The global insurance market remains surprisingly tethered to disorganized Excel spreadsheets even as climate-driven disasters accelerate in frequency and total financial impact. While high-performance computing has advanced significantly, the industry continues to struggle with the "dirty data"

Simon Glairy is a veteran in the InsurTech space, renowned for bridging the technical divide between cybersecurity and financial risk transfer. With a career dedicated to refining how carriers assess digital vulnerabilities through practitioner-led insights, he offers a unique perspective on the

The sheer magnitude of modern mass tort litigation has reached a point where a single unresolved claim can spiral into a multi-billion dollar liability that threatens the core survival of even the most established global corporations. In response to this volatile environment, Lee Equity Partners

The sheer scale of the gathering at the InterContinental London this March signals a definitive departure from the speculative era of insurance technology toward a period of high-stakes industrial execution. With more than 6,500 delegates and 400 senior speakers descending upon the capital for

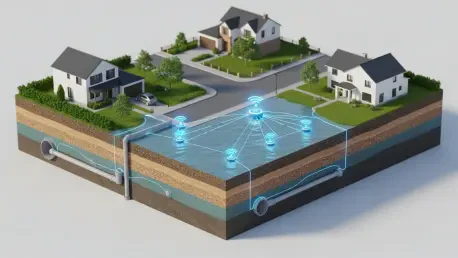

The familiar rhythm of rainfall across the British Isles underwent a sinister transformation during the final week of January as a meteorologically standard storm shattered the country's defensive assumptions. Storm Chandra did not arrive with the record-breaking wind speeds or the unprecedented

A microscopic fracture on a car windshield or a faint, discolored water spot on a living room ceiling might appear like mundane evidence of a routine insurance claim, yet these tiny details are becoming the frontline of a high-tech deception. While the global conversation often centers on

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67