The home insurance landscape across the United States is experiencing a seismic shift, with costs soaring in ways that defy traditional expectations of regional risk. Homeowners in states like Florida and California, frequently hit by devastating hurricanes and wildfires, are accustomed to high premiums due to the constant threat of natural disasters. However, a startling trend has emerged: even residents in states with minimal exposure to such catastrophes are seeing their insurance bills climb. This raises critical questions about how losses in high-risk areas are influencing markets nationwide, challenging the assumption that premiums are tied solely to local conditions. A complex web of regulatory differences, insurer strategies, and environmental pressures is reshaping the industry, leaving many to wonder how far-reaching the financial ripple effects of distant disasters can be. This interconnected dynamic is not just a regional issue but a national concern affecting millions of policyholders.

Exploring the Cross-State Impact

Unraveling the Financial Ripple Effect

A surprising reality is unfolding in the home insurance market, where disasters in one part of the country are quietly driving up costs in another, far removed from the storm’s path. Research published in the Journal of Finance highlights that approximately 30 percent of rate increases in less-regulated states are directly linked to insured losses in high-risk regions like Florida or California. This cross-state impact shatters the notion that premiums are determined solely by local risk factors. Instead, it reveals a deeply interconnected system where insurance companies adjust rates in one area to offset financial hits taken elsewhere. For homeowners in quieter regions, this means bearing the burden of events they’ve never experienced firsthand, raising concerns about equity in how costs are distributed across the market. The phenomenon underscores a broader trend of shared financial consequences, regardless of geographic boundaries.

Beyond the immediate numbers, the interconnected nature of the insurance industry reflects a strategic balancing act by companies aiming to maintain stability. When significant claims arise from a hurricane or wildfire in a high-risk state, insurers often spread the financial load to other markets where they operate. This practice ensures they can cover massive payouts without jeopardizing their overall solvency. However, it also means that a homeowner in a state with rare natural disasters might see a premium hike tied to a catastrophe hundreds of miles away. This approach, while pragmatic from a business standpoint, fuels frustration among policyholders who feel they’re paying for risks that don’t apply to them. The challenge lies in understanding how these adjustments are calculated and why certain regions seem to absorb more of the cost than others, pointing to a need for greater transparency in pricing mechanisms.

Market Dynamics and Shared Burdens

Delving deeper into the cross-state impact, the insurance market’s structure shows how intertwined regional risks have become in a globalized economy, with companies operating across multiple states using a portfolio approach to view their operations as a single financial entity rather than isolated local businesses. When losses mount in disaster-prone areas, the shortfall isn’t contained—it’s redistributed through rate adjustments in other markets to protect the company’s bottom line. This strategy, while effective for insurers, often leaves homeowners in low-risk areas puzzled by unexpected increases. The lack of direct correlation between local conditions and premium costs can erode trust, as policyholders question why their rates reflect distant events. This dynamic illustrates a fundamental tension between corporate risk management and consumer expectations of fairness.

Moreover, the ripple effect of losses isn’t just about numbers on a balance sheet—it’s about the lived experience of millions facing higher costs. In states with minimal natural disaster exposure, residents might assume their premiums are safe from the volatility seen in coastal or fire-prone regions. Yet, the reality of cross-subsidization means that a single catastrophic event can alter the financial landscape nationwide. This shared burden highlights the necessity of a broader conversation about how risk is assessed and allocated. As the industry navigates these challenges, the focus must shift toward educating consumers about the interconnected nature of insurance markets and exploring ways to mitigate the impact on those least exposed to direct threats. The question remains whether such a system can balance the needs of insurers with equitable outcomes for all.

Regulatory Disparities and Their Role

Navigating a Patchwork of Rules

The regulatory environment governing home insurance in the United States is far from uniform, creating a complex landscape that significantly influences rate changes. Rooted in the McCarran-Ferguson Act of 1945, the authority to oversee insurance rests with individual states rather than a centralized federal body. This results in a diverse set of rules, where some states impose strict requirements for rate approvals before changes can take effect, while others adopt a more lenient “file-and-use” system, allowing insurers to implement new rates and justify them later. Of the 50 states, 38 plus Washington, D.C., operate under the file-and-use framework, compared to just 12 that demand prior approval. This disparity offers insurers greater flexibility in certain markets, often leading to quicker rate hikes where oversight is lighter. The variation shapes how companies respond to losses, often shifting financial burdens to less-regulated areas.

This patchwork of regulations doesn’t just affect how quickly rates can rise—it also determines where insurers focus their recovery efforts after major losses. In states with tight controls, such as California, the process to increase premiums can be slow and contentious, limiting immediate recoupment of funds lost to wildfires or other disasters. Conversely, in file-and-use states like Texas, insurers can adjust pricing with less delay, making these markets attractive for offsetting deficits from stricter regions. This imbalance can create a scenario where homeowners in less-regulated states indirectly subsidize the risks of high-exposure areas, even if their own risk profile remains low. The regulatory divide thus plays a pivotal role in how financial pressures are distributed, often leaving some policyholders feeling unfairly targeted by rules they didn’t choose. Addressing this requires a closer look at harmonizing standards without sacrificing state autonomy.

Flexibility and Its Consequences

The flexibility afforded by differing state regulations often benefits insurers seeking to stabilize their finances, but it comes with significant consequences for consumers. In markets with minimal oversight, companies can swiftly raise rates to compensate for losses incurred in disaster-heavy states, ensuring they remain solvent across their operations. This agility, as noted by industry advocates like the Property Casualty Insurers Association of America, can enhance policy availability by preventing market withdrawals. However, it also means that homeowners in these areas may face sudden and unexplained cost increases unrelated to their local environment. The speed of such adjustments can catch policyholders off guard, especially when they lack the context of broader industry losses driving the change. This dynamic fuels debates about whether regulatory leniency serves the public or primarily aids corporate interests.

Furthermore, the consequences of regulatory disparities extend beyond immediate rate hikes to influence long-term market behaviors, shaping how insurers operate across different regions. Insurers may strategically prioritize operations in states with looser rules, knowing they can adjust pricing more readily if losses spike elsewhere. This can lead to an uneven distribution of insurance availability, with tightly regulated states facing higher nonrenewal rates as companies pull back from less profitable areas. For homeowners, the result is a fragmented experience where the ability to secure affordable coverage depends heavily on geographic luck. The tension between state-specific oversight and national market trends suggests a need for dialogue on balancing insurer flexibility with consumer protection. Without such a balance, the current system risks perpetuating inequities that leave some regions disproportionately burdened by the costs of distant disasters, challenging the fairness of the insurance framework as a whole.

Rising Costs and Policy Challenges

The Surge in Premiums and Coverage Gaps

Home insurance costs have seen a sharp upward trajectory, placing an unprecedented financial strain on homeowners across the nation, with significant implications for household budgets. Between 2023 and the current period, the national average annual premium has risen by more than 9 percent, climbing from $2,261 to $2,470. In certain regions, the spike has been even more dramatic, with increases reaching up to 40 percent, even in states not traditionally associated with insurance crises. This escalation isn’t limited to high-risk zones like coastal areas prone to storms; it’s affecting a wide swath of the country, leaving many to grapple with budgets stretched thin by unexpected expenses. The rising costs signal a broader shift in the industry, where the financial impact of disasters is no longer contained to the areas directly hit. Instead, the burden is shared widely, often without clear explanation to those footing the bill, highlighting a growing disconnect between risk and pricing.

Alongside premium hikes, the challenge of policy nonrenewals is adding another layer of difficulty for homeowners seeking stability, as they struggle to maintain consistent coverage in an unpredictable market. In recent years, nonrenewal rates—where insurers opt not to renew existing policies—have increased in 35 states, with some areas reporting a 1 in 100 nonrenewal rate by the latest data. Surprisingly, states like North Carolina and Massachusetts, not typically seen as disaster hotspots, rank among the highest in nonrenewal trends, alongside more expected regions like Florida and Louisiana. This trend reduces the availability of coverage, forcing affected individuals to scramble for alternatives, often at higher costs or with reduced protections. The combination of rising premiums and shrinking options creates a precarious situation, where maintaining adequate insurance becomes a significant hurdle. This widespread issue points to systemic pressures that transcend regional boundaries, affecting the security of homeownership nationwide.

Consumer Impact and Market Instability

The financial burden of escalating insurance costs is reshaping how homeowners approach property protection, often with limited resources to adapt. For many, the steady climb in premiums means reallocating household budgets, cutting back on other essentials to afford coverage that’s increasingly seen as non-negotiable. The impact is particularly acute in areas where rate hikes are steepest, but even moderate increases can strain finances over time. Beyond the dollar amount, the unpredictability of these costs erodes confidence in the insurance system, as policyholders struggle to anticipate future expenses. This uncertainty is compounded by the fear of nonrenewal, which can leave properties uninsured at critical moments. The cumulative effect is a growing sense of vulnerability among consumers, who feel caught between rising expenses and diminishing control over their coverage options, prompting calls for more predictable pricing models.

Market instability further exacerbates these challenges, as the interplay of premium increases and nonrenewals reflects deeper structural issues within the industry. Insurers, facing their own financial pressures, may view certain markets as too risky to sustain, leading to strategic withdrawals that reduce competition and drive costs higher. This creates a vicious cycle where limited availability pushes remaining providers to charge more, further straining homeowners. In states not historically tied to insurance volatility, the sudden emergence of these trends can be particularly jarring, as residents confront a reality previously associated with distant, disaster-prone regions. The resulting instability underscores the need for innovative solutions, whether through regulatory adjustments or industry initiatives, to restore balance. Without intervention, the ongoing erosion of affordable coverage options threatens to undermine the foundational role insurance plays in protecting homeownership across diverse communities.

Insurer Strategies and Profit Motives

Market Exits and Rate Adjustments

Insurance companies, operating as for-profit entities, face a delicate balancing act between covering claims and ensuring financial viability, often leading to tough decisions in high-loss areas. When claims outstrip premiums in disaster-prone regions, many insurers choose to limit exposure by exiting those markets altogether or halting the issuance of new policies. This retreat is a pragmatic response to unsustainable loss ratios, where the cost of payouts threatens overall stability. Simultaneously, rate adjustments become a critical tool, allowing companies to recoup losses by increasing premiums in other areas where they continue to operate. This strategy, while necessary for solvency, often shifts the financial burden to policyholders in less-affected states, amplifying the cross-state impact of regional disasters. The result is a market where insurer actions directly influence the affordability and availability of coverage, often prioritizing corporate health over consumer needs.

The rationale behind these market exits and rate hikes is rooted in the fundamental economics of the insurance business, yet it sparks significant debate about fairness. Insurers argue that withdrawing from unprofitable regions or adjusting rates is essential to maintain the capacity to pay claims elsewhere, preventing broader systemic failures. However, this approach can leave entire communities with limited options, particularly in high-risk states where replacement coverage is scarce or prohibitively expensive. Meanwhile, rate increases in lower-risk areas, intended to offset distant losses, can feel punitive to homeowners who see no direct connection to the underlying events. This disconnect between insurer strategies and consumer experiences highlights a critical tension in the industry, where the pursuit of financial stability can inadvertently exacerbate inequities. Addressing this requires a nuanced understanding of how such decisions ripple through the market, impacting trust and accessibility.

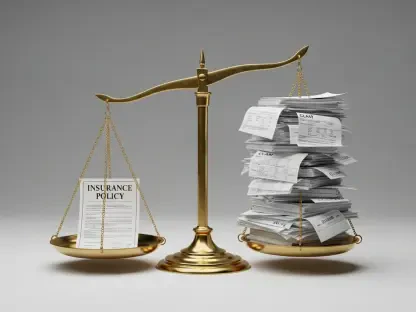

Profitability Under Scrutiny

The financial success of the insurance industry in recent times has brought renewed scrutiny to the justification behind rate increases and market strategies, especially as stakeholders question the alignment of pricing with actual risks. In 2024, the property and casualty sector reported record profits of $169 billion, a staggering 333 percent surge compared to just two years prior, with $85 billion of that gain attributed to investment income rather than premium collections. That same year marked a historic milestone as the industry surpassed $1 trillion in written premiums, reflecting robust financial health. These figures raise pointed questions about whether premium hikes are always driven by the need to cover claims or if they partly serve to bolster already substantial earnings. Critics argue that such profitability, especially from investments, suggests a disconnect between the narrative of loss-driven rate increases and the reality of corporate gains, fueling skepticism about pricing practices.

This scrutiny of profitability extends to broader ethical considerations about the role of insurers in society and their obligations to policyholders, especially as financial strategies come under the spotlight. While companies defend rate adjustments as necessary for maintaining solvency in the face of rising claims, the scale of their 2024 earnings—particularly from non-premium sources—prompts concerns about transparency in how rates are determined. Homeowners, already burdened by escalating costs, may view these profits as evidence that their premiums are funding more than just claim payouts. The debate intensifies around whether the industry’s financial strategies prioritize shareholder value over consumer affordability, a perspective echoed by voices advocating for stricter oversight. As this conversation unfolds, the challenge lies in reconciling the legitimate need for insurer stability with the growing demand for fairness, ensuring that record profits don’t come at the expense of accessible and equitable coverage for all.

Homeowner Struggles and Broader Pressures

Facing Escalating Costs with Limited Relief

Homeowners across the nation are finding themselves caught in a financial squeeze as insurance premiums continue to climb, often outpacing other household expenses, and this persistent challenge is compounded by the unpredictability of future increases. The steady rise in costs creates a significant hurdle for those striving to maintain adequate coverage. Experts in the field, such as Erika Tortorici from Optimum Insurance Solutions, caution that a decline in rates is unlikely in the near term, with the most optimistic outlook being stabilization rather than reduction. For many, this means adopting cost-saving measures, such as avoiding minor claims to preserve discounts or diligently maintaining properties to prevent damage that could trigger rate hikes. However, these individual efforts offer limited relief against systemic trends driving prices upward, leaving policyholders to navigate a landscape where affordability feels increasingly out of reach. The burden is palpable, reshaping how families plan for the security of their homes.

The struggle with escalating costs is further compounded by personal rating factors that can exacerbate premium increases, often beyond a homeowner’s immediate control. Elements like credit scores or claims history play a significant role in determining individual rates, adding another layer of complexity to managing expenses. While proactive steps—such as regular home upkeep or understanding how personal data influences pricing—can help mitigate some costs, they don’t address the root causes of industry-wide hikes. This reality leaves many feeling powerless against forces shaped by distant disasters and corporate decisions. The lack of imminent relief, as highlighted by industry analysts, underscores the urgency of broader solutions, whether through policy changes or market innovations. Until such measures materialize, homeowners must contend with a challenging environment where securing affordable insurance demands constant vigilance and adaptation, often at significant personal cost.

Environmental and Economic Forces at Play

Beyond individual struggles, the home insurance industry is grappling with powerful macro trends that are fundamentally altering its trajectory. The increasing frequency and severity of extreme weather events, from hurricanes to wildfires, are placing unprecedented pressure on insurers to adjust rates to cover escalating claims. Simultaneously, the cost of building materials and labor for repairs has surged, further necessitating premium hikes to ensure companies can meet their obligations. These environmental and economic forces are not transient issues but long-term challenges that threaten the stability of the market. If rates fail to keep pace with these rising costs, insurers risk insolvency, which could lead to even greater disruptions, including widespread market exits and coverage gaps. This delicate balance between pricing and solvency shapes the difficult reality facing both the industry and its customers.

The broader implications of these pressures extend to how risk is perceived and managed across the insurance landscape, influencing future strategies. As climate patterns shift and economic conditions evolve, the need for adaptive measures becomes more pressing, requiring insurers to rethink traditional models of risk assessment. For homeowners, this translates into ongoing uncertainty, as the factors driving rate increases—such as a warming planet or fluctuating construction costs—show no signs of abating. The industry must contend with the dual challenge of maintaining financial health while addressing the growing needs of policyholders in an era of heightened risk. This complex interplay of environmental and economic trends suggests that the current trajectory of rising costs and shrinking options may persist, demanding innovative approaches to safeguard affordability. The path forward hinges on collaborative efforts to mitigate these systemic pressures, ensuring that the burden of inevitable change is shared equitably.