In an era where the mobility economy is reshaping how people move and goods are delivered, one company stands at the forefront of insuring this dynamic landscape, reflecting a proactive approach to industry shifts. Mobilitas, based in Glendale, Arizona, and a subsidiary of CSAA, has emerged as a

Imagine a world where insurance underwriting, once a labor-intensive process riddled with inefficiencies, transforms into a seamless, data-driven operation that anticipates risks with uncanny precision. In North America, particularly across the United States and Canada, artificial intelligence (AI)

In the ever-evolving landscape of the insurance industry, agents are grappling with unprecedented challenges as customer expectations soar and digital demands reshape the way business is conducted, putting immense pressure on them to adapt. The need to deliver personalized experiences, manage

In the United Kingdom, a startling disparity exists in financial protection, with countless women lacking life insurance despite their critical roles as caregivers and contributors to household stability, a situation that leaves many families vulnerable. Recent data paints a concerning picture:

What happens when a single stolen password unlocks a treasure trove of sensitive data, jeopardizing millions of customers and an insurer’s reputation in mere hours? In a world where digital breaches strike with surgical precision, the insurance sector finds itself squarely in the crosshairs of

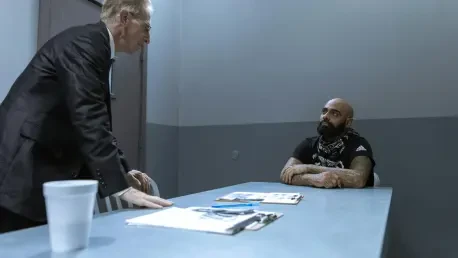

I'm thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, with a deep understanding of risk management and AI-driven risk assessment. With years of experience navigating the complexities of surety insurance and bail bond disputes, Simon is the perfect person to help