Despite a year marked by several widely publicized and tragic aviation incidents that captured global attention, the underlying data reveals a surprising narrative of stability within the airline industry’s safety record for 2025. The overall frequency of airline insurance claims held steady, remaining close to long-term historical averages and painting a picture that contrasts sharply with media headlines. This apparent disconnect underscores a significant industry paradox: while airlines have successfully rebounded to pre-pandemic operational levels, they are concurrently grappling with a new and intricate web of evolving risks. High-profile events, including a serious collision near Washington, D.C., and an aircraft fire involving a major Asian carrier, have created a public perception of increased danger, yet the broader statistical trends suggest a far more nuanced and consistent safety trajectory, forcing stakeholders to look beyond incident frequency and focus on the escalating severity and cost of modern aviation risks.

Navigating Operational Headwinds

The Strain of an Aging Fleet

The aviation sector’s robust recovery continued through 2025, with both passenger numbers and cargo volumes maintaining the strong upward momentum seen since 2024. This resurgence, coupled with lower fuel prices and higher load factors, significantly improved the financial health of many airlines, allowing them to begin deleveraging their balance sheets. However, this positive financial narrative is unfolding against a backdrop of severe operational constraints that threaten to undermine progress. Persistent and widespread supply chain disruptions have created extensive waiting lists for new aircraft deliveries from major manufacturers, forcing carriers to extend the service life of their existing fleets. Consequently, older airplanes are being kept in operation longer than planned, which not only increases maintenance costs but also elevates the financial risk profile. An older aircraft is statistically more likely to be declared a total loss following an otherwise manageable incident, turning a repairable situation into a multi-million-dollar write-off and straining insurance reserves.

The Human Element and Geopolitical Risks

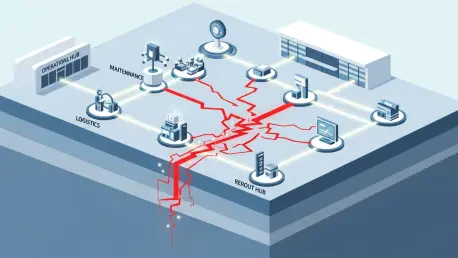

Compounding the challenge of an aging fleet is a critical and growing skills shortage across the industry, particularly within the maintenance, repair, and overhaul (MRO) sector. The scarcity of qualified specialists, combined with extended lead times for essential spare parts, creates a volatile and high-pressure operational environment. This strain on the maintenance infrastructure directly amplifies peripheral risks that might otherwise be more manageable. For instance, a system backlogged with repairs and short on expert technicians becomes a more attractive and vulnerable target for cyberattacks, as adversaries look to exploit operational weaknesses. Furthermore, this internal fragility makes the industry more susceptible to external shocks, such as geopolitical tensions that can abruptly close airspace or disrupt critical supply routes. The confluence of these factors means that a single point of failure—whether human, material, or digital—can now have far more cascading and financially damaging consequences than in previous years, testing the resilience of the entire aviation ecosystem.

The Shifting Landscape of Liability

The Rise of Social Inflation and Nuclear Judgments

A primary driver behind the soaring cost of claims is a phenomenon known as “social inflation,” a trend where the cost of liability payouts increases at a rate that far outpaces general economic inflation. This is significantly impacting the aviation sector, as jury awards and settlement demands continue to climb to unprecedented levels. A key factor is the growing prevalence of claims for psychological harm, which are inherently more subjective and complex to quantify than physical injuries, often leading to larger and less predictable awards. This environment has also fueled the rise of “nuclear judgments”—jury awards that exceed the $10 million threshold. These landmark verdicts do more than just resolve a single case; they establish new, higher benchmarks for all subsequent settlement negotiations, creating a ripple effect that inflates the value of claims across the board. Airlines and their insurers are now forced to operate in a legal landscape where potential liability has become dramatically more expensive, regardless of the actual frequency of incidents.

A Technological Double-Edged Sword

Artificial intelligence is increasingly being viewed as a potential solution to some of the industry’s most pressing challenges, yet its implementation introduces a new layer of complex risk. While AI systems are being considered to address widespread staffing shortages, their immediate impact is more likely to be felt in the reduction of administrative and back-office roles rather than in filling the critical gap for highly trained operational personnel like pilots and MRO specialists. This creates a significant new vulnerability. An increased reliance on automated AI systems for scheduling, logistics, and data management heightens the industry’s exposure to sophisticated cyberattacks. In the event of a successful cyber incident that cripples these systems and forces a reversion to manual processes, the prior reduction of administrative staff could severely hamper recovery operations. This would prolong operational disruptions, delay service restoration, and ultimately magnify the financial impact of business interruption claims, turning a technological solution into a potential catalyst for greater financial loss.

Charting a Course for Resilience

In 2025, the aviation industry successfully demonstrated its operational resilience by restoring service levels, yet it simultaneously confronted a new paradigm of risk that redefined the relationship between safety and financial stability. The year’s events underscored that traditional safety metrics, such as incident frequency, were no longer sufficient to capture the full scope of emerging threats. The intertwined challenges of supply chain fragility, a critical skills gap, and the escalating financial pressures from social inflation required a fundamental shift in risk management strategies. It became evident that navigating this complex landscape demanded a more holistic approach, one that integrated cybersecurity, legal liability trends, and human capital management into the core of safety and financial planning, ensuring the industry could adapt not just to physical incidents but to the complex, systemic risks of the modern world.