The digital backbone supporting nearly every modern business has become both its greatest asset and its most significant vulnerability, transforming data protection from a peripheral legal obligation into an indispensable strategic imperative. In a landscape shaped by stringent regulations, relentless technological advancement, and a perpetually escalating barrage of cybersecurity threats, companies can no longer rely on basic compliance measures alone. Survival in this high-stakes environment demands a multi-layered approach that fuses regulatory adherence with a robust internal security culture and, crucially, specialized data protection insurance. This integrated strategy is no longer optional; it is the essential framework for maintaining corporate integrity, ensuring operational continuity, and building unbreakable trust with stakeholders in an increasingly data-driven world.

Navigating the New Regulatory Minefield

The GDPR Revolution

The General Data Protection Regulation (GDPR) has fundamentally redefined the global standards for data privacy, establishing a rigorous and unified framework that extends far beyond the borders of the European Union. Grounded in core principles like transparency in data handling, the necessity of securing informed user consent, and ensuring data integrity, the regulation has empowered individuals with significant rights, including the right to be forgotten and the right to data portability. This paradigm shift has compelled organizations to move beyond a superficial, checklist-based approach to compliance. Instead, they must now conduct meticulous scrutinies of their information management processes, from data collection and storage to processing and deletion. The regulation’s far-reaching impact forces a cultural transformation where privacy and security are no longer afterthoughts but are woven into the very fabric of corporate strategy and daily operations, demanding proactive governance from the top down.

This cultural evolution, driven by the GDPR, requires a deep and sustained commitment to cultivating an organizational environment where privacy by design is the default standard. It is not enough to simply react to regulatory demands; businesses must proactively embed data protection principles into every new project, system, and process. This involves fostering a pervasive awareness among all employees about their roles and responsibilities in safeguarding sensitive information. The regulation has effectively ended the era of siloed data management, forcing departments to collaborate on creating transparent and accountable systems. For many, this has meant a complete overhaul of legacy infrastructure and workflows, a challenging but necessary step to build a foundation of trust with customers and partners. Ultimately, the GDPR has transformed data protection from a legal hurdle into a strategic differentiator, where demonstrating a commitment to privacy becomes a key component of brand integrity and a driver of customer loyalty in a competitive marketplace.

The Constant Challenge of Compliance

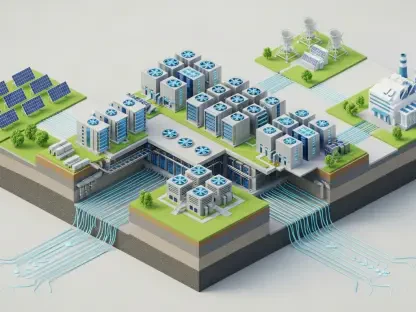

Adapting to this stringent and dynamic regulatory environment presents an ongoing and formidable challenge for businesses of all sizes. The complexity of navigating a constantly evolving legal landscape demands continuous adjustments to operational processes and internal policies. This intricacy is significantly amplified by the dynamic nature of digital data and the rapid emergence of new technologies for data collection and analysis. Innovations such as Artificial Intelligence and advanced cloud computing introduce new layers of risk and regulatory ambiguity, requiring organizations to stay perpetually vigilant and agile. The sheer volume and velocity of data being generated create unprecedented hurdles for maintaining compliance, as businesses must ensure every piece of information is handled in accordance with a complex web of rules that can vary by jurisdiction. This environment of constant change means that compliance is not a one-time project but a continuous cycle of assessment, adaptation, and implementation that demands dedicated resources and expertise.

The pivotal role of Data Protection Authorities (DPAs) further underscores the high stakes of non-compliance. These regulatory bodies are crucial for enforcing the rules of the road, equipped with the authority to monitor organizational practices, conduct audits, and impose significant financial penalties for violations. Beyond their enforcement capacity, DPAs also serve as essential resources, providing vital guidance to help businesses interpret and effectively implement the intricate regulations. They publish guidelines, answer queries, and set precedents that shape the compliance landscape. For businesses, engaging with DPA guidance is not just advisable; it is a critical component of a proactive risk management strategy. Staying informed about DPA rulings and recommendations allows companies to anticipate regulatory shifts, adjust their practices accordingly, and demonstrate a good-faith effort to meet their obligations. This proactive stance is essential for mitigating the risk of costly sanctions and reputational damage that can result from a compliance failure.

From Technical Problem to Strategic Imperative

Understanding Today’s Multifaceted Risks

The escalating sophistication of cyber threats has elevated the protection of information from a purely technical concern to a broader geopolitical and strategic domain. Cybersecurity challenges are now deeply embedded in every facet of an organization, demanding attention from the C-suite and the boardroom. The consensus among security experts is that companies face a wide and diverse spectrum of risks that extend far beyond the stereotypical image of external hackers. These modern threats include critical vulnerabilities introduced through complex supply chains, data breaches originating from third-party partners who may not share the same security standards, and the persistent, often underestimated, threat of internal human error. An employee clicking on a phishing link or an improperly configured cloud server can cause as much, if not more, damage than a direct assault. This expanded threat landscape means that a perimeter-focused defense is no longer sufficient; organizations must adopt a security posture that accounts for risks from every angle, both internal and external.

To effectively manage this complex risk environment, a holistic and proactive approach is not just recommended—it is essential for survival. This involves fostering a pervasive corporate culture that prioritizes data protection through continuous, engaging employee training and awareness initiatives that go beyond annual compliance videos. It requires the deployment of state-of-the-art security technologies, such as advanced endpoint detection, AI-powered threat monitoring, and zero-trust architectures, to defend against sophisticated attacks. Furthermore, establishing clear, well-practiced security protocols for incident response is critical. Cybersecurity must be treated as an indispensable element of the overall business strategy, focusing not just on defense but on a complete incident lifecycle of prevention, detection, and efficient response. This ensures the integrity of information is maintained, operational resilience is strengthened, and the business is prepared to weather any storm in an increasingly turbulent digital world.

A Real-World Test Learning from a Crisis

A case involving a large-scale ransomware cyberattack on a major insurance company serves as a powerful illustration of these principles in action. The incident acted as a severe test of the company’s established cybersecurity systems and response protocols, pushing its defenses to their limits. The absolute key to their effective management of the crisis was early detection, which was made possible by advanced monitoring tools and a vigilant security team. This rapid identification of the breach enabled the swift activation of a pre-planned, multidisciplinary crisis team composed of IT security, legal, communications, and executive leadership. This team was tasked with the critical responsibilities of mitigating the immediate impact, safeguarding critical infrastructure to prevent further intrusion, and, crucially, maintaining transparent and honest communication with all affected parties, including customers, regulators, and employees. This last step was highlighted as vital for preserving trust and facilitating a timely recovery of compromised operations, turning a moment of extreme vulnerability into a demonstration of corporate responsibility and resilience.

Following the successful mitigation of the immediate attack, the company engaged in a thorough and unflinching post-incident analysis to identify the root causes and address any underlying security vulnerabilities that the attackers had exploited. This comprehensive review went far beyond a simple technical patch; it involved a reassessment of security policies, employee training protocols, and third-party vendor risk management. The findings led to a significant update and reinforcement of the company’s cybersecurity systems and a renewed investment in advanced threat intelligence and response capabilities. The incident, therefore, not only demonstrated the resilience of the company’s existing protocols but also acted as a valuable catalyst for strengthening its overall security structure and strategic approach. By treating the crisis as a learning opportunity rather than just a disaster to be contained, the organization underscored its commitment to continuous improvement and emerged with a more robust and battle-tested defense posture for the future.

The Role of Specialized Data Protection Insurance

More Than Just a Financial Safety Net

In an era defined by the constant and escalating threat of cyberattacks, data protection insurance has become an indispensable cornerstone of any modern corporate risk management strategy. Its value extends far beyond simply providing financial compensation in the aftermath of a data breach. Instead, this specialized insurance offers a comprehensive support system designed for both proactive prevention and effective recovery. It functions as a strategic partnership, providing access to a wealth of expertise and resources that many businesses, particularly small and medium-sized enterprises, would not be able to afford on their own. This includes proactive support to help businesses align with complex and ever-changing regulatory requirements like the GDPR, offering risk assessments and guidance to harden defenses before an incident occurs. This preventive aspect is critical, as it helps reduce the likelihood of a breach in the first place, thereby protecting the company’s most valuable assets: its data and its reputation.

The true value of this insurance is often most apparent in the chaotic moments following a breach. When an incident occurs, the policy provides robust assistance to manage the consequences effectively, safeguarding the company’s brand and ensuring operational continuity. This support is multifaceted, covering the immense costs associated with incident response, such as forensic investigations to determine the scope of the breach, legal counsel to navigate complex notification obligations, and public relations expertise to manage communications with customers and the media. By providing immediate access to a team of seasoned experts, data protection insurance helps an organization navigate the crisis with confidence and precision. This comprehensive support system transforms the insurance from a simple financial backstop into an active partner in resilience, helping the business not only to survive a cybersecurity incident but also to emerge from it with its reputation and customer trust intact.

What Comprehensive Coverage Looks Like

A modern data protection insurance solution is specifically engineered to help businesses and self-employed individuals meet the stringent and often overwhelming requirements of regulations like the GDPR. The coverage offered by these policies is extensive, designed to address the full spectrum of financial and reputational risks associated with a data breach. A comprehensive policy typically encompasses civil liability, protecting the company against lawsuits from individuals whose data has been compromised. It also provides critical financial coverage for the substantial fines and sanctions that can be imposed by regulators, which can reach tens of millions of dollars under GDPR. Furthermore, the policy covers the significant operational expenses related to a breach, including the costs of notifying all affected individuals as required by law, setting up credit monitoring services, and executing a campaign for image and reputation restoration to rebuild public trust.

A noteworthy feature of leading data protection insurance policies is a distinct focus on prevention, aligning with legal mandates that emphasize proactive security measures. This can include access to risk assessment tools, cybersecurity training resources, and expert consultations to help organizations strengthen their defenses before an attack ever happens. The coverage for image restitution expenses, particularly those related to penalties from data protection agencies, highlights the policy’s role in managing the long-term reputational fallout of a compliance failure. Ultimately, integrating specialized data protection insurance into a corporate strategy was a significant and proactive step toward building organizational resilience. It strengthened overall risk management and upheld the corporate integrity and customer trust that were vital in the technologically-driven landscape.