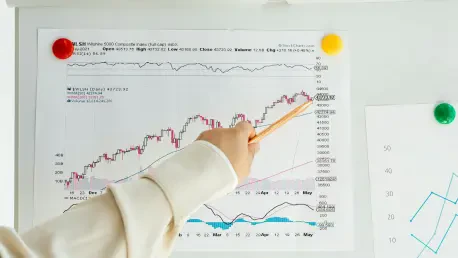

Imagine a world where the cost of protecting your car and home steadily decreases, easing the financial burden on households across the UK, and in recent months, this scenario has become a reality with motor and home insurance premiums showing a consistent downward trend. This roundup dives into

In the bustling heart of Midtown Manhattan, a complex legal battle has emerged between two insurance giants over who should shoulder the financial burden of a severe construction injury, highlighting the intricate web of policies and obligations. This dispute, unfolding in the United States

I'm thrilled to sit down with Simon Glairy, a renowned expert in insurance and Insurtech, particularly in the realms of risk management and AI-driven risk assessment. With years of experience under his belt, Simon has been at the forefront of integrating cutting-edge technologies like data

The landscape of American homeownership is undergoing a dramatic transformation as homeowners insurance premiums have skyrocketed to an average of nearly $3,000 annually for single-family homes across the United States. This unprecedented surge, driven by the escalating impacts of climate change

In the ever-changing world of insurance, staying abreast of legal and regulatory shifts is vital for insurers, policyholders, and industry stakeholders across the United States. As societal challenges like cyber threats and long-latency health conditions collide with traditional insurance

Florida homeowners are facing a pivotal moment as Citizens Insurance, the state-backed provider often seen as a last resort, introduces significant rate adjustments for the current year, effective since June 1. For many residents already grappling with some of the highest insurance costs in the