In an era where digital connectivity defines business operations, small and medium-sized enterprises (SMEs) in Australia and New Zealand (ANZ) are grappling with an alarming surge in cyber claim costs that threaten their very survival. A recent report from a leading insurance provider paints a

As climate change intensifies, bringing more frequent and severe natural disasters like wildfires, hailstorms, and flooding, the insurance industry faces an unprecedented challenge in managing escalating risks, while the increasing cost of these events, often reaching billions of dollars in losses,

I'm thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, with deep expertise in risk management and AI-driven risk assessment. With years of experience guiding insurers through technological transformations, Simon offers a unique perspective on how innovations like

I’m thrilled to sit down with Simon Glairy, a trailblazer in the world of insurance and Insurtech, whose expertise in risk management and AI-driven risk assessment has positioned him as a thought leader in modernizing highly regulated industries. With decades of hands-on experience, Simon has a

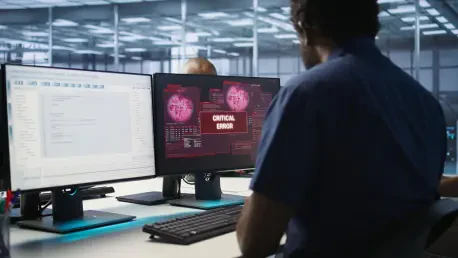

The cybersecurity landscape has been rocked by startling allegations of a colossal data breach involving Salesforce, a cornerstone of cloud-based enterprise solutions, with hackers claiming to have pilfered nearly a billion customer records. Operating under cryptic aliases such as Scattered LAPSUS$

As the digital landscape continues to evolve, understanding cyber risks and their impact on businesses has never been more critical. Today, we’re thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, with a sharp focus on risk management and AI-driven risk