In a world where economic and environmental uncertainties loom large, the global commercial insurance market presents a rare and fleeting opportunity for buyers to secure favorable terms amidst a softening landscape. Recent insights from industry reports reveal a temporary easing of conditions, with competitive pricing and increased capacity creating a buyer-friendly environment across various regions and sectors. However, this window of opportunity comes against a backdrop of escalating systemic risks, from geopolitical tensions to climate-driven catastrophes, which could swiftly alter the market dynamics. This juxtaposition of short-term advantages and long-term threats raises critical questions about how organizations can strategically position themselves. Navigating this complex terrain requires a deep understanding of current trends and a proactive approach to risk management, as the balance between opportunity and vulnerability has never been more delicate.

Understanding the Current Market Dynamics

A Window of Opportunity for Buyers

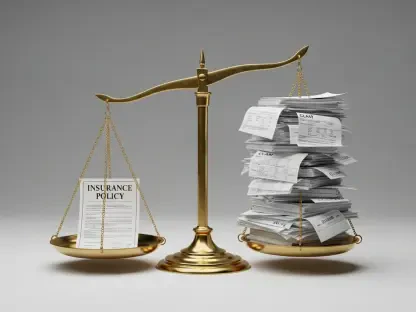

The commercial insurance sector is experiencing a notable softening, characterized by increased capacity and more competitive pricing across multiple lines of business. Property pricing in the United States, for instance, has seen significant double-digit reductions, especially in shared and layered programs, offering substantial cost savings for organizations. Similarly, markets for cyber insurance and directors & officers coverage have eased, with rate decreases ranging from single to low double-digit percentages. Globally, the Pacific region stands out with steeper price declines compared to more moderate reductions in areas like Latin America and Europe. This environment, driven by an influx of capacity, provides a unique chance for buyers to negotiate better terms and enhance their coverage. Yet, the temporary nature of these conditions means that hesitation could result in missed opportunities as market forces remain unpredictable and subject to rapid shifts.

Beyond the immediate benefits of lower premiums, this softening market allows organizations to address gaps in their insurance programs that may have been neglected during harder market cycles. For many, this could mean expanding coverage for emerging risks or securing more flexible policy terms that align with long-term business goals. The current climate also encourages a reevaluation of risk appetites, enabling companies to lock in advantageous pricing before potential disruptions tighten conditions. However, while the numbers paint an optimistic picture, underlying challenges such as loss deterioration in certain lines hint at fragility. Buyers must act with both speed and foresight, recognizing that this favorable period is not a guarantee of stability but rather a strategic moment to build resilience against future uncertainties in an ever-evolving risk landscape.

Regional Variations in Pricing Trends

Pricing trends across the globe reveal a patchwork of opportunities and challenges that buyers must navigate with precision. In the Pacific markets, rate reductions are among the most pronounced, ranging from 11 to 20%, creating an especially attractive environment for securing insurance at lower costs. In contrast, in regions like Asia-Pacific, Latin America, and parts of Europe, the Middle East, and Africa, the decreases are more modest, often between 1 and 10%, reflecting a slower pace of softening. North America, meanwhile, shows relatively flat pricing, with minimal fluctuations that suggest a more stable but less dynamic market. These disparities highlight the importance of localized strategies, as a one-size-fits-all approach to insurance procurement may overlook critical cost-saving opportunities or expose organizations to region-specific risks that are not immediately apparent.

Delving deeper into these variations, it becomes evident that regional economic conditions, regulatory environments, and risk profiles play significant roles in shaping market behavior. For example, areas with higher exposure to natural catastrophes or geopolitical unrest may not experience the same level of softening due to insurers’ cautious underwriting practices. This creates a complex decision-making landscape where organizations must weigh the benefits of immediate savings against the potential for sudden rate hikes triggered by localized events. Understanding these nuances is essential for tailoring insurance programs that not only capitalize on current pricing trends but also safeguard against region-specific volatilities. As the market continues to evolve, staying attuned to these differences will be a key determinant of successful risk management strategies.

Navigating the Challenges of Systemic Risks

Geopolitical and Climate-Driven Threats

Amidst the softening insurance market, a surge of systemic risks casts a shadow over the apparent opportunities, with geopolitical tensions and climate volatility emerging as dominant concerns. Conflicts such as those in the Middle East and Eastern Europe continue to destabilize political risk and aviation sectors, prompting stricter terms and tighter reserving practices in affected markets. Trade disputes and tariffs further complicate the picture, driving supply chain disruptions and inflating claims costs in industries like construction. Simultaneously, climate-related challenges intensify, with events like widespread blackouts and wildfires exposing infrastructure vulnerabilities. With natural catastrophe losses already reaching staggering figures in the first half of the year, the forecast for an active hurricane season adds urgency to the need for robust coverage against such unpredictable threats.

Compounding these issues is the interconnected nature of modern risks, where a single event can trigger cascading effects across multiple sectors and regions. The ripple effects of geopolitical instability, for instance, often exacerbate economic pressures that influence insurance pricing and availability. Likewise, climate events not only cause direct damage but also strain critical systems, amplifying recovery costs and timelines. For organizations, this means that even as they benefit from softer market conditions, the potential for sudden disruptions looms large. Addressing these challenges requires more than just securing favorable terms; it demands a comprehensive approach to risk assessment that accounts for the interplay of global forces. As these threats evolve, staying ahead will hinge on anticipating their impact and integrating adaptive strategies into insurance planning.

Cyber Risks in a Softening Landscape

Even as insurance markets soften, cyber threats remain a persistent and evolving challenge that organizations cannot afford to overlook. Emerging dangers such as deepfakes, AI-driven fraud, and sophisticated ransomware attacks continue to test the limits of existing defenses, leaving many exposures underinsured despite more favorable pricing in this line of business. The rapid pace of technological advancement means that new vulnerabilities emerge almost as quickly as solutions are developed, creating a cat-and-mouse dynamic that complicates risk management. While the current market offers opportunities to expand cyber coverage at reduced rates, the underlying severity of potential losses underscores the importance of prioritizing this area, as a single breach can have devastating financial and reputational consequences.

Further complicating the cyber landscape is the gap between perceived and actual protection, as many organizations underestimate their exposure or rely on outdated policies that fail to address modern threats. This disconnect is particularly concerning given the increasing regulatory scrutiny and potential for litigation following data breaches or privacy violations. As insurers adjust their offerings to reflect softening conditions, there is a chance to close these gaps by investing in comprehensive coverage and leveraging analytics to better understand risk profiles. However, the transient nature of market softness means that waiting too long could result in missed opportunities or exposure to hardening conditions if a major cyber event shifts industry sentiment. Proactive engagement with insurers and a focus on tailored solutions will be critical for navigating this high-stakes area of risk in the current environment.

Strategic Actions for a Volatile Future

Capitalizing on Alternative Risk Solutions

As traditional insurance markets soften, a growing trend toward non-traditional and alternative risk solutions offers organizations innovative ways to manage volatility. Parametric insurance, tied to specific triggers like weather events or supply chain disruptions, is gaining traction in sectors such as energy, infrastructure, and agribusiness, providing a more predictable payout structure during crises. Additionally, facilities in major markets are seeing increased interest as clients seek to diversify their risk transfer mechanisms. These approaches, often supported by advanced analytics and alternative capital, enable a more holistic view of total cost of risk, allowing companies to address complex exposures that standard policies may not fully cover. Embracing such solutions now can position organizations to better withstand future shocks.

Exploring these alternatives also reflects a broader shift in how risk is perceived and managed, moving beyond conventional insurance to a more integrated framework. By leveraging advisory services and data-driven insights, companies can customize their strategies to align with specific operational needs and risk tolerances. This is particularly valuable in a softening market, where the flexibility to experiment with new tools can yield long-term benefits without the burden of prohibitive costs. However, adopting these solutions requires a willingness to invest time and resources into understanding their mechanics and potential limitations. As the market remains susceptible to sudden changes, the organizations that prioritize innovation in risk management today are likely to emerge as leaders in resilience tomorrow, ready to face an uncertain landscape with confidence.

Building Resilience Amidst Uncertainty

Reflecting on the insights from recent industry analyses, it becomes clear that the softening insurance market of this year offers a critical juncture for organizations to fortify their defenses against an array of looming risks. The strategic moves made during this period, such as securing favorable terms and expanding coverage, prove essential in preparing for potential market shifts driven by geopolitical unrest or climate events. Looking ahead, the focus must shift to sustaining this momentum by continuously reassessing risk profiles and integrating lessons learned from past challenges. Engaging with insurers to explore tailored solutions and investing in predictive tools can further enhance preparedness, ensuring that temporary advantages translate into enduring stability.

Moreover, the actions taken in response to emerging cyber threats and the adoption of alternative risk mechanisms during this softer cycle lay a foundation for navigating future volatility. As systemic risks continue to evolve, organizations should consider establishing cross-functional teams to monitor global trends and adjust strategies accordingly. Partnering with industry experts to stay informed about regulatory changes and technological advancements will also be vital. By embedding a culture of proactive risk management, companies can transform the opportunities seized in this unique market phase into a robust framework for addressing whatever challenges lie ahead, safeguarding their operations against the unpredictable nature of tomorrow’s risks.