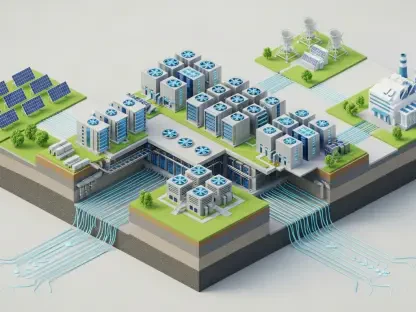

The relentless expansion of data consumption, cloud computing, and artificial intelligence has triggered an unprecedented demand for digital infrastructure, creating a highly complex and interconnected ecosystem where conventional, siloed risk management strategies are proving inadequate. To successfully navigate the inherent challenges and seize the opportunities presented by trillions of dollars in projected investment, data center owners and operators must now adopt a forward-looking approach that integrates risk management directly into the core of strategic planning, capital deployment, and long-term growth initiatives. This high-stakes environment demands a new operational mindset, one that balances the immense pressure to deploy new facilities at speed with the meticulous management of intricate construction challenges, power procurement, supply chain integrity, and evolving environmental regulations. A single misstep, such as a delay in securing a critical power interconnection agreement, can initiate a cascade of negative consequences, including stalled projects, significant revenue loss, and a sharp decline in investor confidence. A proactive framework built on the foundational pillars of evolved risk management, strategic capital enablement, and holistic resilience has therefore become essential for transforming these modern challenges into powerful opportunities for accelerated and sustainable growth.

Evolving Risk Management Beyond the Basics

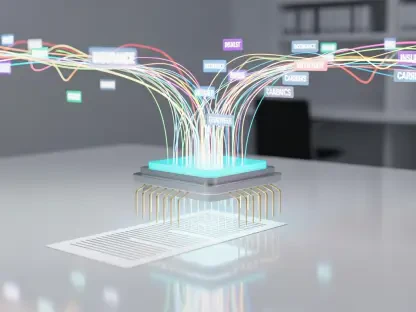

The first pillar of this advanced strategy necessitates a fundamental shift away from conventional insurance products toward sophisticated, tailored solutions that provide comprehensive coverage across the entire asset lifecycle, from acquisition and development through to long-term operations. While foundational coverages such as builders’ risk and property and casualty insurance remain integral, the sheer scale and immense value of modern data center projects demand more robust and strategic protection. For the massive, multi-billion-dollar campus clusters that are becoming the industry standard, Owner-Controlled Insurance Programs (OCIPs) represent a superior model. Unlike traditional Contractor-Controlled Insurance Programs (CCIPs), OCIPs grant the owner direct control over the entire insurance program. This centralized control translates into significant advantages, including the reduction of frictional administrative costs, the flexibility to apply coverage seamlessly across multiple concurrent or future projects, and the ability to align the organization’s insurance strategy directly with its rapid expansion plans and evolving risk profile, ensuring protection keeps pace with progress.

Beyond standard operational and construction risks, a critical vulnerability for many high-value data center campuses is their geographical location in regions susceptible to natural catastrophes like tornadoes or severe convective storms. In these areas, securing adequate coverage through traditional property insurance markets can become exceedingly difficult or prohibitively expensive, creating a significant gap in an organization’s financial defenses. To bridge this critical gap, innovative alternative risk solutions, most notably parametric insurance, offer a powerful and effective alternative. These innovative products provide rapid, predefined cash payouts triggered by a specific, measurable event—such as wind speeds exceeding a certain threshold—rather than relying on a lengthy and complex claims adjustment process. This structure allows for much quicker financial recovery, enhances overall financial resilience, and perfectly complements traditional policies by covering gaps and ensuring operational continuity. Furthermore, recognizing that human capital is as vital as physical infrastructure, a comprehensive directors and officers (D&O) liability insurance program is fundamental for attracting and retaining the executive talent required to navigate these complexities and pursue major investments or public offerings.

Unlocking Capital for Strategic Growth

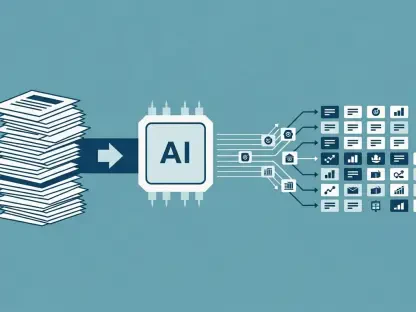

The second pillar of this forward-thinking framework directly addresses one of the most significant operational constraints impacting the pace of data center growth: capital. The enormous energy consumption inherent to these facilities necessitates complex, long-term power purchase agreements (PPAs) with utility providers. To safeguard their own substantial capital investments in the required infrastructure upgrades, these utilities typically demand substantial performance guarantees from the data center operator to mitigate the risk of a potential contract default. Historically, Letters of Credit (LOCs) have been the standard financial instrument for providing these guarantees, valued for their security and credibility. However, their primary and most significant drawback is the requirement for substantial collateral, a condition that effectively ties up vast amounts of cash—often totaling hundreds of millions of dollars—that cannot be used for any other corporate purpose. This practice puts a considerable brake on potential growth by rendering a significant portion of a company’s working capital completely illiquid and inaccessible for strategic initiatives.

A powerful and compelling alternative, the surety guarantee, has emerged to transform this restrictive financial requirement from a capital constraint into a potent catalyst for growth. Issued by highly-rated insurance companies, surety guarantees provide the same unwavering level of financial security to utilities and power providers as traditional LOCs but, critically, do so without requiring the data center operator to post any collateral. By strategically replacing restrictive LOCs with these more flexible surety guarantees, an organization can effectively free up hundreds of millions of dollars of previously trapped working capital. This unlocked cash can then be immediately redeployed to fund new construction projects, accelerate ambitious expansion plans into new markets, and seize emerging opportunities with agility. In doing so, this innovative financial tool fundamentally transforms a standard operational requirement from a barrier to expansion into a direct and powerful engine for fueling corporate growth and enhancing competitive advantage in a rapidly evolving marketplace.

Building Resilience as a Competitive Advantage

The final pillar of this integrated strategy synthesizes the others, framing resilience not merely as a defensive tactic but as a strategic business enabler that actively underpins long-term success and bolsters investor confidence. True organizational resilience requires a comprehensive, holistic perspective that spans the entire asset lifecycle, from the initial stages of planning and construction through the complexities of daily operations and ongoing management. This proactive approach involves anticipating and systematically mitigating a broad and diverse spectrum of risks, including physical property exposures, increasingly sophisticated cyber threats, intricate operational vulnerabilities, and significant reputational challenges that can arise in an instant. Such a forward-looking stance is a marked departure from traditional, reactive risk mitigation models, which often address threats only after they have materialized, and it positions the organization to thrive amidst uncertainty rather than simply survive it, turning potential disruptions into opportunities for demonstrating strength and reliability to the market.

Ultimately, this robust resiliency strategy became more than a protective shield; it evolved into a key competitive differentiator that attracted and secured vital capital injections from discerning investors. Institutional financiers, particularly private equity funds, had become increasingly focused on protecting their investment returns from a wide array of potential disruptions, making a demonstrably resilient organization a more attractive and secure investment proposition. The proactive anticipation, quantification, and management of the interconnected risks within the digital infrastructure ecosystem allowed data center owners and operators to preserve capital, maintain the unwavering confidence of stakeholders, enhance their speed to market, and achieve a higher standard of operational excellence. It was this strategic fusion of evolved risk management, capital enablement, and deep-seated resilience that provided the foundational element supporting the industry’s sustainable, long-term business success.