As cyber incidents multiply and artificial intelligence surges into the insurance workflow, Australia’s carriers have reported a readiness deficit that contrasts with a slight easing in perceived risk, creating a tension that demands sharper strategy and faster execution. PwC’s Insurance Banana

Why This Market Turn Matters Now Boards are seeing premium budgets shrink even as questionnaires lengthen and control expectations intensify, a paradox that signals a more mature cyber insurance market where price relief coexists with rigorous selection. The current setup rewards clarity:

I’m thrilled to sit down with Simon Glairy, a trailblazer in insurance and Insurtech with deep expertise in risk management and AI-driven risk assessment. As the visionary behind innovative solutions in the industry, Simon has a unique perspective on transforming operational inefficiencies into

Imagine a world where an insurance claim is processed in mere minutes, personalized policies are crafted in real-time, and customer inquiries are handled by virtual assistants with uncanny precision, transforming the U.S. insurance industry. This is the reality unfolding today, driven by the rapid

In an era where digital threats loom larger than ever, businesses face an unprecedented challenge as cyber incidents have tripled over the past two years, fueled by geopolitical tensions and rapid advancements in artificial intelligence. This alarming statistic underscores a harsh reality for

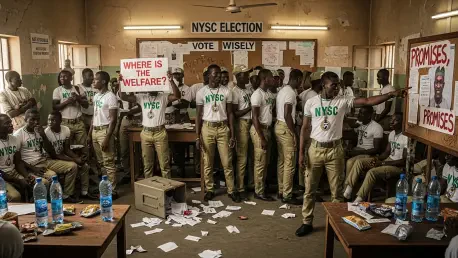

In the heart of Nigeria’s democratic process, National Youth Service Corps (NYSC) members stand as vital cogs, ensuring the smooth operation of elections as ad-hoc staff under the Independent National Electoral Commission (INEC). Despite their indispensable role at polling units across the nation,