A seemingly minor collision at a busy four-way intersection could now carry devastating financial consequences for Louisiana drivers following a monumental shift in the state’s civil law that took effect on January 1, 2026. This legislative change has fundamentally altered how fault is assigned and how compensation is awarded in personal injury claims, moving the state from a lenient “pure comparative fault” system to a much stricter “modified comparative fault” model. For individuals involved in vehicle accidents, this new legal framework introduces a critical threshold of responsibility that can mean the difference between receiving a financial award for damages and being left with nothing at all. The implications of this new standard are far-reaching, promising to reshape the strategies of insurance companies, increase the burden on the court system, and place a new level of scrutiny on the actions of every driver involved in a crash. As the state’s legal and insurance industries adapt, residents are now navigating a landscape where even a small degree of fault could completely bar them from recovery.

The New Legal Landscape for Accident Claims

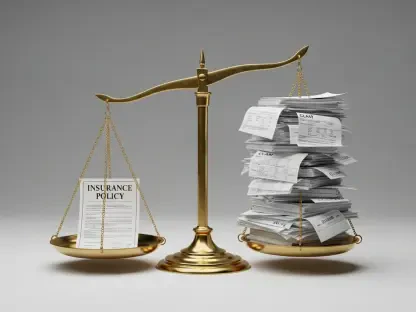

Previously, Louisiana’s civil code operated under a system of pure comparative fault, a legal doctrine that allowed an injured party to recover damages regardless of their degree of responsibility for an accident. Under this former standard, a court or jury would determine the total damages and then assign a percentage of fault to each party involved. The injured person’s financial award would simply be reduced by their own percentage of fault. For example, if a driver sustained $100,000 in damages but was found to be 70% responsible for the collision, they could still recover the remaining 30%, or $30,000, from the other at-fault party. This system ensured that no individual was completely denied compensation as long as another party shared at least some of the blame. It was a model that focused on proportional responsibility, acknowledging that fault is rarely an all-or-nothing proposition in complex traffic incidents and providing a pathway to at least partial financial relief for all injured parties, even those who were primarily at fault.

The modified comparative fault system, now in effect, introduces a rigid and unforgiving cut-off point for financial recovery. The new law stipulates that an individual involved in an accident must be found 50% or less at fault to be eligible to receive any compensation for their injuries and damages. If a person is deemed to be 51% or more responsible for the incident, they are completely barred from recovering any money from the other party. This creates a critical tipping point where a single percentage point of fault can have profound financial consequences. According to legal experts, this change is expected to empower insurance companies to more aggressively contest claims. Insurers now have a powerful incentive to dispute liability and argue that the claimant was slightly more responsible for the accident, as shifting the blame by just a few percentage points could absolve them of any financial obligation. This strategy is particularly viable in common but ambiguous situations like collisions at uncontrolled intersections, disputes over traffic signal right-of-way, and failure-to-yield incidents where fault is often subjective and difficult to prove definitively.

Projected Consequences for the Legal System and Claimants

The shift to a 51% fault-bar rule is widely anticipated to trigger a significant increase in litigation across the state. With insurance companies now motivated to deny more claims outright by arguing the claimant bears the majority of the fault, fewer disputes will likely be resolved through pre-trial settlements. Injured parties who believe they are less than 51% responsible will be forced to take their cases to court to prove their standing, leading to a more contentious and adversarial legal process. This surge in court cases is expected to drive up costs for everyone involved. Claimants will face higher legal fees and expenses associated with a prolonged court battle, while insurance companies will also incur greater costs defending these cases. Furthermore, the increased caseload will inevitably lead to substantial delays within the judicial system. Individuals injured in accidents may have to wait much longer for their cases to be heard and resolved, placing them under immense financial and emotional strain as medical bills and other expenses accumulate without any immediate prospect of compensation.

The implementation of this new standard established a fundamentally different environment for personal injury claims in Louisiana. The long-term effects of the law became a subject of intense observation as the state’s courts began the complex process of interpreting and applying the 51% fault bar to a wide variety of accident scenarios. This legal evolution was expected to clarify the nuances of the statute over the ensuing years, setting precedents that would shape the outcomes of future claims. For the state’s drivers, the change represented a significant transfer of risk, where the financial burden of an accident increasingly fell upon the individuals involved rather than being distributed proportionally through the insurance system. The move away from pure comparative fault marked a pivotal moment that redefined the balance of power between claimants and insurers and underscored the critical importance of clearly establishing liability in the immediate aftermath of any vehicle collision.