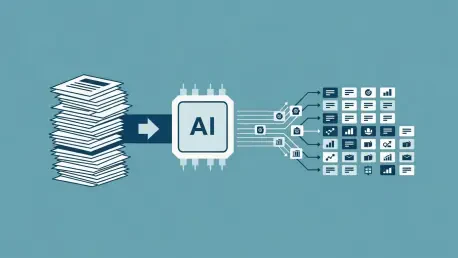

The insurance industry has long been constrained by a persistent operational bottleneck that has stifled growth and consumed countless hours of manual labor, specifically the tedious and error-prone process of generating quotes for potential clients. SUPERAGENT AI, Inc. has officially announced a

The global insurance industry has long relied on a vast, intricate network of business process outsourcing to manage its monumental administrative workload, a dependency that currently represents an estimated $70 billion in annual expenditure. This massive market, traditionally characterized by

The stark reality on Northern Ireland's roads is that a small fraction of its drivers, those aged just 17 to 23, are disproportionately represented in the most tragic of statistics, a lethal imbalance that has prompted a landmark legislative overhaul. As of October, the region is set to become the

The increasing reliance of digital-first businesses on cloud infrastructure has created a critical vulnerability, where even brief outages can trigger catastrophic financial losses that traditional insurance models are ill-equipped to cover. Addressing this significant gap in the market, a new

The United Kingdom is charting a distinct course for governing artificial intelligence within its financial services sector, opting not to create a new, AI-specific rulebook but instead to apply its existing and powerful regulatory frameworks to the technology. This strategy of "regulation by