The interconnectedness of the modern global economy has created a landscape where a single disruption, whether a containership casualty in a vital shipping lane or a critical failure in energy infrastructure, can trigger a cascade of complex, high-stakes insurance claims across multiple

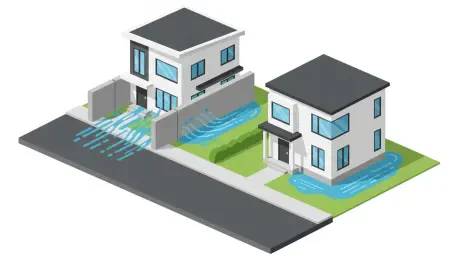

A significant and growing risk is jeopardizing the financial stability of Canadian homeowners and the insurance industry, not from a new and unforeseen threat, but from the absence of a critical tool: modern, accurate flood maps. As climate change continues to drive an increase in the frequency and

The maritime industry is currently charting a course through an increasingly complex and bifurcated insurance landscape, where economic crosscurrents, climate volatility, and rapid technological evolution create both significant opportunities and formidable challenges. This environment is defined

Two foiled school attack plots originating in the American heartland are now set to cast a long shadow across the Pacific, poised to fundamentally reshape the security and insurance landscapes for Japan's K-12 education sector. A new analysis suggests the high-profile incidents, including a planned

The United States property and casualty insurance landscape is currently undergoing a profound transformation, creating a sharply divided or two-tracked market that presents distinctly different challenges and opportunities for commercial insurance buyers. This pivotal transition is defined by a

A plume of smoke stretching across the northern Gold Coast suburbs served as a stark reminder of the ever-present threat of bushfires, even on the fringes of densely populated urban areas. The recent blaze near Coombabah, which consumed approximately 70 hectares of vegetation, unfolded as a