As we dive into the evolving world of insurance technology, I’m thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, with deep expertise in risk management and AI-driven risk assessment. Today, we’re exploring a groundbreaking development in claims management

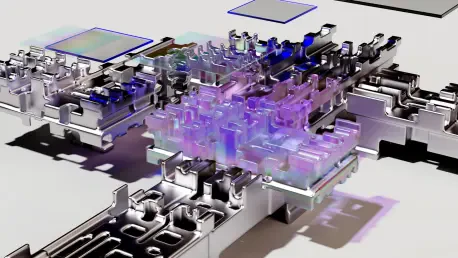

In an era where data overwhelms traditional systems, the insurance industry faces a staggering challenge: processing claims and managing policies with speed and precision while meeting rising customer expectations. With billions of data points generated annually from policies, claims, and customer

Imagine a scenario where a major corporation relies on an advanced artificial intelligence system to streamline its hiring process, only to face a costly lawsuit due to unintended bias in the algorithm that discriminates against certain candidates. The company turns to its commercial insurance

Allow me to introduce Simon Glairy, a renowned expert in insurance and Insurtech, with a deep focus on risk management and AI-driven risk assessment. With years of experience guiding small businesses through the complexities of coverage, Simon offers invaluable insights into the challenges and

Setting the Stage for Digital Transformation in Insurance Payments In an era where efficiency dictates market success, the insurance industry grapples with outdated payment systems that frustrate policyholders and burden carriers with high operational costs, as evidenced by the staggering statistic

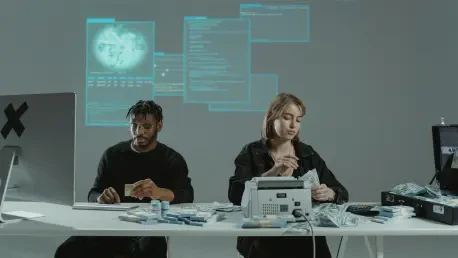

In an era where digital transactions and data handling dominate the financial landscape, small finance and insurance firms across the UK are grappling with an unprecedented wave of cyberattacks that threaten their very existence. Recent findings paint a stark picture, revealing that nearly half of