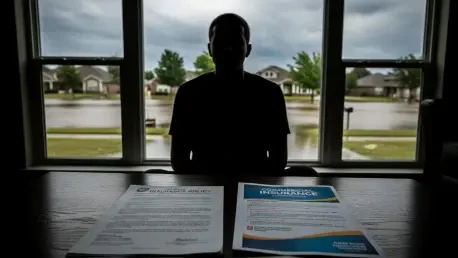

For countless homeowners residing in America's coastal and flood-prone regions, the escalating cost of flood insurance has become a significant source of financial anxiety, threatening the affordability of their homes and the stability of their communities. This persistent challenge is exacerbated

For nearly two decades, a critical financial safety net designed to protect the families of American service members was quietly losing its value, its purchasing power steadily eroded by the persistent creep of inflation. While the cost of living climbed, the maximum life insurance coverage

The modern business landscape, with its intricate web of interconnected and rapidly evolving risks, has rendered traditional, one-size-fits-all insurance models increasingly obsolete. Companies operating in highly specialized sectors now require far more than a standard policy; they need a

The unsettling reality of modern domestic threats is that a catastrophe does not need to occur for profound financial and societal disruption to take place, a lesson starkly illustrated by a recently thwarted plot in Southern California. Federal authorities successfully intercepted a plan by four

The long-standing perception of insurance as a mere transactional safety net is rapidly becoming a relic of the past, as the relationship between businesses and their insurers undergoes a profound and necessary transformation. In today's interconnected and increasingly complex global market,

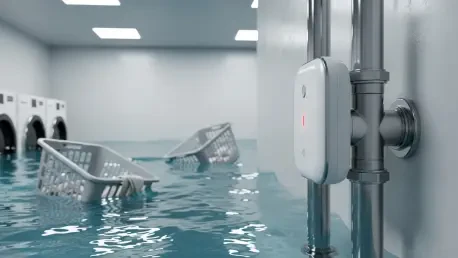

A multi-thousand-dollar smart water valve, designed with sophisticated sensors and cloud connectivity to prevent catastrophic floods, can be rendered completely useless by something as mundane as a changed Wi-Fi password or a power cord accidentally unplugged from the wall. This simple reality