In the rapidly evolving landscape of financial services, traditional risks are giving way to new, more complex challenges fueled by digital transformation, regulatory changes, climate factors, and geopolitical tensions. For financial institutions in Europe, this dynamic environment demands a keen understanding of emerging risks and proactive resilience strategies to maintain stability and growth.

Digital Transformation and Risk Landscape

Evolving Financial Services

In recent years, the financial sector has seen a significant shift from physical to digital platforms, fundamentally altering the risk landscape. Where banks once focused on insuring physical assets, the demand has moved toward protecting digital assets. This transformation has pivoted the needs from traditional insurance products to more contemporary solutions such as cyber insurance and professional indemnity policies tailored to cover threats specific to the digital realm. Cyber insurance has become paramount, as institutions face threats like data breaches, hacking, and AI-generated wrongful advice, underpinning the importance for financial entities to adapt their risk management frameworks in line with technological advancements.

As financial services become more reliant on digital channels, the need to safeguard against cyber threats has never been more critical. Legacy systems are often unable to cope with the complexities of modern cyber threats, making robust cyber insurance and advanced cybersecurity measures indispensable. The industry’s shift to digital platforms means that physical branches are decreasing in relevance, and safeguarding digital information has taken a front seat. This trend underscores the necessity for financial institutions not only to adopt cutting-edge technology but also to reinforce their digital infrastructure to counter ever-evolving cyber risks effectively.

Mitigating Cyber Threats

The surge in digital financial services has brought about an uptick in cyber risks, marking financial institutions as prime targets due to the highly sensitive nature of their data and operations. This increasing vulnerability has led to a significant rise in the demand for comprehensive cyber insurance policies. These policies are intricately designed to cover financial losses stemming from a variety of cyber incidents, including data breaches, system hacking, and ransomware attacks. Financial institutions must constantly update their cybersecurity protocols and insurance coverage to hedge against these persistent and growing threats.

Moreover, as cyber threats become more sophisticated, the financial sector must adopt a proactive stance on cybersecurity. This includes regular vulnerability assessments, adoption of advanced threat detection systems, and ensuring that all employees are trained in cybersecurity best practices. The costs associated with cyber incidents can be astronomical, not only in terms of immediate financial loss but also in potential long-term damage to a company’s reputation. Consequently, comprehensive cyber insurance acts as a crucial line of defense, offering financial institutions a means to manage the considerable risks inherent in today’s digital landscape.

Regulatory Challenges and Compliance

ESG and Sanctions Legislation

The regulatory landscape for financial institutions is becoming increasingly intricate, especially with the introduction of new ESG (Environmental, Social, Governance) requirements and enhanced sanctions legislation. These regulations demand that financial institutions not only demonstrate adherence to these comprehensive standards but also ensure they are effectively incorporated into their operational and strategic frameworks. This regulatory shift places additional pressures on these institutions, necessitating heightened demand for directors and officers (D&O) liability insurance and professional indemnity coverage. Such policies provide a financial safety net against the risks associated with non-compliance, including substantial fines and reputational damage.

As these entities grapple with the extensive requirements of ESG and sanctions legislation, they must implement robust compliance measures to ensure adherence. The fines and penalties connected with non-compliance can be substantial, making it imperative for financial institutions to invest in comprehensive compliance frameworks. Additionally, the emphasis on ESG factors means that institutions must disclose the environmental and social impacts of their activities, adding another layer of complexity and potential liability. Professional indemnity coverage becomes critical in this context, helping to protect against claims arising from alleged failures to meet these new regulations.

Navigating Increased Scrutiny

The ever-evolving regulatory framework necessitates robust compliance measures within financial institutions, requiring significant investment in compliance infrastructure and resources. As scrutiny intensifies, financial entities must be prepared for an escalation in customer complaints and legal defense costs, making comprehensive liability coverage indispensable. The pressure to adapt to these rigorous standards creates a landscape where robust internal policies and continuous monitoring become vital components of a successful compliance strategy.

Financial institutions must develop and implement a proactive approach to regulatory compliance, ensuring they are always one step ahead of changes in legislation. This can include deploying advanced compliance software, hiring specialists, and conducting regular training sessions for employees. The stakes are high; failure to comply can lead to not only financial penalties but also severe reputational damage. By investing heavily in robust compliance measures, institutions can better navigate this intricate regulatory environment, maintaining their standing and operational effectiveness amidst growing scrutiny.

Climate Change and Geopolitical Risks

Assessing Physical Risks

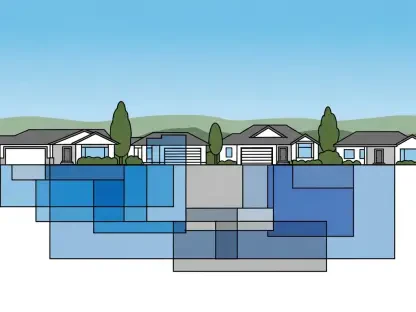

Climate change is now a critical factor in risk management for financial institutions, necessitating a thorough assessment of the physical risks associated with asset portfolios. The increasing frequency and severity of natural disasters require these institutions to reevaluate their insurance coverage to ensure it adequately addresses potential damages from catastrophic events, including floods, hurricanes, and wildfires. This paradigm shift underscores the need for financial entities to adapt their risk management strategies, incorporating climate resilience to safeguard against these unpredictable and often devastating events.

In this context, financial institutions are increasingly turning to advanced modeling and forecasting tools to predict and mitigate the risks associated with climate change. These tools enable institutions to better understand and prepare for the potential impact of natural disasters on their assets and operations. Additionally, there is a growing emphasis on sustainable investments, with financial entities prioritizing portfolios that are less susceptible to climate risks. By integrating climate considerations into their risk management frameworks, financial institutions can better protect their assets and maintain stability in the face of environmental uncertainties.

Geopolitical Instability

Geopolitical tensions significantly impact financial risk management, as instability in different parts of the world can threaten investment portfolios and disrupt supply chains. Financial institutions must account for political risks in their assessments, especially where assets are situated in regions prone to political upheaval. This growing instability has affected everything from investment decisions to operational logistics, contributing to the rising demand for political risk insurance and contingent business interruption insurance. These specialized insurance products are designed to mitigate the risks associated with trade disruptions and political upheaval, helping financial institutions maintain stability amidst global uncertainties.

The integration of geopolitical risk assessments into financial strategies is now more crucial than ever. Financial institutions must monitor international developments and adjust their portfolios accordingly to minimize exposure to politically volatile regions. This requires a dynamic approach, where institutions must be agile enough to pivot their strategies in response to geopolitical shifts. Political risk insurance provides a vital layer of protection, helping to shield institutions from unforeseen events and enabling them to continue operations smoothly. In an increasingly interconnected global economy, understanding and preparing for geopolitical risks is essential for maintaining financial resilience and stability.

Artificial Intelligence (AI) Risks

The Double-Edged Sword of AI

AI is at the forefront of transforming financial services, offering substantial benefits such as enhanced efficiency, improved decision-making, and the development of innovative financial products. However, this technological revolution is not without its risks. Systemic errors in AI algorithms can lead to widespread operational failures, affecting crucial functions like fraud detection and anti-money laundering (AML) compliance. The inherent complexity and opacity of AI systems can make it difficult to pinpoint and correct these errors, making robust safeguards and stringent oversight essential.

Despite the transformative power of AI, financial institutions must approach its deployment with caution. Ensuring the accuracy and reliability of AI-driven systems is paramount to preventing systemic failures. This involves rigorous testing, continuous monitoring, and the establishment of fail-safes to mitigate the potential fallout from algorithmic errors. Additionally, as AI systems become more integral to financial operations, there is a growing need for transparency and accountability in their deployment. By balancing the benefits of AI with a cautious approach to its risks, financial institutions can harness its full potential while safeguarding against operational disruptions.

Regulatory Oversight on AI

To address the inherent risks of AI, new regulations are on the horizon, framing a stricter governance landscape for AI systems. The forthcoming EU Artificial Intelligence Act aims to enforce strict governance and transparency in high-risk AI systems. These regulations will require financial institutions to comply with stringent standards to prevent systemic failures and protect fundamental rights such as data privacy. This underscores the necessity for ethical and transparent use of AI within the financial sector, ensuring that technological adoption aligns with regulatory standards and public expectations.

Financial institutions must prepare for the implementation of these new regulations by integrating robust governance structures and ensuring complete transparency in their AI operations. This may involve revising existing frameworks and adopting new practices to meet the demands of these regulations. The emphasis on ethical AI use also means that institutions must ensure their AI systems are free from biases and are used responsibly. Compliance with the EU AI Act will help financial institutions mitigate risks and build trust with customers and stakeholders, reinforcing the need for a balanced and responsible approach to AI integration.

Strengthening Digital Resilience

Introduction of DORA

The Digital Operational Resilience Act (DORA), set to take effect in January 2025, represents a landmark regulation aimed at enhancing IT security within financial institutions. DORA mandates stronger measures to prevent and manage cyber-attacks and operational disruptions, reflecting the EU’s commitment to maintaining a secure and resilient financial sector. This regulation requires financial institutions to adopt comprehensive cybersecurity frameworks and resilience strategies, positioning them to better navigate the challenges of a rapidly digitizing landscape.

The introduction of DORA signifies a significant step forward in bolstering the digital resilience of financial institutions. By imposing stringent cybersecurity requirements, DORA aims to mitigate the risks associated with cyber threats and operational disruptions. Financial institutions will need to invest in advanced cybersecurity technologies and practices to comply with these regulations. This includes continuous monitoring, incident response planning, and regular risk assessments to identify and address potential vulnerabilities. The ultimate goal of DORA is to create a more secure and stable financial sector, capable of withstanding the challenges posed by an increasingly digital world.

Building Trust Through Compliance

In the swiftly changing world of financial services, traditional risks are increasingly being overshadowed by more intricate challenges created by digital transformation, shifting regulations, climate change, and geopolitical stressors. Financial institutions in Europe find themselves in a demanding environment where understanding these emerging risks is critical. In an age where technology advances at a breakneck pace, new cyber threats and operational risks become prevalent. Regulatory bodies continue to introduce new rules those financial institutions must quickly adapt to, further complicating the landscape.

Additionally, the pervasive impact of climate change presents multifaceted risks, from physical damage to assets to transitional risks associated with moving toward a low-carbon economy. Political instability and international conflicts also add layers of uncertainty, challenging the resilience of these institutions. To navigate these complexities, financial institutions must adopt proactive resilience strategies.

Implementing robust cybersecurity measures, staying abreast of regulatory changes, and integrating sustainability into business models are crucial. Continuous adaptation and innovation can empower these institutions to not just maintain stability but also thrive. Europe’s financial entities must combine technological, regulatory, and environmental insights to craft strategies that safeguard their future while fostering growth in an unpredictable climate.