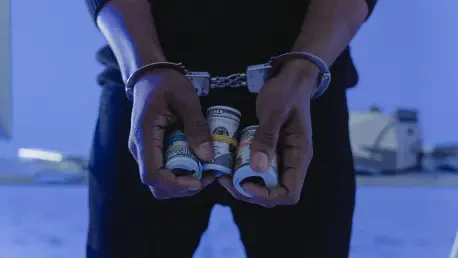

The insidious nature of “crash for cash” scams has become an alarming concern as these fraudulent schemes evolve over time. Originating in London a few years ago, these scams initially involved orchestrated vehicular accidents, primarily with moped riders, aiming to claim compensation for damages and injuries. However, this deceptive act has now taken a more dangerous turn by integrating identity theft, magnifying the threat from mere financial fraud to invasions of privacy and potential long-term personal harm. This shift challenges individuals and insurance companies alike, compelling a reassessment of security measures and responses to such fraudulent activities.

A New Dimension to Vehicular Fraud

The Role of Identity Theft in “Crash for Cash” Schemes

Identity theft has significantly amplified the complexity of “crash for cash” scams, transforming them into sophisticated schemes with far-reaching consequences. This fraudulent strategy is no longer confined to fabricating accident claims; it now exploits victims by manipulating their personal information. Typically, after orchestrating a collision, perpetrators prompt victims to exchange seemingly routine information like insurance and driver’s license details, unwittingly opening the door to future identity misuse. Such occurrences have become increasingly common across major urban centers in the UK, evidenced by numerous accounts from victims. Initially appearing as innocuous exchanges, these interactions often spiral into profound invasions of privacy, resulting in identity fraud that can haunt individuals for extended periods.

The aftermath of these scams is multifaceted, not just affecting the victims’ financial stability but also subjecting them to long-term identity-related complications. Victims often realize the extent of misuse unpredictably, encountering unauthorized financial transactions or receiving ominous correspondences from institutions. These experiences highlight the urgent need for awareness and education concerning the integration of identity theft within these scams. As this dual-faceted fraud gains momentum, policymakers and industry stakeholders face mounting pressure to devise comprehensive strategies that protect potential victims from both physical and digital theft. By examining these evolving patterns, it becomes imperative to reinforce anti-fraud measures that adapt to contemporary tactics, emphasizing the protection of individual identities.

Victims’ Experiences Highlight the Cost of Misuse

The narratives shared by victims illustrate the deceptive and calculated nature of those orchestrating “crash for cash” scams. A common scenario involves a deliberate collision, often implemented by a moped rider attempting to swiftly execute a maneuver, leading the targeted vehicle into a minor accident. Initially perceived as chance occurrences, these incidents transition into meticulously planned setups, designed to exploit victims’ trust. In the aftermath, victims often recount how they unknowingly complied with requests to share extensive personal details, exacerbating their vulnerability to subsequent fraudulent activities.

Such encounters bring to light the more extensive implications of these scams, with victims often finding themselves entangled in a web of identity-related fraud well after the event. They experience identity exploitation that extends beyond immediate financial loss, potentially affecting credit scores, personal reputations, and emotional well-being. These experiences underscore the urgency of educational initiatives aimed at safeguarding individuals from such schemes. Increasing awareness regarding the dangers of sharing sensitive information under duress and encouraging caution in the aftermath of accidents are deemed essential. By adopting preventive measures, individuals can reduce risks, thus fortifying their defenses against the dual threat posed by these evolving scams.

Insurer Responses and Preventative Strategies

Insurance Industry’s Role in Combating Fraud

Insurance companies are confronted with challenges posed by the intersection of vehicular fraud and identity theft, necessitating a reconsideration of traditional anti-fraud measures. As evidenced by the stance of companies like Ageas, there is an urgent need to innovate and strengthen defenses against these escalating threats. The insurance industry plays a pivotal role, not only in managing fraudulent claims efficiently but also in collaborating to unravel and dismantle larger fraud networks. By fostering partnerships with law enforcement and other stakeholders, insurers can share intelligence to disrupt these pervasive schemes, thus deterring potential perpetrators.

One of the pivotal steps insurers recommend includes limiting the exchange of personal information post-accident. By educating clients about the minimal necessity for sharing details such as name, phone number, and vehicle registration alone, companies aim to mitigate the likelihood of identity theft. Alongside, managing the sensitive handling of reported incidents is emphasized, ensuring that any suspicious activity is swiftly communicated to legal authorities and specialized organizations like the Insurance Fraud Bureau. Through these collaborative efforts, there is a concerted push to shift from reactive to proactive measures, aiming to anticipate and thwart fraudulent attempts before they escalate.

Insights from Industry Leaders on Future Strategies

Industry leaders, like Katie Davies from Ageas, advocate a robust response to the evolution of fraud, emphasizing that maintaining information security is crucial in a digital world. Highlighting the agility and cunning of modern fraudsters, such leaders call for heightened vigilance and the integration of technological innovations to stay ahead of emerging threats. The rise of digital identity management systems, advanced analytics, and real-time monitoring tools are among the proposed solutions to safeguard against increasingly sophisticated scams. This approach seeks to anticipate fraud patterns, providing critical insights that enable swift identification and mitigation of risks.

Moreover, promoting widespread education on identifying and responding to suspicious interactions is essential. Insurers are advancing public awareness campaigns, endorsing best practices for accident management, and advising on appropriate responses when approached by malicious actors. By ingraining a culture of caution and informed action, there’s an engineered effort toward minimizing opportunities for scammers to exploit vulnerabilities. Through shared knowledge and community engagement, both companies and individuals can form an interconnected defense network, robust enough to counteract the evolving landscape of fraud.

Adapting to an Evolving Threat

The evolution of “crash for cash” scams highlights a troubling increase in fraudulent schemes that pose a significant threat today. These scams, first emerging in London, centered around staging fake vehicle accidents, often involving moped riders to unjustly claim insurance compensation for damages and injuries. As these deceitful tactics have developed, they’ve adopted more sinister methods, incorporating elements like identity theft. This escalation transforms the issue from a simple financial deception into a serious infringement on personal privacy and security, causing lasting personal harm. The complexity of such fraudulent schemes demands that individuals and insurance companies rethink their security strategies. This reevaluation is crucial to effectively address and mitigate the multi-dimensional threats posed, ensuring that preventative measures and response protocols are robust enough to combat these dangerous scams and to protect individuals from falling victim to such manipulative tactics.