Retirees across the nation are discovering that the reassurance of a homeowners insurance policy provides little comfort when the system designed to help them is critically backlogged, a situation that has become particularly acute this winter. What was once a straightforward process of filing a claim and seeing repairs begin within days or weeks has transformed into a months-long ordeal, leaving many older adults in a state of uncertainty and distress. A confluence of factors, including unusually harsh winter storms that have increased the frequency of property damage, has collided with a persistent and worsening shortage of skilled contractors. This combination has created one of the most significant winter claim backlogs in recent memory, placing a vulnerable population at risk as they wait for essential repairs to their homes. The delays are not isolated to a single step but are compounding at every stage, from initial damage assessment to final restoration work.

1. The Core Drivers of an Overwhelmed System

The primary obstacle hamstringing the insurance claims process this winter is a severe and widespread shortage of qualified contractors. Insurance companies are fundamentally reliant on this workforce to perform crucial on-site damage assessments, formulate accurate repair estimates, and ultimately carry out the necessary work. However, the construction and repair industries have been grappling with ongoing labor shortages, a problem that has been magnified by a sudden spike in demand. Consequently, when seniors file a claim for a burst pipe or a collapsed roof, they are often placed on extensive waiting lists, with some being told that an inspector will not be available for several weeks. This initial delay creates a significant bottleneck, as no further action can be taken by the insurance company—neither claim approval nor financial payout—until a professional assessment is completed. The scarcity of labor affects every subsequent step, turning a linear process into a frustrating and prolonged waiting game for homeowners.

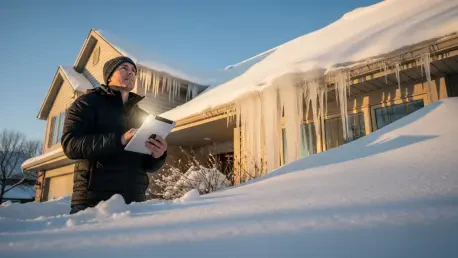

Compounding the labor issue is the unprecedented severity of this year’s winter weather, which has unleashed a higher-than-expected volume of damage across many regions. States that typically experience mild winters have been hit with ice storms, while others have endured record-breaking snowfall and sustained freezing temperatures. This has resulted in a deluge of claims related to common cold-weather problems such as roof leaks from ice dams, structural damage from heavy snow, and widespread burst pipes. Seniors, many of whom reside in older homes that are inherently more susceptible to these issues, are being disproportionately affected. The sheer volume of incoming claims is overwhelming the capacity of both insurance adjusters and the limited pool of available contractors. This surge in demand is a major contributing factor to the growing backlog, as the system is simply not equipped to handle such a concentrated influx of complex and urgent repair needs simultaneously, further straining already limited resources.

2. The Tangible Impact on Older Homeowners

For retirees confronting urgent property damage, such as a complete heating system failure in freezing temperatures or significant water intrusion from a damaged roof, the current delays are more than just an inconvenience—they represent a direct threat to their well-being. Emergency repairs that were once addressed within 24 to 48 hours are now subject to the same prolonged wait times as non-critical issues. Seniors report being told they must wait days or even weeks for a contractor to address problems that make their homes uninhabitable. This situation is particularly dangerous for older adults with pre-existing health conditions or mobility challenges, for whom a cold or damp environment can pose serious risks. Faced with an unresponsive system, some retirees are compelled to pay out of pocket for expensive temporary fixes, such as space heaters or patching services, just to maintain a basic level of safety and comfort. This creates a significant financial and emotional strain, forcing them to deplete savings while navigating a stressful and uncertain claims process.

The complications are magnified for seniors living in older homes, which often feature aging infrastructure like outdated plumbing, original roofing materials, and less effective insulation. These properties are not only more prone to winter-related damage but also tend to trigger more rigorous scrutiny from insurance companies. Insurers may require additional inspections or extensive documentation to verify the home’s condition prior to the damage, a process that can be challenging for those who have owned their homes for decades. Retirees report being asked for maintenance records or building permits they no longer possess, adding another layer of bureaucratic delay to their claims. Furthermore, requests for temporary housing, a critical provision for those whose homes become unsafe, are also caught in the same administrative backlog. Seniors have described waiting days for approval to relocate to a hotel or short-term rental, leaving them in precarious living situations while their claims languish in a queue, further exacerbating the personal toll of this systemic slowdown.

3. Navigating Industry Responses and Limited Options

In an effort to manage the overwhelming volume of claims, some insurance carriers have turned to outsourcing inspections to third-party firms. While this strategy is intended to accelerate the initial assessment phase, it has introduced a new set of challenges for homeowners. Many seniors have reported that these independent inspectors lack critical local knowledge regarding regional building codes or the specific types of damage caused by local weather patterns. This can lead to inaccurate or incomplete assessments, which in turn result in disputes with the insurance company and require further evaluations, ultimately extending the delay. In other cases, contractors in high demand have begun prioritizing jobs based on their size and profitability. This leaves seniors with smaller but still urgent claims—such as a minor roof leak or partial siding damage—at the bottom of the list. This practice creates an inequitable repair landscape where those with more modest homes or less catastrophic damage are forced to wait the longest, even when the issue poses a risk to their property.

Faced with indefinite delays from local contractors, a growing number of seniors are taking matters into their own hands by seeking help from professionals in neighboring towns or even adjacent states. While this can sometimes expedite repairs, it is a solution fraught with its own set of complications and risks. Out-of-town contractors often charge higher rates to account for travel time and expenses, placing an additional financial burden on retirees. Moreover, the urgency of the situation makes seniors a prime target for opportunistic scams, which tend to proliferate in the aftermath of severe weather events. Hiring an unfamiliar contractor without local references or a verifiable track record increases the risk of subpar work or outright fraud. This difficult choice between waiting indefinitely for a trusted local professional and taking a chance on an unknown entity underscores the immense pressure the current backlog is placing on homeowners. The contractor shortage is not just causing delays; it is forcing seniors into making difficult decisions with potentially costly consequences.

4. Proactive Strategies for a Difficult Season

While the systemic issues causing claim delays are largely beyond an individual’s control, seniors can take specific proactive steps to strengthen their position and potentially accelerate the process. Thoroughly documenting all damage is the most critical first step; this includes taking extensive photos and videos from multiple angles before any temporary cleanup or repairs are made. It is also essential to file the claim with the insurance company as soon as it is safe to do so, as claims are typically handled in the order they are received. Following the initial filing, maintaining consistent and documented communication with the assigned adjuster is key. Keeping a detailed log of every phone call, email, and conversation, including dates, times, and the names of individuals spoken to, creates a clear timeline of events. Furthermore, seniors should inquire whether their insurer offers virtual inspections via smartphone video, as this can sometimes bypass the wait for an in-person visit and lead to a faster initial assessment and approval.

Ultimately, navigating the winter claims backlog of 2025 required a combination of persistence and preparedness. Those seniors who successfully minimized their wait times were often the ones who understood the underlying causes of the delays—the overwhelmed adjusters, the severe storm season, and the critical shortage of contractors—and tailored their approach accordingly. By providing clear, comprehensive documentation from the outset and maintaining a steady stream of communication, they were able to keep their claims moving forward, however slowly. Awareness of the systemic pressures allowed them to set realistic expectations and avoid some of the frustration that plagued many others. In a season marked by institutional bottlenecks and widespread delays, the most effective tools for homeowners proved to be meticulous preparation and informed self-advocacy, which made a tangible difference in their ability to secure necessary repairs and restore their homes.