The Rawlins City Council recently encountered a pivotal decision that has stirred a discussion about aligning local vehicle insurance laws with state mandates. At the heart of this issue is a proposed amendment to Rawlins municipal code section 10.15.070, which would require drivers without

The Delaware Superior Court recently grappled with a complex legal dispute involving Elutia Inc. and Medtronic Sofamor Danek USA, Inc., centering on a recall of the biologic product FiberCel, a bone matrix alleged to cause tuberculosis in patients. With lawsuits piling up against both entities,

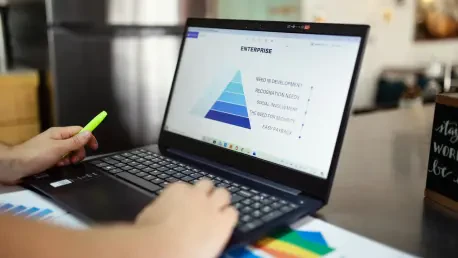

In today's rapidly evolving landscape of insurance and risk management, Simon Glairy is a leading voice in the field. Recognized for his expertise in insurance and Insurtech, Simon brings valuable insights into the challenges and opportunities that arise as traditional insurers retreat and E&S

Simon Glairy's expertise in insurance and Insurtech uniquely positions him to offer insights into the recent court case where Aegis Security Insurance Company successfully defended against a government bond claim. This legal battle highlights critical aspects of customs bond enforcement and the

The healthcare industry is navigating a significant transformation due to the No Surprises Act, a legislative milestone poised to redefine the operational landscape for insurers. This crucial act, aimed at protecting patients from unexpected medical billing, has become a formidable force,

In a landscape defined by constant evolution, two states in the United States have taken the lead in reshaping captive insurance—a form of self-insurance for businesses seeking tailored protection. With traditional insurance models facing challenges and limitations, Vermont and Montana present