Whispers of a softening property and casualty market have grown into a steady murmur across the industry, but these widespread assumptions may be dangerously misaligned with the complex reality on the ground. While select segments indeed show signs of rate relief, a closer look at the data and

International travelers planning spontaneous getaways to the scenic landscapes of Georgia are now met with a significant new prerequisite that reshapes the entry process and demands more thorough preparation. As of January 1, 2026, the Georgian government has enacted a mandatory requirement for all

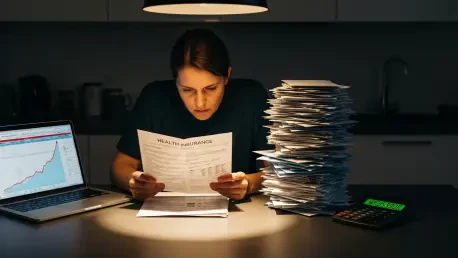

For countless families living in vulnerable regions, the faithful act of paying homeowners insurance premiums each month represents a solemn pact against the unpredictable fury of nature, a promise of restoration should disaster strike. This promise, however, is proving increasingly fragile. A

The intricate web of insurers, adjusters, and contractors responsible for putting lives back together after a loss is straining under the weight of its own fragmented design, signaling an overdue reckoning for the entire claims industry. For decades, the sector has operated on a model where each

The sinking feeling that accompanies the sound of crunching metal in a car accident is often immediately followed by a secondary dread: the inevitable spike in insurance premiums. It is a widely held belief among drivers that filing any claim, regardless of the circumstances or who was at fault,

For over 20 million Americans who rely on the Affordable Care Act (ACA) marketplace for their health insurance, the new year has ushered in an era of profound financial anxiety and uncertainty. The expiration of enhanced federal tax credits at the end of the previous year has triggered a staggering