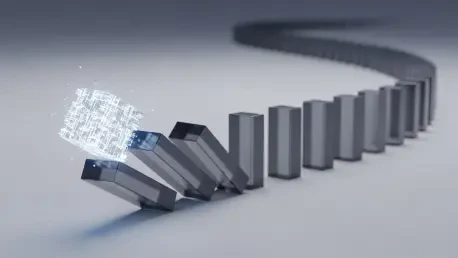

A single cyber-attack on a major automotive manufacturer in 2025 sent shockwaves not just through its digital infrastructure but across an entire physical supply chain, immediately impacting over 100,000 workers and sparking a debate over who should bear the costs. This incident serves as a stark illustration of the modern operational environment, a complex web where cyber threats, digital vulnerabilities, supply chain logistics, and geopolitical tensions converge into a single disruptive event. This phenomenon, often termed a “polycrisis,” describes a state where disparate risks become entangled, creating cascading consequences that defy traditional, siloed risk management approaches. The challenge for organizations is that these multifaceted threats often fall outside the direct control of day-to-day operational teams, demanding a strategic, top-down response. As these interconnected perils grow in frequency and scale, the focus must shift from merely managing individual risks to building comprehensive organizational resilience capable of withstanding systemic shocks.

1. The Shifting Landscape of Modern Risks

The contemporary risk environment is characterized by its unpredictability and the blurring of categorical lines, demanding a far more dynamic approach to contingency planning. Geopolitical risk, for instance, has evolved beyond predictable changes in regulations and laws into a realm of sudden and disruptive events. The drone incursions that temporarily shut down major European airports in Oslo and Copenhagen during the autumn of 2025, alongside separate cyber-attacks that crippled operations at three other key hubs, underscore this new reality. While the specific nature of these events may have been unforeseen, the resulting inability to travel is a contingency that organizations should have anticipated, particularly given the lessons learned during the global travel shutdowns of the early 2020s. These incidents highlight a critical gap: planning must now account for the consequence—such as widespread travel disruption—regardless of the specific cause, building response mechanisms that are robust enough to handle shocks from multiple, unexpected sources. This shift requires a broader perspective where strategic planning and crisis management become integral to surviving in an increasingly volatile world.

Compounding these challenges is the rapid integration of Artificial Intelligence, a technology that presents a duality of profound opportunity and significant risk. Recognized in industry surveys as both a current and emerging threat, AI manifests its risks in diverse and complex ways, including potential data privacy breaches, intellectual property theft, critical technology errors, and sophisticated new forms of fraud. For many organizations, the primary risk exposure occurs at the very beginning of their AI journey—during the planning, design, and implementation phases—and continues throughout the ongoing use of AI tools. However, AI also offers powerful solutions for risk managers. It is already being extensively deployed to protect corporate systems from advanced cyber threats, and sophisticated AI models are being used by the insurance industry to more accurately predict and model complex risks. The rise of Generative AI further complicates this picture. While it promises significant cost savings and operational efficiencies, it concurrently introduces acute risks related to data security, the potential for erroneous output, and complex IP ownership questions. These are areas that insurers are scrutinizing closely, raising fundamental questions about the fair presentation of risk, the adequacy of current policy wordings, and whether resulting losses would be insurable under professional indemnity or cyber coverage.

2. Gauging Perceptions within the Risk Community

Recent surveys from across the business landscape reveal a clear consensus on the primary anxieties facing corporate leaders today, painting a picture of an environment shaped by systemic complexity and the potential for cascading impacts. In a recent report from Travelers, an overwhelming 58% of respondents identified economic uncertainty as their principal business concern. This broad category encompasses a wide variety of specific threats, from inflationary pressures and interest rate volatility to shifts in consumer demand and global market instability. Beyond this top-line concern, supply chain vulnerabilities and cyber risks were also flagged as areas of high and growing apprehension. The Aon 2025 Global Risk Management Survey reinforces these findings, ranking cyber threats as the number one risk faced by businesses globally. Notably, this same survey showed geopolitical risk climbing significantly in the rankings, reflecting a growing awareness of how international tensions and state-level actions can directly disrupt commercial operations. These survey results are not merely academic; they signal a fundamental shift where risks are no longer seen as isolated incidents but as interconnected elements of a larger, more fragile system that demands strategic oversight from the highest levels of leadership.

The elevation of cyber risk to the top of corporate concerns is driven by an escalating threat level that is becoming demonstrably more severe, sophisticated, and widespread. Malicious actors, often backed by hostile states such as China, Iran, North Korea, and Russia, are leveraging advances in Artificial Intelligence to power their attacks, making them harder to detect and defend against. This technological arms race means that defensive measures that were effective just a year or two ago may now be obsolete. The consequences of a successful attack extend far beyond immediate financial loss, encompassing severe business interruption, reputational damage, and the erosion of customer trust. The interconnectedness of the modern digital ecosystem means that a vulnerability in one part of the supply chain can be exploited to compromise numerous other organizations, as seen in the UK auto manufacturer incident. This reality places immense pressure on leadership to move beyond traditional IT security and embed cyber resilience into the core of their operational and strategic planning, treating it not just as a technical issue but as a fundamental business imperative.

3. Forging a Path Toward Organizational Resilience

In the face of this new macro-risk environment, where threats are interconnected and often beyond the control of functional departments, the essential organizational response is the cultivation of deep, multi-dimensional resilience. This involves a combination of “hard” factors, like financial buffers and robust infrastructure, and “soft” factors, such as adaptive leadership and a strong organizational culture. A practical first step is to leverage the insights from major risk surveys to facilitate internal risk identification and awareness. The headings and categories used in reports like the Aon 2025 Global Risk Management Survey can serve as a powerful framework for facilitating horizon scanning and scenario planning workshops. These exercises help organizations think beyond their immediate operational concerns and consider a wider range of potential disruptions. A striking finding from that same survey—that only 14 percent of respondents actively measure their exposure to the top 10 identified risks—reveals a significant gap between awareness and action. By systematically using external data to challenge internal assumptions, leadership teams can begin to build a more comprehensive and proactive response strategy.

Building on this foundation of awareness, organizations must establish clear ownership and accountability for managing these complex threats. Strategic and emerging risks that fall outside the purview of the day-to-day risk management function should be explicitly discussed, owned, and managed by the senior leadership team. Ideally, ownership of individual macro risks is assigned to specific executives to ensure dedicated oversight. To facilitate this high-level view, the role of a Chief Risk Officer (CRO) at the Board or senior management level becomes critical. A CRO can provide a holistic perspective of the entire risk landscape, chart the evolution of new and emerging threats, and ensure that risk considerations are integrated into all strategic decisions. Furthermore, internal resources can be better utilized to strengthen these efforts. The UK’s Chartered Institute of Internal Auditors, for example, urges organizations to use their internal audit teams not just for compliance checks but to proactively assess and enhance the effectiveness of their overall risk management framework. Finally, insurance remains a vital tool for building financial resilience, but its role can be strengthened. In these dynamic times, it is incumbent upon the insurance industry to ensure absolute clarity of coverage in policy responses, providing a reliable backstop that allows businesses to navigate uncertainty with greater confidence.

A Renewed Perspective on Uncertainty

The journey through the complexities of the modern polycrisis ultimately led to a crucial understanding of the distinction between measurable risk and profound uncertainty. While the challenge of planning with incomplete information is not entirely new—a concept explored over a century ago in Frank Knight’s seminal 1921 work, “Risk, Uncertainty, and Profit”—the contemporary context presented an escalated challenge. Knight distinguished between risk, where probabilities could be calculated based on historical data and modeling, and uncertainty, where such calculations were impossible. Today’s conditions, marked by the unprecedented scale of potential consequences from interconnected threats, firmly placed organizations in the realm of deep uncertainty. The recognition of this fact was pivotal; it prompted a fundamental shift away from merely managing known risks and toward building an intrinsic capacity for resilience. This strategic pivot acknowledged that while specific threats might be impossible to predict, the organization’s ability to adapt, respond, and recover became the ultimate measure of its long-term viability.