In a significant development for the insurance industry, the Managing General Agents’ Association (MGAA) has partnered with Insurance DataLab to enhance data-driven decision-making. With data playing an increasingly critical role in shaping decisions, this collaboration provides MGAA members access

Simon Glairy, a renowned expert in insurance law and Insurtech, joins us to illuminate the complexities of a recent landmark decision by the South Carolina Supreme Court, with implications for asbestos-related claims and cross-border insurance disputes. With a deep understanding of AI-driven risk

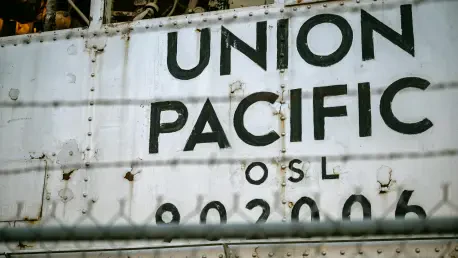

Union Pacific Railroad Company finds itself engulfed in a complex legal quagmire involving the Illinois Mine Subsidence Insurance Fund, as it battles the significant burden of historical mining liabilities. These extended liabilities involve complex legal interactions centered around subrogation

As the frequency and intensity of extreme weather events continue to escalate, the insurance industry faces a transformative period marked by increased volatility and risk. This shift necessitates significant adaptations within traditional operational frameworks, emphasizing the crucial role of

The ripple effects of climbing car insurance premiums have become a tangible reality for Australian drivers, with comprehensive insurance costs steadily accelerating. Over the past three years, these premiums have increased by nearly six percent annually. This follows an earlier surge of 30.5

Critical illness insurance is a pivotal safety net that offers financial protection when faced with life-altering health conditions. Canada Life's approach to critical illness insurance presents policyholders with a mix of opportunities and challenges. This insurance type is designed to provide a