The overwhelming aftermath of a severe storm presents homeowners with the dual challenge of not only repairing physical damage but also navigating the intricate and often stressful process of filing an insurance claim. As communities begin the arduous task of rebuilding, the path to recovery is frequently complicated by administrative hurdles and the potential for fraudulent activities, making it essential for property owners to approach the claims process with diligence and a clear understanding of the steps involved. Making informed decisions from the outset can significantly impact the speed and success of a settlement, ensuring that families and individuals receive the support they need to restore their homes and sense of security. The initial actions taken, from documenting the extent of the damage to selecting a reputable contractor, set the foundation for a smoother and more effective recovery journey, protecting homeowners from further financial and emotional distress in an already trying time.

1. Navigating the Claims Process Effectively

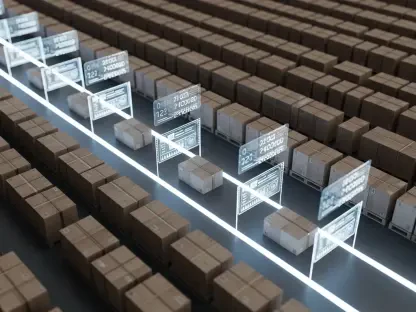

The first and most critical step following property damage is to initiate the claims process as swiftly as possible by contacting your insurance agent or company directly. Prompt notification is often a requirement stipulated in the policy, and delaying this action can complicate the settlement. When making the call, have your policy number ready, along with any other pertinent information that can help the insurer quickly open your file. It is imperative to document every aspect of the damage before any cleanup or repairs begin. Use a smartphone or camera to take extensive photographs and videos of the affected areas, capturing both wide shots for context and close-ups of specific damage points. This visual evidence serves as an irrefutable record of the property’s condition immediately after the storm and will be invaluable during the adjuster’s assessment. Maintaining a detailed log of all communications with your insurance company, including dates, times, and the names of representatives you speak with, will also help ensure clarity and accountability throughout the process.

Following the initial filing, a key component of a successful claim is maintaining full and transparent cooperation with your insurance company and its appointed adjuster. The insurer will likely request various forms of documentation to substantiate your claim, and providing this information promptly and accurately will help expedite the evaluation. Beyond the initial photos and videos, be prepared to supply receipts for any immediate, temporary repairs made to prevent further damage, such as tarping a roof or boarding up windows. An adjuster will schedule a visit to inspect the property in person, and your presence during this inspection can be beneficial. It allows you to point out specific damages they might otherwise overlook and answer any questions they may have on the spot. Responding to all requests for information with thoroughness and honesty builds a foundation of trust and demonstrates your commitment to a fair and accurate assessment of the losses incurred, ultimately facilitating a more efficient and satisfactory resolution.

2. Avoiding Post-Storm Pitfalls and Scams

In the chaotic period following a major weather event, homeowners must remain vigilant against opportunistic scammers who prey on those in vulnerable situations by promising quick and easy repairs. A common red flag is the demand for a large upfront payment or payment in full before any work has commenced; reputable contractors will typically require a reasonable deposit, with the balance due upon completion. Be wary of any individual employing high-pressure sales tactics or claiming to be a government official offering special deals or expedited assistance, as legitimate agencies do not operate in this manner. It is crucial to get every detail of the proposed work in writing, including a detailed scope of the project, a clear breakdown of costs for labor and materials, and an estimated timeline for completion. Before signing any contract, take the time to verify the contractor’s credentials, including their license and insurance. This due diligence is a critical defense against fraud and ensures that the individuals you hire to restore your property are qualified and legitimate.

A fundamental aspect of managing a storm claim is understanding the specifics of what your homeowner’s policy covers and, just as importantly, what it excludes. Standard policies typically provide coverage for damage caused by wind, falling objects like trees, and structural issues resulting from the weight of ice or snow. Additionally, some policies may cover secondary losses, such as food spoilage due to a prolonged power outage. However, it is essential to recognize common exclusions. For instance, damage from flooding, which is defined as rising surface water, is almost always excluded from standard homeowner’s insurance and requires a separate flood insurance policy. Likewise, interior water damage that occurs without any corresponding damage to the roof or walls may not be covered, nor is damage from a backed-up sewer or drain. Carefully reviewing your policy documents before a disaster strikes, and consulting with your agent to clarify any uncertainties, can prevent unwelcome surprises and help you set realistic expectations when filing a claim after a storm.

3. A Path to Resolution After the Claim

After the claim was filed and all documentation was submitted, the homeowner’s role shifted toward patient but persistent follow-up and final negotiations. This phase demanded careful review of the adjuster’s report and the initial settlement offer. It was during this period that discrepancies were identified and addressed, leveraging the detailed records and photographic evidence gathered at the outset. If the offered settlement appeared insufficient to cover the full cost of repairs, a formal process of dispute was initiated, often involving the submission of independent contractor estimates to substantiate a request for a higher amount. Communication remained the cornerstone of this stage, and maintaining a professional and organized approach proved essential in reaching a fair and equitable agreement. The process, while often lengthy, ultimately concluded with a resolution that allowed for the complete restoration of the property, reinforcing the value of preparedness and diligent advocacy.