Imagine a world where an insurance claim is processed in minutes rather than weeks, where personalized policies are crafted in real time based on a customer's unique needs, and where cyber threats are neutralized before they even strike. This isn’t a distant dream but the reality being shaped by

Imagine a world where an insurance underwriter’s decades of hard-earned intuition and expertise could be distilled into a single, powerful tool capable of assessing risks with uncanny precision. This isn’t the stuff of science fiction but a tantalizing possibility within reach thanks to

Setting the Stage for a Digital Revolution in Insurance Imagine a specialty insurance market where complex risk placements happen in minutes rather than weeks, driven by seamless technology that prioritizes both speed and precision. This is no longer a distant vision but a reality unfolding in

Allow me to introduce Simon Glairy, a globally recognized authority in insurance and Insurtech, with a sharp focus on risk management and AI-driven risk assessment. With decades of experience navigating the complexities of mergers and acquisitions, Simon has advised on some of the most pivotal

Imagine a world where insurance claims, often mired in lengthy disputes and costly delays, are resolved with speed and precision, saving millions in operational expenses for insurers globally. This vision is inching closer to reality as a UK-based startup, known for its innovative approach to

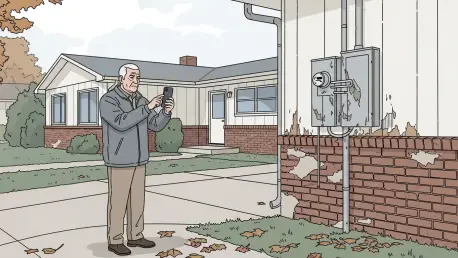

Imagine a world where a simple smartphone scan could save homeowners thousands of dollars by catching hidden risks in their property before disaster strikes. This isn’t a distant dream but a reality unfolding through an innovative partnership between a leading US-based insurance provider and an