For decades, the insurance technology landscape has been governed by a single, unwritten rule where core systems are intrinsically linked to hefty, recurring software licensing fees that dictate budgets and strategic planning. This vendor-centric model, meticulously designed to drive corporate

The insurance brokerage industry, long a bastion of handshake agreements and personal relationships, is currently undergoing a seismic shift driven by the relentless pace of digital transformation. This evolution from traditional, in-person service models to a digitally-centric landscape is not

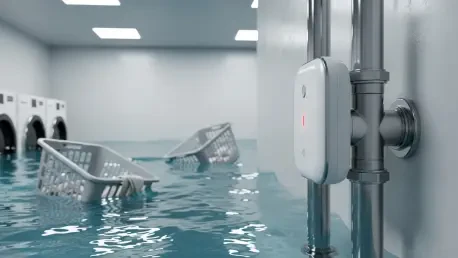

A multi-thousand-dollar smart water valve, designed with sophisticated sensors and cloud connectivity to prevent catastrophic floods, can be rendered completely useless by something as mundane as a changed Wi-Fi password or a power cord accidentally unplugged from the wall. This simple reality

The insurance industry has reached a critical inflection point in its relationship with artificial intelligence, moving decisively beyond a period of speculative hype and into an era defined by a rigorous demand for measurable returns. After years of pilot projects and exploratory initiatives, the

In an increasingly digitized world where a single hour of cloud service interruption can trigger millions of dollars in losses for large enterprises, the financial risks associated with digital infrastructure failure have become a paramount concern for modern businesses. Addressing this critical

Recent exclusive research reveals the insurance industry is actively navigating the integration of artificial intelligence, displaying a strong sense of readiness that is carefully balanced with a strategic and cautious approach to adoption. An analysis of survey data from approximately 100