Investing in the financial markets can be a complex endeavor, demanding not only knowledge but also the appropriate tools and updates to stay ahead. As the market fluctuates, leveraging modern tools and staying informed with the latest updates is crucial for achieving market success. This article explores the various methods and resources investors can utilize to make informed financial decisions and optimize their investment strategies. Understanding these elements not only helps mitigate risks but also positions investors to seize emerging opportunities and drive sustained growth in their portfolios.

Identifying Growth Stocks through Analytical Tools

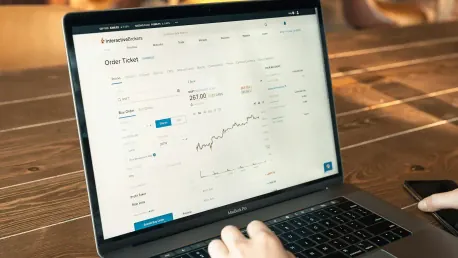

Modern investors have access to a plethora of analytical tools designed to identify promising growth stocks. Services offering premium growth stock picks provide investors with curated lists tailored for maximum potential returns. These tools act as a beacon in the often-murky waters of stock selection, flagging opportunities that align with specific growth metrics. Stock screeners are an essential resource, allowing users to filter stocks based on criteria such as market capitalization, P/E ratio, and growth potential. These tools simplify the process of sifting through thousands of potential investments to find those that match specific investment strategies, making the task less daunting and more precise.

Further enhancing the utility of these tools, ETF screeners enable investors to locate exchange-traded funds that align with their financial goals. By utilizing these resources, investors can diversify their portfolios with a mix of stocks and ETFs that promise sustainability and growth. This diversification is a critical aspect of a well-balanced investment strategy, as it can mitigate risk and smooth out potential volatilities. The efficiency and precision offered by these screeners mean that investors can more confidently assemble a portfolio that meets their long-term financial objectives.

Utilizing Insider and Analyst Recommendations

Insider and analyst recommendations serve as a valuable compass for making informed investment decisions. These insights often provide a behind-the-scenes look at companies, offering a perspective that may not be immediately visible through standard public information. Insider buying and selling activities can be particularly telling; when company executives and insiders buy shares, it often signals confidence in the company’s future performance. Conversely, significant selling activity might indicate potential troubles or a perceived overvaluation that warrants caution. Thus, keeping an eye on insider activities can provide meaningful context to an investor’s decision-making process.

Moreover, top analysts’ stock picks provide a considered viewpoint based on rigorous research and analysis. Subscribing to services that aggregate these recommendations can give investors a strategic edge, integrating professional insight into their investment decisions. These services often come at a premium but offer a high return on investment by saving time and providing expert opinions that could otherwise take hours of research to uncover. By combining insider actions and top analyst recommendations, investors can create a robust framework for evaluating stocks, enhancing the potential for a successful portfolio.

Comprehensive Market Data and Analytical Calendars

Keeping abreast of market data is fundamental for crafting successful investment strategies. Various calendars and data sources supply investors with key information on earnings reports, dividend schedules, economic indicators, IPOs, stock splits, and buybacks. This wealth of data forms the backbone of informed investing, enabling individuals to anticipate market movements and make timely decisions. Earnings calendars, for instance, provide a timeline of when companies will release their financial results, crucial for making portfolio adjustments either before or after earnings announcements.

Economic calendars highlight important dates for economic events and indicators that can affect market performance, such as interest rate decisions and employment reports. These events often cause significant market fluctuations, and being aware of them allows investors to position themselves appropriately. Dividend and IPO calendars are equally critical, enabling investors to track upcoming payouts and new market entries. Having a comprehensive view of these events helps in anticipating market movements and preparing investment actions accordingly, facilitating a more strategic approach to portfolio management.

Strategic Moves in the Financial Sector: The Case of Woori Financial Group

Significant corporate actions, such as mergers and acquisitions, provide insight into strategic moves within the financial sector. Woori Financial Group’s acquisition of ABL Life Insurance Co. serves as an illustrative example of how strategic acquisitions can enhance market competitiveness and broaden service offerings. Such moves are not just about expanding market share but often involve integrating technologies, improving operational efficiencies, and enhancing customer service capabilities. For Woori Financial Group, this acquisition is seen as not just a financial transaction but a strategic initiative to solidify its footing in a competitive market.

These moves reflect a broader trend of consolidation within the industry, where financial entities strengthen their positions through targeted acquisitions. For investors, staying informed about these developments is essential for understanding market dynamics and potential opportunities. Analyzing these strategic decisions can identify trends and make informed predictions about future market behavior. Observing how these acquisitions affect market positions and service capabilities can provide clues about which companies might be poised for growth, thereby informing investment strategies and decisions in the long run.

Enhancing Investment Strategies with Research Tools

Efficient investment decisions are underpinned by robust research. Stock screeners, technical analysis tools, and ETF screeners are some of the primary resources that investors can utilize to conduct thorough market analysis. Technical analysis tools, for instance, help investors understand price movements and identify patterns that may indicate future performance. These tools often include charts, trendlines, and indicators such as moving averages and relative strength index (RSI), which collectively offer a comprehensive view of stock trends and potential market behaviors.

While stock and ETF screeners facilitate the identification of potential investment opportunities based on various parameters, integrating technical analysis can refine these choices, offering a well-rounded approach to market investment. Utilizing these tools allows investors not only to find potential stocks and ETFs but also to forecast their movements more accurately, thereby crafting a more fine-tuned investment strategy. Through these combined approaches, investors can maintain an edge in a competitive market environment, backed by data-driven insights and technical analyses.

Staying Informed with Continuous Updates and Newsletters

Regular updates and continuous education are paramount for maintaining an edge in the financial markets. Subscribing to newsletters like “Smart Investor” and “Smart Dividend” ensures that investors receive timely information and expert insights directly to their inbox. Such resources are invaluable for keeping investors updated on market trends, breaking news, and insightful analysis, which collectively support sound decision-making. Mobile apps further enhance the ability to stay informed on the go, providing real-time updates, market news, and personalized alerts, all of which contribute to a more agile and responsive investment strategy.

These resources enable investors to react swiftly to market changes and adapt their strategies as necessary. In today’s fast-paced market environment, having access to the latest information in real time can be a game-changer. By integrating these tools and resources into their daily routine, investors can maintain a high level of market awareness, which is critical for making informed investment decisions. This continuous stream of updates ensures that investors never miss out on vital information that could influence their strategies and outcomes.

Unlocking Additional Financial Tips through Sponsored Content

Investing in financial markets is a complex task that requires not only a deep understanding but also the right tools and timely updates to succeed. The market’s dynamics are ever-changing, making it essential for investors to use modern tools and stay updated with the latest information. This ensures they can make well-informed financial decisions and refine their investment strategies.

Navigating the intricacies of the market involves leveraging various methods and resources. By doing so, investors can effectively mitigate risks and position themselves to capitalize on emerging opportunities. Staying informed and updated not only enhances the potential for sustained portfolio growth but also boosts overall investment effectiveness.

In this article, we delve into the different strategies and resources available to investors. Understanding these tools helps in making informed decisions that drive long-term growth. Investors who manage to stay ahead of market trends are better equipped to handle fluctuations and ensure their investments yield favorable returns. This holistic approach is key to achieving market success.