What happens when a devastating hailstorm leaves a commercial property in ruins, and the fight over repairs spirals into a federal court clash? In Texas, a staggering $354,000 valuation gap between Travelers Lloyds Insurance Company and VSS Carriers, Inc. has ignited a legal firestorm that captures

In a rapidly evolving digital landscape, the European insurance sector is undergoing a profound transformation, driven by the integration of artificial intelligence technologies that promise to redefine operational efficiency and customer engagement. A standout example of this shift is a pioneering

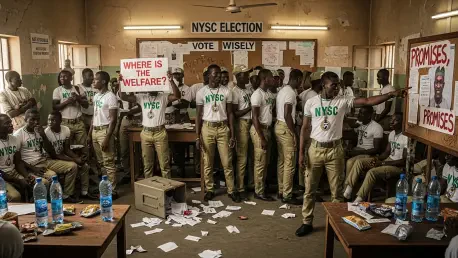

In the heart of Nigeria’s democratic process, National Youth Service Corps (NYSC) members stand as vital cogs, ensuring the smooth operation of elections as ad-hoc staff under the Independent National Electoral Commission (INEC). Despite their indispensable role at polling units across the nation,

Imagine opening an email from your home insurance provider only to discover that the annual premium to protect your property has nearly doubled, jumping from a manageable $5,600 to a staggering $9,800, significantly inflating monthly mortgage payments by hundreds of dollars. This scenario is

In the electrifying realm of rock and roll, aging legends like AC/DC continue to reign supreme, their recent Melbourne performance sending literal shockwaves through the earth with seismic vibrations detected from fan energy and booming speakers. These heritage acts, often in their 70s or older,

Every year, the United States faces an overwhelming financial challenge as fraudulent insurance claims soar past the $1.5 billion mark, hitting a staggering $1.74 billion in 2024, according to data from the Insurance Information Institute (III). This isn’t just a statistic—it’s a pervasive issue