The United Arab Emirates has successfully navigated the complexities of global economic shifts by positioning its insurance sector as a central pillar of its long-term diversification strategy. This market operates as a sophisticated intersection where traditional business values meet aggressive

The landscape of the American insurance industry just witnessed a seismic shift as State Farm Mutual Automobile Insurance Company committed to returning a staggering $5 billion to its policyholders. This monumental payout, the largest in the organization’s history, serves as a significant financial

Simon Glairy is a distinguished strategist in the insurance and Insurtech sectors, renowned for his deep understanding of how emerging technologies reshape risk management and distribution. With a career dedicated to navigating the intersection of traditional underwriting and artificial

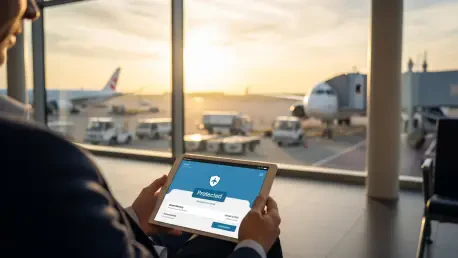

Simon Glairy is a powerhouse in the Insurtech space, renowned for his ability to weave complex risk management strategies into user-friendly digital architectures. As the landscape of travel insurance shifts from an afterthought to a core component of the booking experience, his insights into the

The New Zealand-based Medical Assurance Society (MAS) recently embarked on a definitive technological pivot by integrating the comprehensive Duck Creek Technologies SaaS suite into its core operations to better serve its specialized membership of medical professionals. This strategic move marks a

Thetraditionalinsuranceindustryhashistoricallybeenplaguedbyfragmentedprocessesandmanualdocumentationthatfrustratemoderntravelersseekingasmootherdigitalexperience. Modern travelers frequently encounter significant frustration when forced to navigate separate websites or complex paperwork just to