Insurance on crypto represents a fundamental safety net to protect digital investments from theft, hacking, and technical failures. In a rapidly evolving sector, knowing the available coverages is crucial. Let’s look at them in this article.

As anticipated, in the increasingly complex landscape of cryptocurrencies, the protection of digital assets has become a priority for individuals, companies, and institutional investors. Insurance on crypto offers solutions to protect these assets from losses due to theft, hacking, technical issues, and smart contract failures. But how does this type of insurance actually work, and why is it becoming increasingly important?

Evaluation of Risks

The insurer examines various factors, including the value of the digital assets owned, security protocols in place, and regulatory compliance by the insured party. The process begins with a thorough risk assessment to determine the specific needs of the client. This involves evaluating the type and volume of digital currencies held, the security measures currently implemented such as multi-signature wallets or cold storage, and the level of regulatory adherence exhibited by the entity seeking insurance.

In assessing these multifaceted elements, the insurer can identify potential vulnerabilities and losses that might arise from cyber threats or human errors. Factors like historical incidences of breaches, types of assets, market volatility, and frequency of transactions are meticulously analyzed. This provides a foundational understanding which will inform the structure and specifics of the insurance plan.

Creation of a Custom Plan

Based on the assessment, a tailored insurance strategy is developed, outlining the specifics of the coverage—such as protection against theft or exchange breaches. The customization of the plan ensures that the insurance coverage is optimally aligned with the identified risks. Such a plan clearly delineates what scenarios are covered, be it unauthorized access, fraud, system faults, or disruptive cyber-attacks.

For example, an insurance plan tailored for a cryptocurrency exchange would focus extensively on breach protection and internal fraud measures. On the other hand, an individual investor’s plan could prioritize the protection of private keys and wallet recovery features. By aligning the insurance provisions with specific risks, both parties—insured and insurer—can have a clear understanding of coverage bounds and liabilities.

Premium Calculation

Premiums, which are the payments made by the insured, are computed considering market conditions, previous risks, and the value of the assets being protected. Premium costs are derived from a complex matrix of factors including the volatility of the cryptocurrencies in question, the historical data about the security framework of the insured entity, and broader market trends.

For instance, holding highly volatile assets like Bitcoin might attract higher premiums compared to relatively stable coins. Moreover, if an entity has experienced frequent security breaches in the past, this would contribute to higher premiums. The comprehensive nature of this calculation ensures that premium rates are reflective of the genuine risk, thereby emphasizing the importance of preemptive risk mitigation measures by the insured.

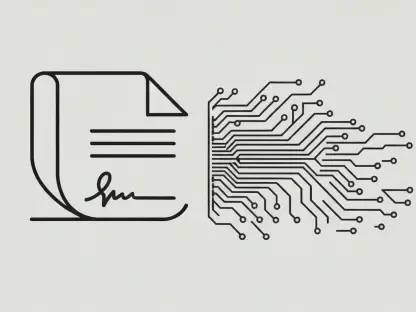

Contract Agreement

Once terms are agreed upon, a formal contract is signed by both parties, detailing the policy terms. At this juncture, the insured commits to paying the premiums while the insurer promises to cover losses in the event of a claim. This stage signifies a mutual consensus on the coverage aspects and legally binds both parties to adhere to the stipulated terms.

The agreement encompasses detailed provisions such as the duration of coverage, specific inclusions and exclusions, and the process for claim submissions and settlements. The insurer’s obligations to provide financial compensation under specified circumstances are clearly laid out, ensuring that there are no ambiguities in expectations post-incidents.

Claim Submission

In case of a loss, the insured files a claim with the insurance company. After verifying the provided information, the insurer reimburses the agreed amount. This process of claim submission involves the insured documenting the nature, extent, and cause of the loss as stipulated in the policy.

Upon receiving the claim, the insurance company undertakes a stringent verification procedure to authenticate the claim. This could involve technical audits, consultations with cyber-security experts, and reviewing security logs and other documentation provided by the insured. Once validated, the insurer disburses the compensation up to the agreed limits, aiding in financial recovery post-incident.

Overall, the digital protection of crypto investments through well-structured insurance policies serves as a critical framework in maintaining financial stability amidst the pervasive threats in the digital asset landscape.

Conclusion

Insurance on crypto acts as a crucial safety net, safeguarding digital investments against theft, hacking, and technical failures. In the rapidly evolving world of cryptocurrencies, understanding available coverages is essential. This protection is critical for individuals, companies, and institutional investors, addressing the risks associated with losses from theft, hacking, technical issues, and smart contract failures.

Evaluation of Risks: Insurers assess various factors, such as the value of digital assets, security protocols, and regulatory compliance. The process begins with a thorough risk evaluation to cater to the specific needs of the client. This includes assessing the type and volume of digital currencies, the security measures in place like multi-signature wallets or cold storage, and the level of regulatory adherence.

Creation of a Custom Plan: Tailored plans are developed based on the risk assessment, specifying the coverage for scenarios like theft or exchange breaches. For example, an exchange’s plan might focus on breach protection, while an individual investor’s plan may emphasize private key and wallet recovery.

Premium Calculation: Premium costs are calculated based on factors such as market conditions, previous risks, and asset values. Holding volatile assets like Bitcoin can result in higher premiums. Factors including historical security breaches and overall market trends also influence the premium rates.

Contract Agreement: A formal contract is signed, detailing policy terms. The insured commits to paying premiums, while the insurer agrees to cover losses as specified. The agreement includes coverage duration, specific inclusions and exclusions, and claims process details.

Claim Submission: When a loss occurs, the insured files a claim. The insurer verifies the information and reimburses the agreed amount. This process involves documenting the loss and undergoing a verification procedure by the insurer.

Overall, crypto insurance provides a vital framework for maintaining financial stability amidst digital threats, ensuring peace of mind for investors.